As The Deleveraging Dust Settles with The Bitcoin Layer

We're back with another collaborative piece with our friends at The Bitcoin Layer. We analyse the aftermath of this weekend's deleveraging event, and assess the liquidity picture for the rest of Oct.

G’day Folks,

Is everyone having fun with their Bitcoins?

I think it is safe to assume, a lot of us were glued to the Bitcoin price chart over the weekend, watching how the market responded after the largest deleveraging and liquidation event in Bitcoin/crypto history.

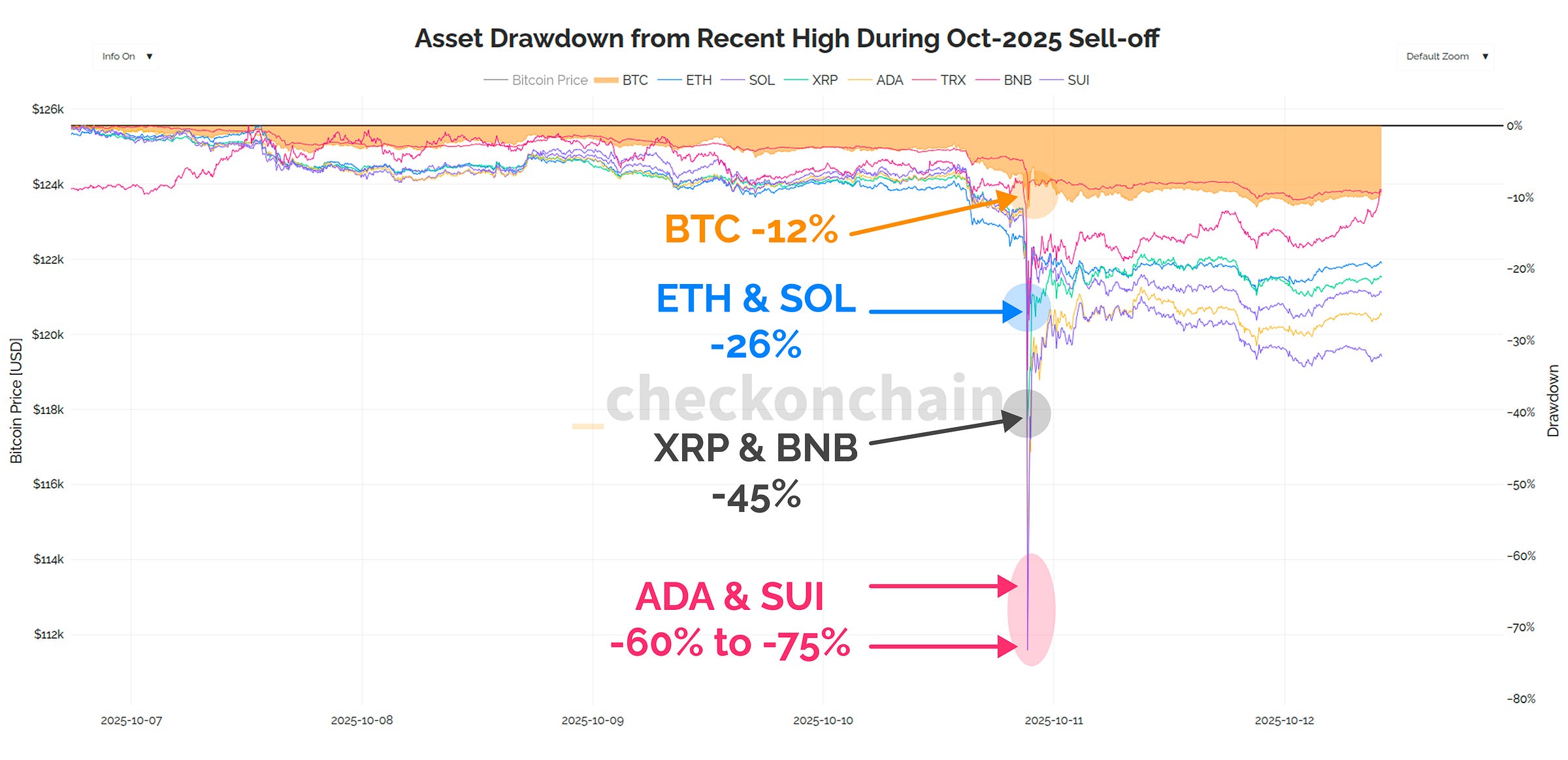

Whilst Bitcoin sold off -12%, many altcoins got massacred, with ETH and SOL trading down -26%, XRP and BNB cut in half, and SUI and ADA trading down -65% to -75%… and the price of some long tail assets literally went to zero!

This event was a real wake-up call for many crypto investors, showing that when volatility picks up, and market makers back off, the bid for many of these tokens is simply non-existent.

I’m also very confident, that we weren’t the only ones watching the corn price this weekend. Every trader and investor with a Bloomberg terminal was watching it as well to get a read on what their equity portfolio was likely to do Monday morning.

