Bitcoin's Back On The Move

Bitcoin has rallied back above $71k, showing significant strength, and providing numerous signals that positive momentum has returned. The market is a stones throw away from price discovery.

Slowly at first, and then all at once. Bitcoin is back on the move, with the bulls pushing prices back above $71k. In many ways, this feels like they are taking another attempt to properly enter price discovery.

Only seven days in all history have a closing price above this, so we are really breathing thin air up here. As I will cover later on, very few coins still have a cost basis up here too, so we are also in a sort of ‘supply discovery’.

If you can believe it, the checkonchain newsletter has just passed its first month anniversary. As with many things in Bitcoin, time flies, and yet it simultaneously feels like I have been writing for years.

In this post, I wanted to return to a few key metrics and concepts we have been watching and covering in our reports throughout this market correction. By revisiting the main conditions we had our eye on, we can try and put the strength of this rally into context, and spot which risks remain in play.

Disclaimer: This article is general in nature, and is for informational, and entertainment purposes only, and it shall not be relied upon for any investment or financial decisions.

📽️ Full Video Analysis

All-Time-Highs Take Time

Punching a convincing all-time-high is rarely successful on the first go. A period of chopping wood, and a couple of significant attempts is very normal.

The 2024 ATH break has been no different.

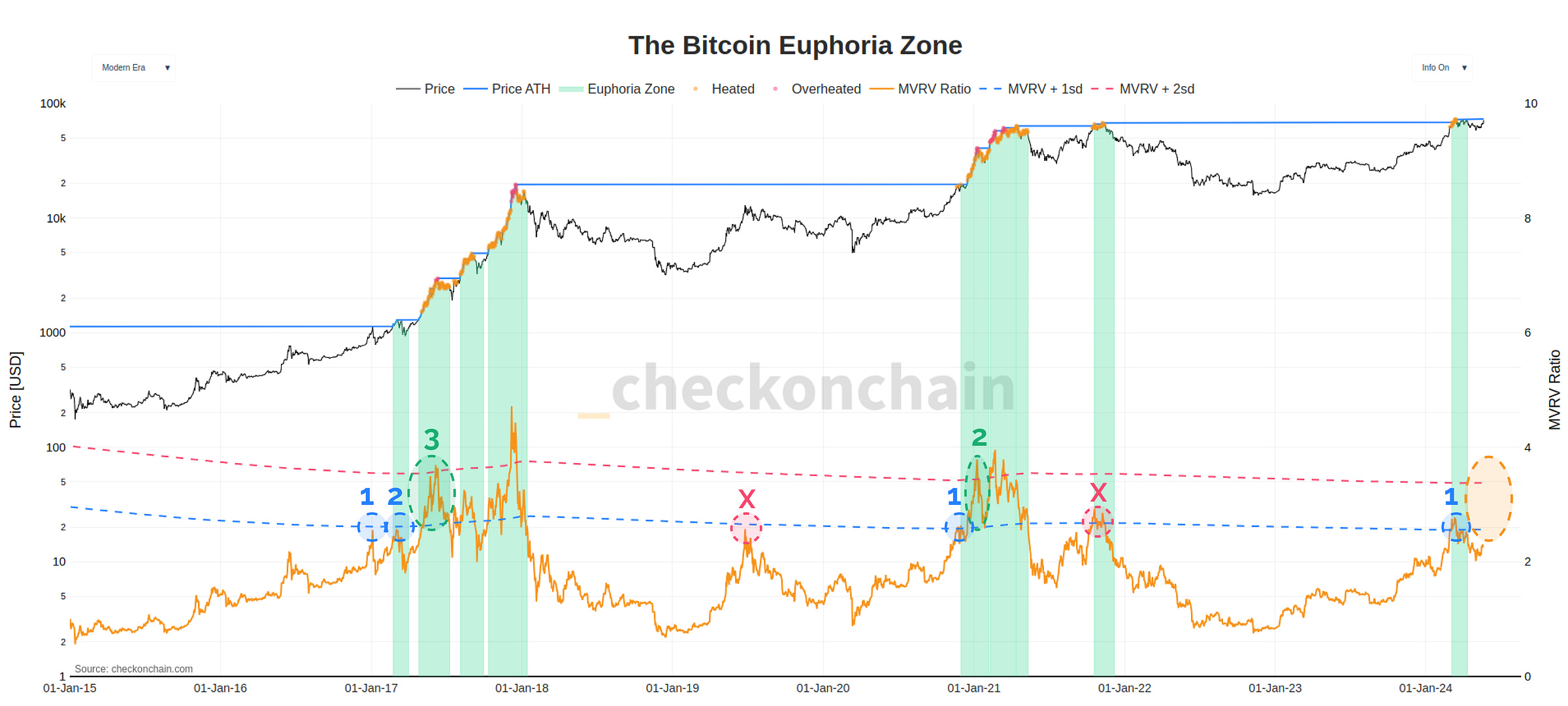

The reality is that investors often respond to prices approaching the ATH by taking profits, as they know the demand liquidity is likely to be there. Such events also tend to coincide with the MVRV Ratio reaching 1 standard deviation above the mean, which indicates existing HODLers are holding a statistically significant sum of ‘paper profits’.

It takes a few attempts to truly break into price discovery because it takes time to work through, and absorb the supply from these sellers.

