How I'm Thinking About This Dip

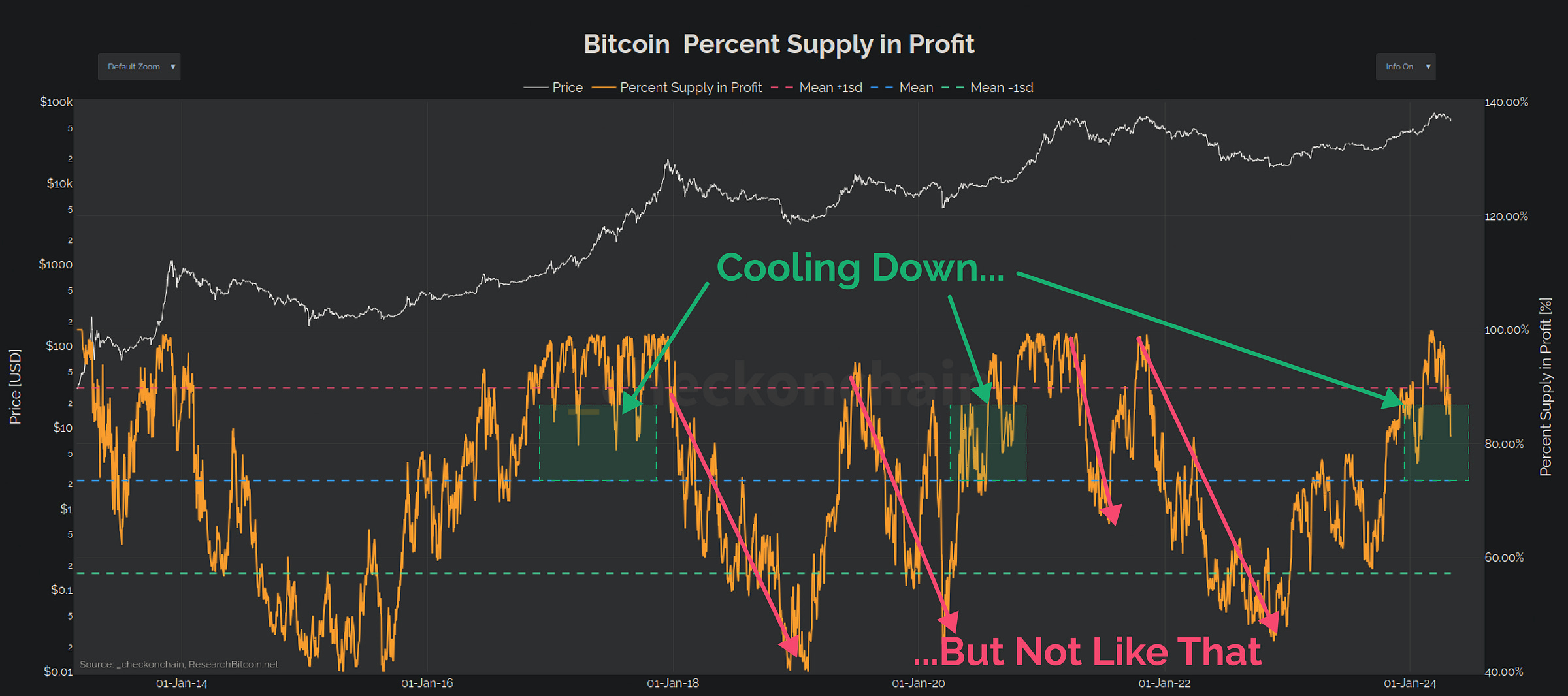

When people ask me what metrics I use to find DCA opportunities within a Bitcoin bull market, I would probably pull out a set of on-chain and pricing tools, and say 'it looks a little bit like that'.

Surviving in markets is not easy because our ancient emotional hardware is poorly equipped for the task. We often wait for things to feel very safe and comfortable before we make a decision to buy or sell. That usually that involves us hunting around looking for confirmation bias, just to be sure that what we’re doing is a good idea.

Now the challenge is that when everyone is doing and thinking the same thing, it is usually a sign that it’s the wrong decision, at the wrong time. When things become consensus, it is because most of the juice has been squeezed from the move.

There are two saying that I always keep in mind:

When a trade feels great to take, it is usually the wrong decision.

When a trade feels absolutely horrible, it is more often a good one.

Today I wanted to share a quick overview of how I think about dips like this one, coming from my personal perspective as a HODLer. My goal is to stack as many sats as I can over the long-term, whilst avoiding as much pain as I possibly can.