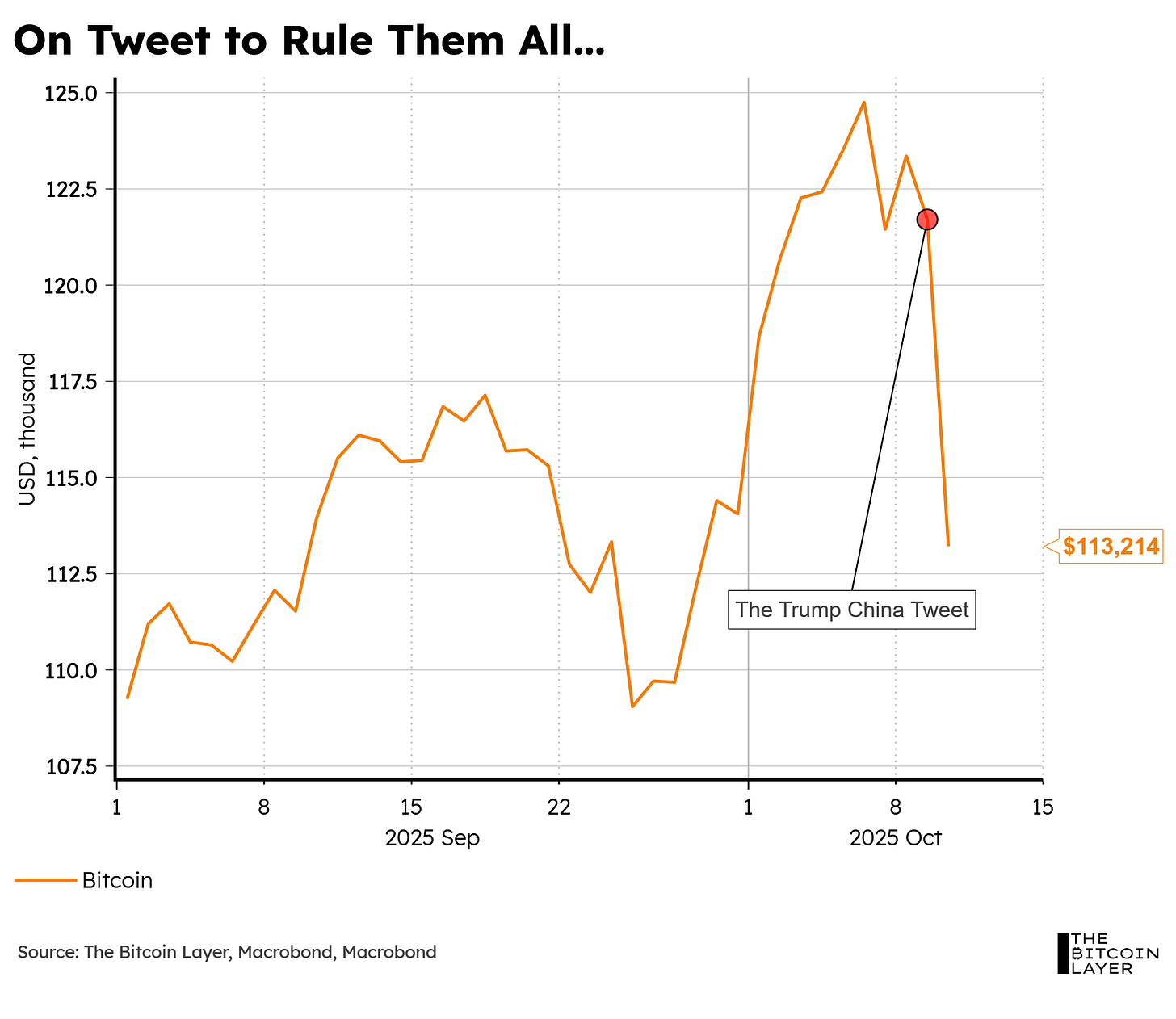

Bitcoin is one of the most sensitive assets to liquidity conditions, and even though this sell-off was arguably triggered by a Trump tweet about 100% tariffs with China, the impacts of such a thing would be felt market wide.

In today’s post, we return with our monthly collaboration with team at The Bitcoin Layer, where we will be covering:

The aftermath of the deleveraging event, and what it means moving forwards.

The divergence in performance between Bitcoin and crypto.

My current thinking about the price levels which I see as lines in the sand.

The Bitcoin Layer team’s analysis of liquidity conditions for October.

The impact of bond yields falling alongside rising volatility in the bond market.

It feels to me like markets are very ready to start trending once again, and today’s post is all about re-calibrating our expectations, so none of us are surprised by whichever way it breaks.

🚨 7 Day Free Trial Offer (48 Hrs Left)

As part of this collaboration, both Checkonchain and The Bitcoin Layer are offering 7 Day Free Trials for our Paid Subscriptions. These offers are ending in 48 hours, so be quick.

Disclaimer: This article is general in nature, and is for informational, and entertainment purposes only, and it shall not be relied upon for any investment or financial decisions.

