There Is No Undo Button

The two economic apex predators are going head to head in a game of chess, and eight moves later, the board will be an entirely different place.

G’day Folks,

Information is changing by the hour, and anyone who tells you they have a good read on what comes next in markets, is kidding themselves.

We’re in the midst of the biggest trade war in living memory, and to the best of my understanding, the US has now imposed 104% tariffs on China, and China has retaliated with their own 84% tariffs.

The two largest and most important economies in the world are going head to head, and neither one of them is likely to back down easily.

Two economic apex predators are playing a game of chicken, to see which great power backs down first. China is the creditor nation, but has control of the majority of the world’s manufacturing and production capacity. The US is the debtor nation, and the one in control of both the global reserve currency, and the global reserve asset (treasury bonds).

Sadly, the stability of the global economy and financial markets are likely to be pawns in this game of chess.

I am of the view that these conditions are outright dangerous, and I encourage everyone to be extremely cautious with your decisions over the coming weeks and months.

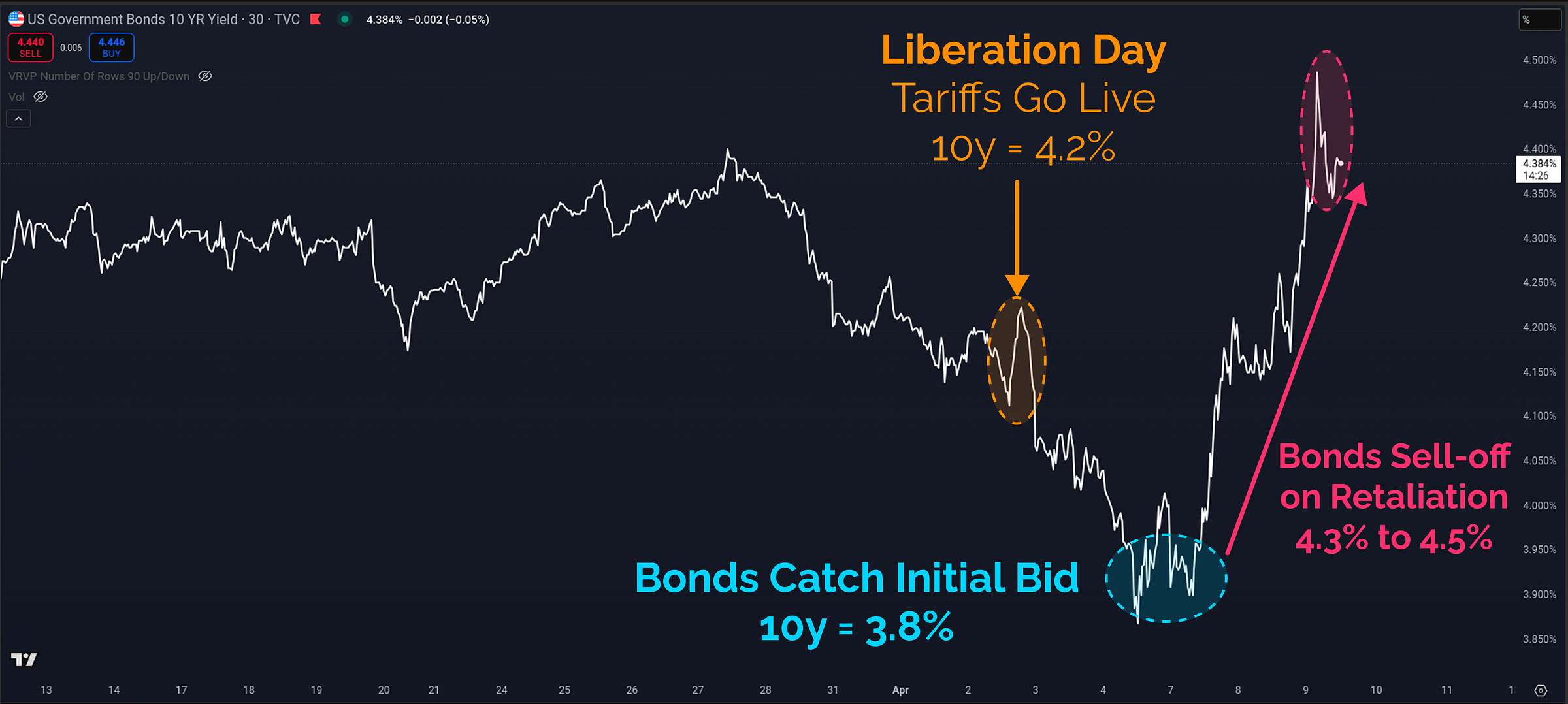

Nowhere is the scale of this dynamic more visible than the US Treasury yields, where the 10y is whipping around like the US is an emerging market…I am going to be honest folks, this is scary stuff. The base layer asset of the financial system, and the de-facto global reserve asset, should not be trading like this.

This is a dysfunctional market.

The bond market is the one that calls time out on everything in finance, so I am taking moves like this one very seriously.

The bond market may be trying to take the keys away from the politicians.

In today’s post, I want to paint a mental roadmap for how I am thinking about the current market structure. I’ll be the first to admit that this is a highly dynamic system, well beyond my experience base, and I can’t pretend to know how any of this plays out in the immediate term.

That said, I find these events endlessly fascinating, and my hobby (and job) is to try and put pieces of the puzzle together. The idea of this post is to get my ideas on a page, and use that as a foundation to better adjust and tune my view of the world as new information comes in.

Big macro post incoming, let’s try and synthesise all the information in front of us into a coherent framework for what is going on.

Premium Members will find the full written post below. Consider upgrading to premium today to unlock the rest of the content!