I don’t intend to be perfectly right, nor pick the exact top, nor the exact bottom. Instead, the goal of this post is to demonstrate how I personally use my own tools to avoid stacking sats too high, and instead optimising my DCA to acquire them at a relatively low (but not the lowest) level as I can.

For full disclosure, I stacked sats today, and as I thought about how I made that decision, I thought it might be helpful for others to see the framework and logic I used.

Disclaimer: This article is general in nature, and is for informational, and entertainment purposes only, and it shall not be relied upon for any investment or financial decisions.

The challenge of markets is they force us to hold two competing views at the same time when it comes to corrections:

It could very well be over, and the truth is, the start of a bear market is always right after we set the most euphoric peak of the bull.

It just as likely could be just fine, because the bottom of a dip always looks horrific…that is why it is called a dip.

The hardest part is accepting and being honest that it really could be either outcome, and we won’t know until after the fact. We can for sure improve our odds through analysis, but we can never be certain.

Accepting Uncertainty

This was a real unlock for me in my market journey, accepting that I don’t know, and that not knowing is ok. Once I allowed myself to accept that I don’t know what the future holds, I found I could more easily take a bet based on my gut instinct, which is naturally informed by my analysis, my experience, and my familiarity with how Bitcoin trades.

If you were to ask ‘bear market James’ to describe what a nice healthy dip would look like during an uptrend, one that I would consider a sat stacking opportunity, it would probably look something like the following set of metrics:

✅ I’d like to see price trading above, but not too far above the 200-day Moving Average. This would mean we’re not too overheated, and downside risk is somewhat contained with the 200D close enough below. We’re not astronomically high, so I won’t pay a hefty premium, and that is what I’m looking for.

✅ Price trades at or below the Short-Term Holder Cost Basis creating incentives for weak handed top buyers to panic sell at the wrong time. The truth is, more inexperienced folks will invariably buy high and sell low. My goal is to try and identify moments when this is happening, and do the opposite.

If the market is in fact within a robust uptrend, and it is indeed a bull market, then a retest of the STH cost basis is about as textbook of a signal as you get in on-chain analysis. We can study 2019 as an example where this didn’t work so well, but it didn’t affect my thinking today, and I can cross that bridge if/when we get to it.

✅ STH SOPR would trade below the break-even level of 1 with a nice healthy undercut to flush out those very same weak handed top buyers. This is an indicator that they are increasingly fearful. These kinds of micro-capitulation are what I consider to be a contrarian signal, telling me that the inexperienced top-buyers, are now starting to sell low.

✅ Can I please also order a side of Futures Funding Rates which have cooled off, and are no longer indicating there is excessive leverage in the system? I’d rather not have a market filled with degenerate traders with margin up to the hilt, and risk a sharp sell-off the second I buy. Thus a cooled down futures market is a nice to have after a sell-off, as it reduces the risk of further volatility and cascading sell-side.

✅ Lastly, it would be good to see just enough supply being at risk, where it looks so bad that it could even be the start of a bear…but it also could just be a good old fashioned dip, and thus an opportunity. Bitcoin and its holders are a resilient bunch, and we have recovered from far worse in the past.

If it was going to find some kind of a bottom, it is probably going to be within a reasonable proximity to where we are right now. If it keeps deteriorating, I would just wait for the next opportunity whenever that arises.

Concluding Thoughts

Now let’s not forget that nobody really knows whether the bear market has returned. I don’t personally consider that likely, but Mr Market will do as it does. The reality is that we could have a choppy and challenging road ahead, and there is no shortage of evidence suggesting this is the case.

However, the way I like approach this problem is from the perspective of a HODLer who likes a discount. $73k didn’t feel like a discount to me, but I still took a few nibbles around $60k. I didn’t have all the right signals in effect, but I also like buying Bitcoin, so it was just part of my week.

But now we have a different story. Bitcoin has hit a lot of levels where if you asked ‘bear market James’ what a bull market dip would look like…he’d probably point at the one we’re experiencing right now and say ‘it looks a little bit like that’.

Who knows, maybe if I am still teaching onchain analysis in 5yrs time, this dip could be one the case studies I keep referring to whilst forgetting that my video feed is covering it up the left side of the chart for the viewers!

Thanks for reading folks!

James

Exactly the kind of material why I subscribed to your channel. My complain with your free video and glassnode weekly review was that you were sharing only market analysis without really giving your final thoughts.

With this format, you bring us with you through your decision journey of buying/selling. This is what people wants and pays content for. You are an expert of on-chain and people strongly rely on your observation, analysis and ultimately, your decision.

Please keep the great work and providing this format.

Thanks James, this is exactly the sort of content I would consider 'premium'. Appreciate your opinions & insight. Totally agree with Thibault above.