TL;DR

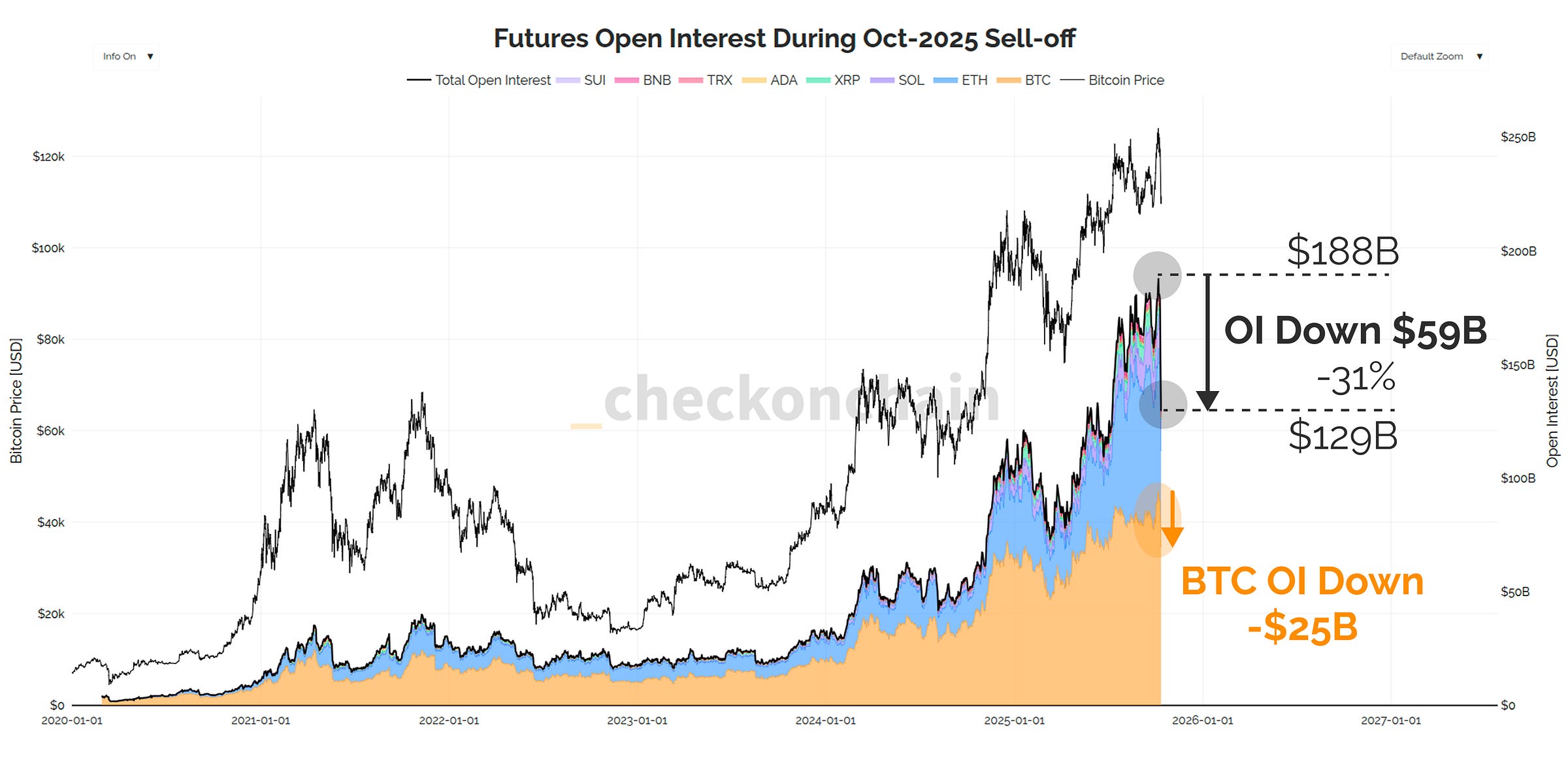

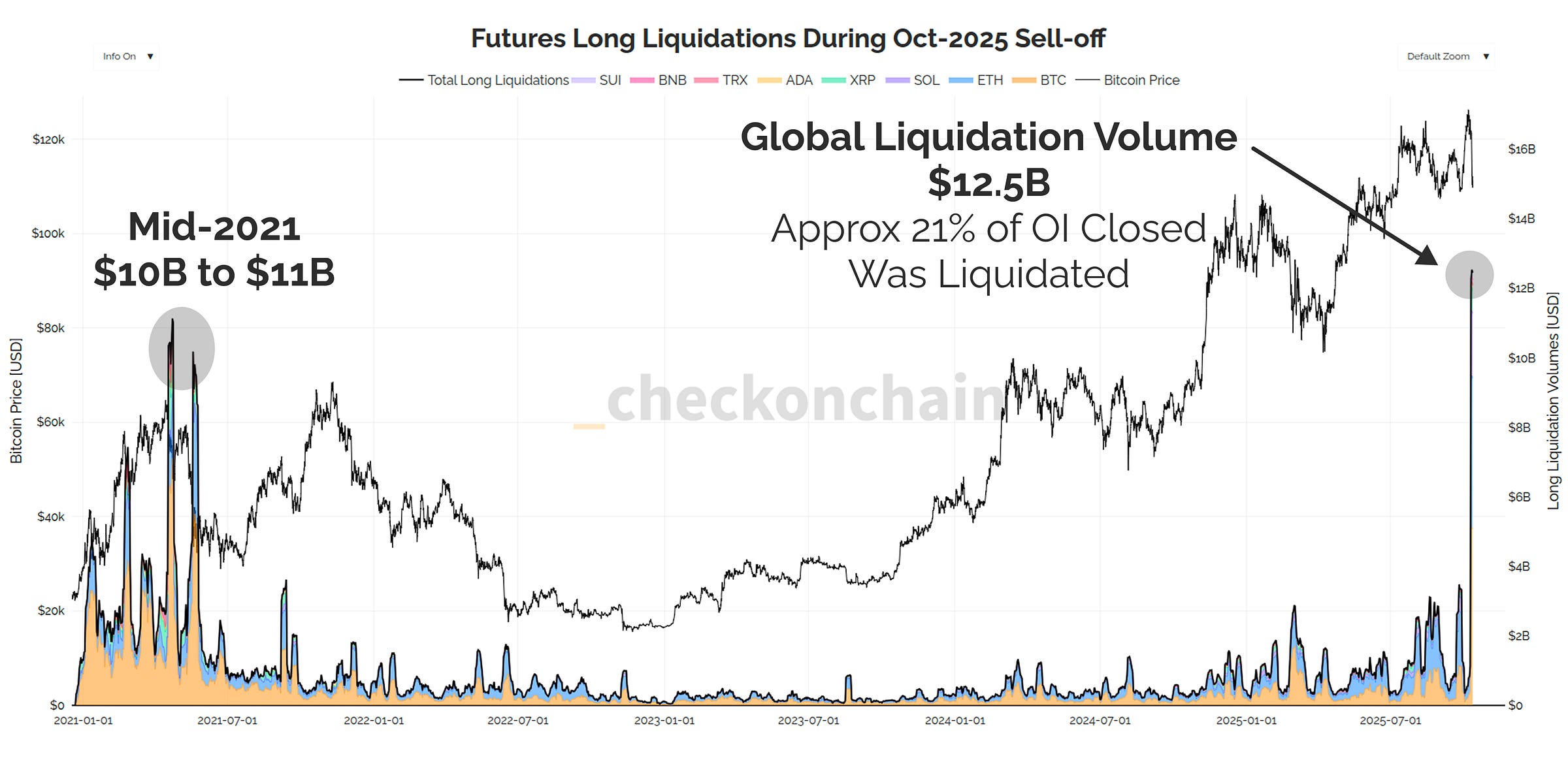

This deleveraging event was pretty serious, in that it wiped out over $59B in futures open interest across the largest crypto-assets, with $12.5B of this (~20%) being liquidations which zeroed the traders account.