In Expecting Chopsolidation, I highlighted that a second wave of new demand hadn’t emerged yet, even though things looked relatively robust under the hood. Whilst it is still early days, the ETFs appear to have now reversed a four week long streak of outflows which resulted in -$1.047B in share redemption.

Over the last two weeks, the ETFs have brought in over +$1.23B in net inflows, with +$165M flowing in on Monday alone. This may well be ground zero for that second wave of demand.

The chart below is based off Willy Woo’s NVT price model, and it imputes a form of fair value based off onchain transaction throughput (I use a few different measures of volume here).

From a fundamental standpoint, the transaction throughput of the Bitcoin network is comfortably in line with its price. This most closely resembles the conditions of late 2020, which was the last time we cleared a cyclical ATH.

This suggests to me we’re not too hot, and not too cold up here, but we do have to see onchain volumes follow through on any uptick in price.

I also wanted to quickly give a shout-out to the short-sellers who have sacrificed their positions for the greater good. For some reason, people keep betting against this uptrend…with leverage no less.

When everyone is on one side of the boat in markets, it is usually a sign that everyone is about to be very wrong.

This chart suggests that many folks still think the Bitcoin boat needs to sink, but in my opinion, they are swimming against the tide.

This post is an unlocked version of our early-week premium market update. If you’d like to receive 2 weekly updates (like this one), get involved in subscriber-only Q&A sessions and access a growing bank of educational guides - become a premium subscriber!

Still Quiet, Still Trending

The overall structure of this uptrend continues to feel very resilient in my view, and the Quiet and Trending market structure keeps showing up across many metrics. I think the amplitude of STH-MVRV shows this off nicely, where we are still within a steady, stable, enthusiastic, but importantly NOT euphoric phase of the bull.

Whilst the transition from enthusiasm, to euphoria can happen quickly, it feels like we have not reached the point of euphoric escape velocity…yet.

This is a good thing, as it signals the market is unlikely to be over-stretched, over-bought, and over-saturated. A break above $73k would put STHs into sufficient profit that we might find some resistance…but could also be the point where an escape velocity phase shift takes place.

We have also found support on the AVIV momentum oscillator (90-day), which tracks how ‘vertical’ price is moving relative to onchain capital inflows. It is not uncommon for this metric to reset around the neutral level of zero, and then recover strongly during a bull market.

For whatever reason, 90-days seems to be a bit of a sweet spot period for Bitcoin corrections during uptrends. It is just long enough to spook top buyers into capitulating out, but not long enough to kill aggregate sentiment.

In this instance, it appears to be a case of so far, so good. The bears had an opportunity to establish more meaningful negative momentum, but they just didn’t find enough follow through.

Top Heavy, Be Gone

One of the key and opening themes we have been tracking was been whether the Bitcoin Market became Top Heavy. This is a condition where a significant number of holders are caught off guard, and buy too many coins, at too high of a price.

As prices sell off below their cost basis, there is a risk that it breaks sentiment, creates panic sellers, and precipitates a protracted bear market.

Remarkably, we have seen supply held in loss by Short-Term Holders recover dramatically on this rally, now representing just 322k BTC out of 4.85M (6.6%).

During the worst of the correction, around two thirds of STH supply was held in loss, and this has since rebounded to 93% over just a few days. Around 2.82M BTC held by the STH cohort have now returned to a profit during this rally, putting considerably fewer holders at risk of panic selling.

It also means dip buyers were rewarded, and this is what reinforces their behaviour to do it again next time! The Short-Term Holder cost basis was their line in the sand, and it ended up being one for the textbook.

It also indicates that a significant volume of coins bought higher were redistributed to a lower cost basis during this correction.

This is exactly what we want to see.

Closing Thoughts

Bitcoin is always keeping us on our toes, but fortunately it also can’t hide the data about what is going on internally. One of the big analysis lessons that I personally took away from this first month of analysis was the importance of comparing Supply in Loss to the magnitude of Unrealised Loss when assessing a Top Heavy Market.

We looked at this chart last week, and I think the contrast of minimal unrealised losses with the pretty severe sounding 67% of STH supply in loss really paints a powerful picture.

To summarise, my current read of the Bitcoin market remains constructive:

We’re seeing early signs of a new wave of demand;

Are coming out of two months of very healthy consolidation;

Remain within a Quiet and Trending pattern (which is very stable);

Have not seen the market devolve into a concerning Top Heavy status;

The bears still didn’t manage to get more than a -20% pullback at the lows.

I really wouldn’t be surprised if we chopped around for a while yet, but I also wouldn’t be surprised if we’re on the cusp of setting new ATHs.

Genuinely, I like what I see.

Thanks for reading, and thank you for all of your support for our opening month.

James

This post is an unlocked version of our early-week premium market update. If you’d like to receive 2 weekly updates (like this one), get involved in subscriber-only Q&A sessions and access a growing bank of educational guides - become a premium subscriber!

James, your realistic analysis is the perfect balance between the omega candle moon guys promising an imminent supply shock, and the anti coiners who think the entire market is propped up by fake Tether printing, and any retail are just exit liquidity.

Thanks for keeping us all grounded, yet optimistic.

Great work James! Quick questions, are you interested in providing/analyzing Ethereum on-chain data? If not, why not?