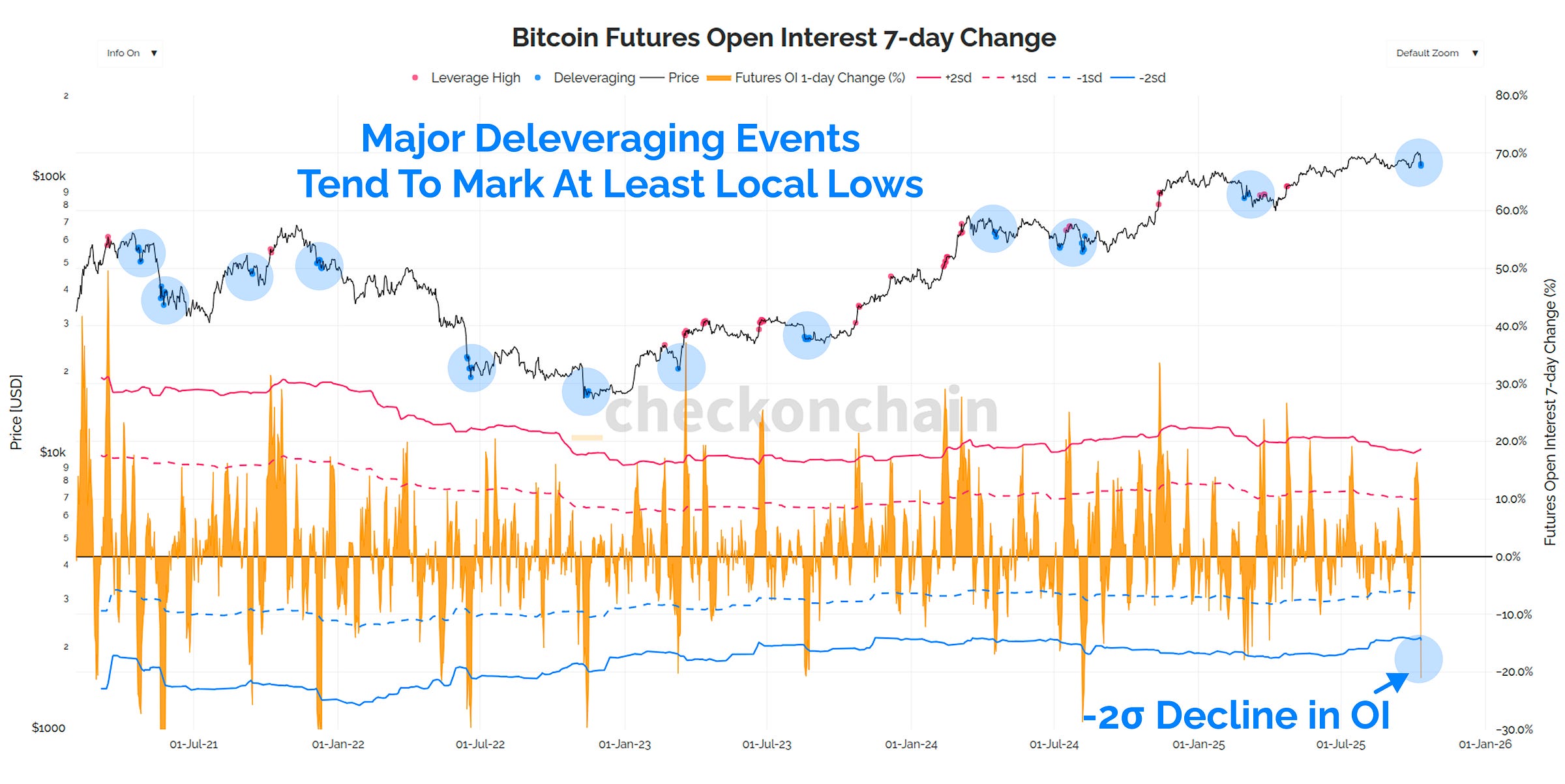

This leverage unwind was a 2-sigma event, and historically speaking, similar events typically signal that at least a meaningful local low has been hit for the time being.

Deleveraging events like this one are a bit like a forest fire, where it burns off all the excess speculative wood, leaving a lot less kindling to start the next one.

Given Bitcoin futures markets unwound ~$25B in open interest, it is remarkable we only traded down -12% off the ATH, although that doesn’t negate the potential damage done to the price chart.

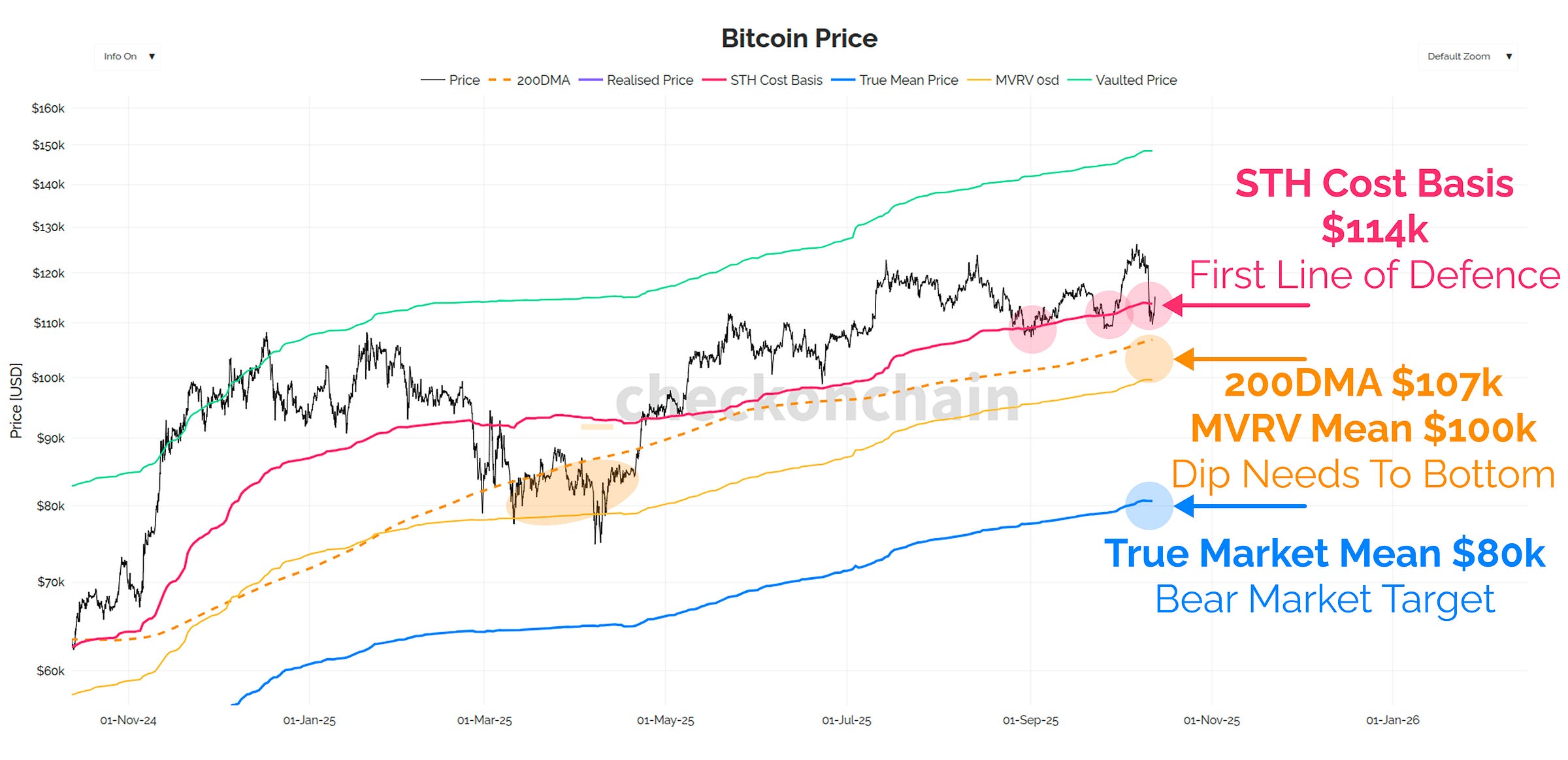

We do have to be careful in the weeks ahead, because whilst the Short-Term Holder cost basis (the first line of defence) has held for now, this is the third retest of it, and the more touches, the more likely it breaks.

My key levels remain largely unchanged for now, and I think whichever we break through, will signal the direction of the next macro trend.

Above $118k point of control, and we’re off to the races.

Below $114k STH cost basis, is a sign for real caution.

Range between $105k to $100k is equivalent to where the 2024 and 2025 corrections found their low, and really needs to hold.

Below $95k…and I think we’re in trouble. This is the bulls last stand, and I don’t want to see price trading this far down.

For the time being, I actually remain constructive for Bitcoin, but the (hopefully) recovery over the next few weeks will tell us which way the winds want to blow.

Watch Video Update

Futures Forest Fire

At the start of October, I published The Bulls Are In Control, which highlighted that the break back above $118k likely signalled we were due a run back to all-time-highs.

What I also flagged, is that futures open interest was hitting fresh ATHs, and the odds were increasingly high that we would see a lot more volatility as a result.

Whilst there was no way to predict Mr President tweeting about 100% tariffs on an illiquid Friday afternoon, it was likely we’d see a wash-out of futures leverage at some point in time.

What is crazy about this particular deleveraging event, is how massive it was in absolute terms. Across the largest crypto-assets, we saw over $59B in open interest flushed out, with $25B (42% of total) coming from Bitcoin markets.

The drop in open interest was precipitous, and the majority of the flush out occurred in less than an hour of trading.

When we look at the open interest decline for Bitcoin specifically, this was a -2σ standard deviation decline, and the largest since the Yen-carry-trade unwind in August 2024.

Massive deleveraging events like this are very important to take seriously, because they have the several knock on impacts:

Obviously prices declined significantly in a short span of time, and that can spook investors, and make them think twice about their next buy.

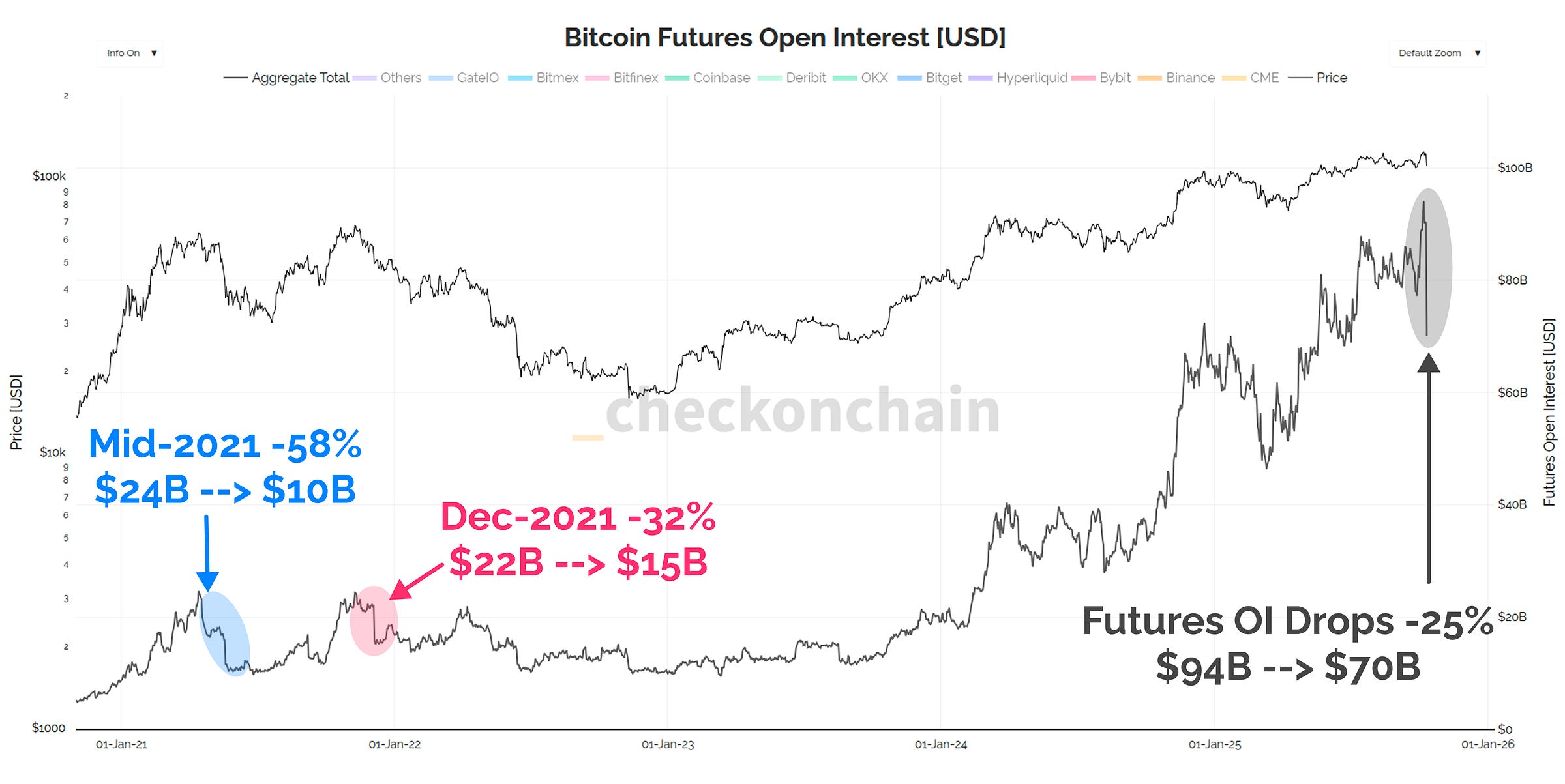

We saw this in both May and Dec 2021, both of which were really nasty, and in my opinion were the one-two punch that killed the bull market.

Deleveraging events destroy capital. When the price of the token you‘re trading literally goes to zero, it doesn’t matter what leverage you applied, you will be wiped-out. A lot of traders zeroed their accounts over the weekend, and that will remove a lot of demand moving forwards.

Clearing out leverage is also a very good and healthy thing, because it minimises further deleveraging events on the immediate road ahead. Like a forest fire, we just flushed out an enormous volume of speculative dead wood, leaving only the serious unlevered spot buyers still in the market.

I also want to highlight, how remarkable it is, that Bitcoin could see -$25B in futures open interest flushed out in an hour, and the price only declined 12% from the ATH.

The ability for Bitcoin markets to absorb such huge volumes of capital in distress, is an incredible signal unto itself.

I do want to highlight the May and Dec 2021 deleveraging events as a reference point, because if this was to turn out to be the straw that broke the bulls back, these are the right reference points.

In May 2021, the GBTC premium had dried up in February, removing a 660k BTC spot bid from the market. Futures leverage was ripping higher, and everyone was anticipating a rally to the fabled $100k level…we went to $29k instead, washing out $14B worth of the futures OI as it did so (a 58% decline)…

Many blamed the China mining ban, and Elon Musk backing away from Bitcoin as the catalyst, but I am of the view it was the GBTC premium going to a discount, plus excessive leverage, and unrealistic expectations that did it.

For those interested, I authored a report for Glassnode called Surveying The May-2021 Sell-off reflecting on the event afterwards.

In Dec 2021, the market had reached a new ATH of $69k, but the underlying market structure was dead after the May 2021 sell-off. Bitcoin onchain activity was a ghost town, MVRV had a massive bearish divergence, and the market was extremely top heavy (lots of investors with a very high onchain cost basis).

As the market sold off, we discovered that once again, traders had levered up to the gills, and open interest swiftly declined by $7B (-32%), and was the final nail in the coffin for the bull market.

Truth be told, it remains to be seen whether these two events are appropriate comparison points, but we should all keep them in our back pockets as a potential outcome.

Later in this piece, we will draw price lines in the sand for where this result may become increasingly likely.

Returning to our current deleveraging event, the proportion of open interest decline associated with direct liquidations (meaning the trader’s entire account was wiped-out), was massive.

Over $12.5B in liquidation volume occurred across the largest crypto-assets, representing around 21% of the total OI decline (the rest was from stop-losses and traders manually closing out their position, which didn’t zero their entire account).

This exceeds the previous ATH liquidation volumes of $10B to $11B set in April and May 2021 as the bull market came off its first cycle high.

Any way we want to slice it, the futures forest fire that has swept through was historic in size, and has no doubt cleared out a lot of the speculative excess.

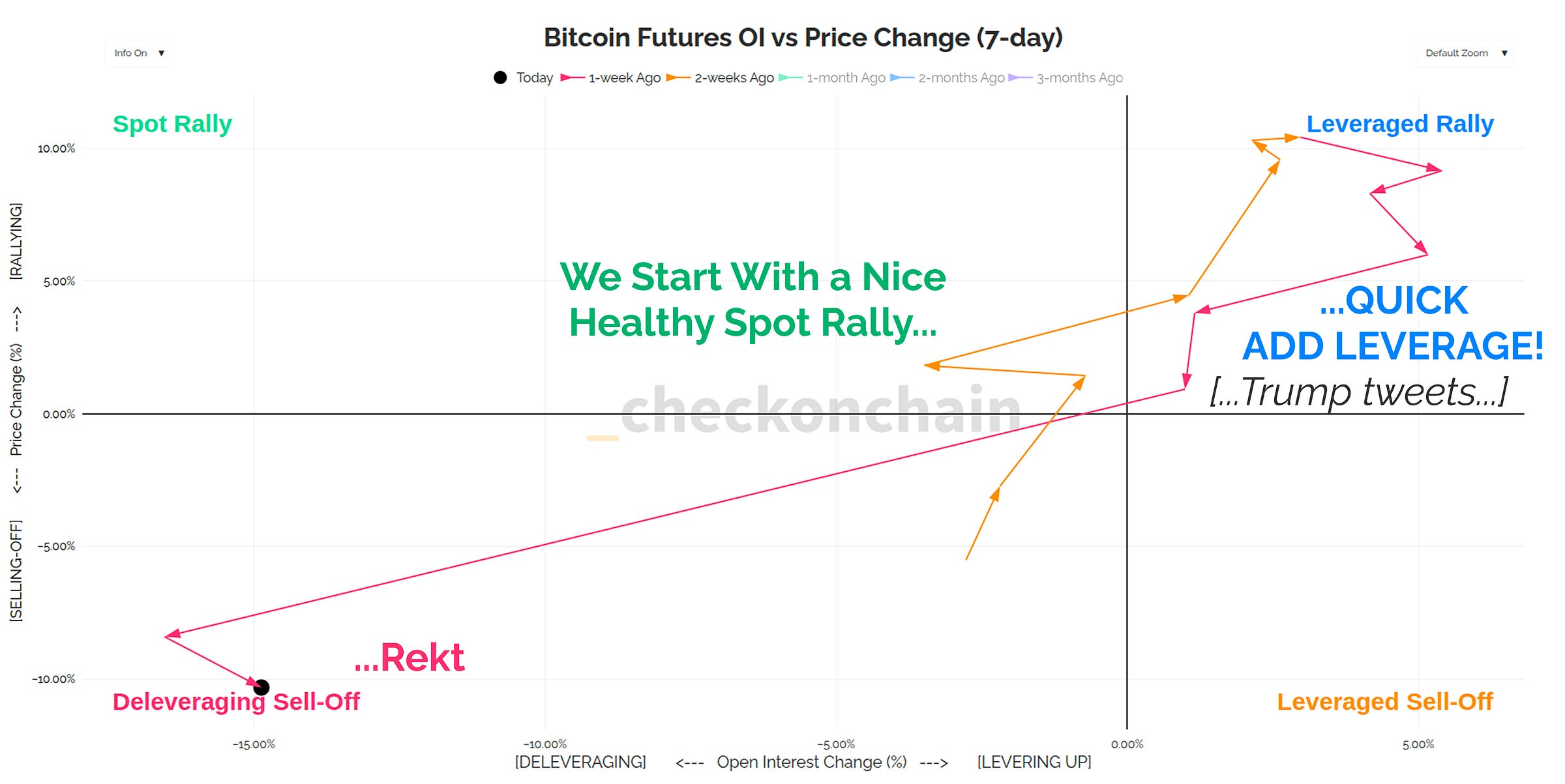

The chart below is a strange one, but I think it helps us visualise the investor behaviour that I would characterise as ‘speculative excess’.

On the X-axis is the 7-day percent change in futures open interest, with the RHS indicating the market is levering up, and the LHS signalling a deleveraging.

On the Y axis is the 7-day percent price change in the Bitcoin price, with the top half being price rallies, and the bottom half a sell-off.

The arrows then show the path we took over the last two weeks around these four quadrants.

The short summary is, as the price rallied two weeks ago, the market added more and more leverage, expecting us to fly to $1M…

…Instead, we sold off -12%, and open interest declined by such a massive amount, I had to adjust the default view of this chart to fit it in.

Moving forwards, a healthy market structure will see us trading more in the top left quadrant, and less on the right hand side.

Lines In The Sand

So in the aftermath of a pretty significant event, how does this affect the setup for Bitcoin moving forwards? Readers will know that we have retained a core bullish stance, however with key lines in the sand for where things are likely to deteriorate.

The framework by which we think about the rolling over of a bull into a bear is as follows:

When too many people, buy too many coins, at too high of a price, we consider that market to be ‘Top Heavy’.

This means that small downwards fluctuations of the BTC price can put an outsized number of investors underwater, which can quickly dampen sentiment and demand.

If the price falls too far below a large number of cost basis levels, then unrealised losses start to explode higher, and there is nothing quite like the overwhelming feeling of regret due ‘buying the top’, and staring at big red portfolio number to slay the spirit of the bulls.

With that as context, we can start mapping out the key levels where we expect Bitcoin investor sentiment to experience marked shifts.

Remember, these are not price predictions, but instead price levels where investors have historically changed their behaviour patterns in response to their portfolio performance.

🔴 The Short-Term Holder cost basis ($114k) is the first line of defence for the bulls. Truthfully, I didn’t expect us to revisit this for a while, and I am hoping that the third time is the charm.

🟠 The 200DMA ($106k) and long term average of MVRV ($100k) are levels coincident with the deepest dips we have had so far in this cycle. As we will see in a moment, below $105k, we start to get a majority of holders underwater, and things get increasingly hairy below there.

$95k is what I personally consider to be the bulls last stand, and I will explain why in the next charts.

🔵 The True Market Mean ($80k) is the average cost basis for active investors. It was derived from the Cointime Economics study, and in my opinion supersedes the Realised Price as my expected bear market floor level. It is also coincident with the ETF cost basis ($81k), Strategy’s cost basis ($75k), and the top of the 2024 chopsolidation range ($75k).

Whilst I’d rather we were higher, the fact of the matter is, the bears still have not taken us below the bulls first line of defence (the STH cost basis) on a serious closing basis.

We had a forest fire…but our cabin in the woods still stands.

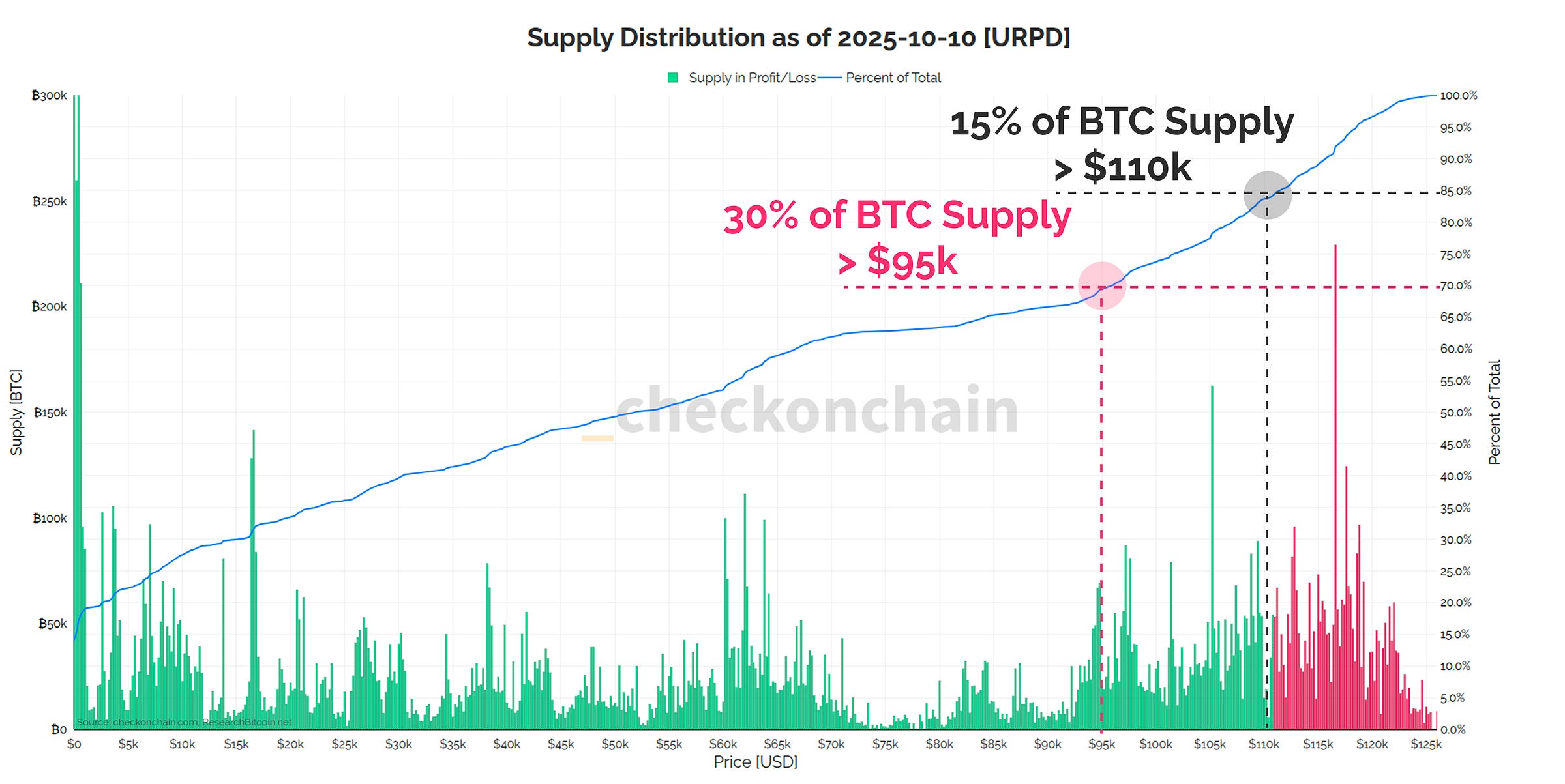

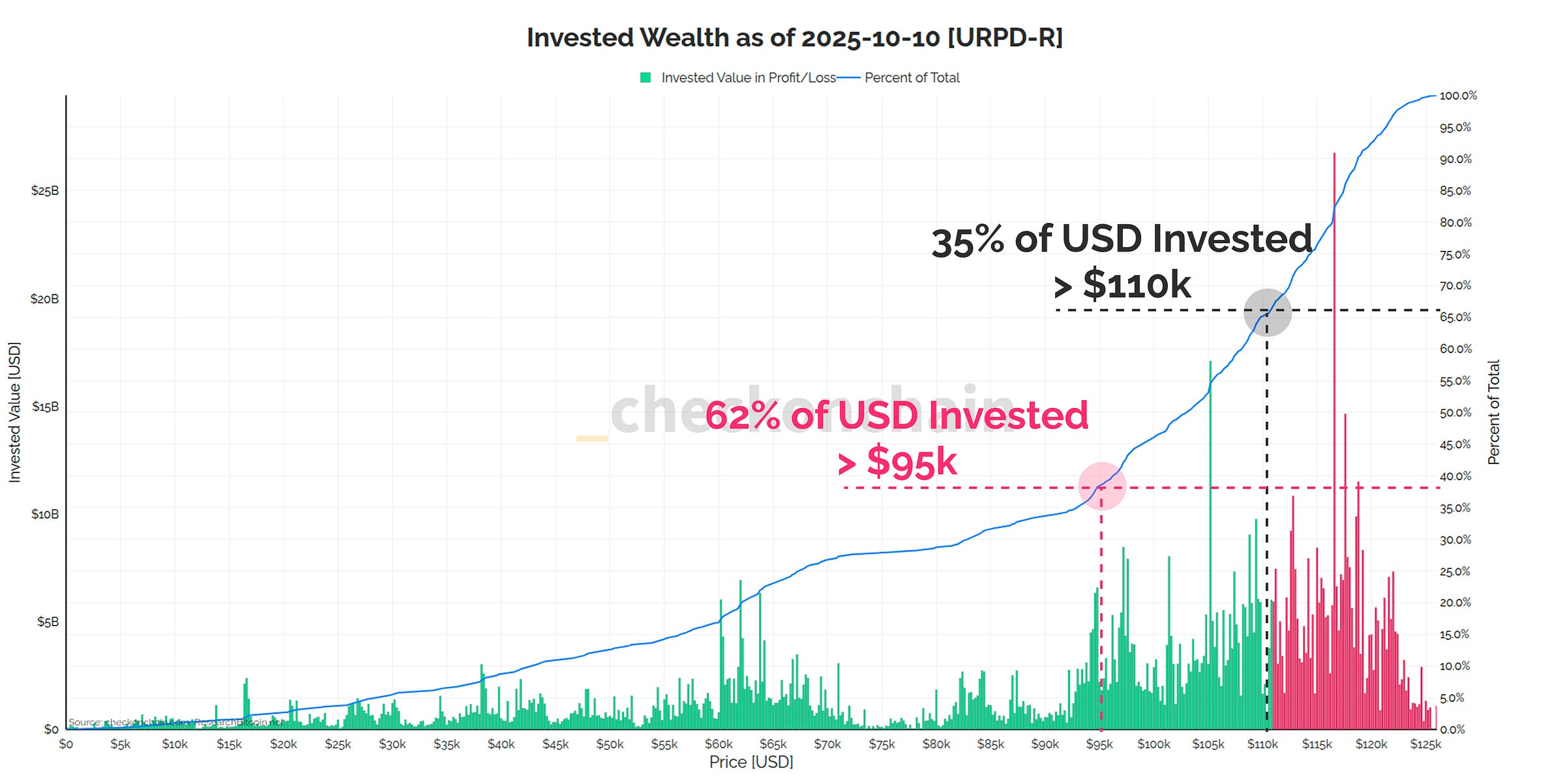

If we look at the distribution of the entire BTC supply vs price, we can start to see why these price levels are quite important.

Over 30% of the Bitcoin supply has an onchain cost basis higher than $95k, and $15% of it was acquired above $110k.

This is by far the largest zone of supply cluster that is relevant to us, because the next largest one is all the way back in the 2024 chopsolidation range, between $55k and $75k. I’m sure most of us would rather not see Bitcoin trading back down at those levels.

Now whilst the chart above is in BTC terms, most people still think about their portfolio value in terms of fiat currency (rightly or wrongly). As a result, people will naturally anchor to how much they invested, and less so to the number of coins held.

The chart below shows each coin in the supply, except we have weighted them by the price when they were acquired (think the USD value invested).

From this vantage point, it becomes very clear why $95k is the most important price level to hold, because over 62% of the dollars ever invested in Bitcoin, are above that price level.

This is Bitcoin’s new home, and if you can imagine how nasty sentiment would get if all of those coins fell underwater…it would likely get pretty rough.

Below $95k, Check the Analyst would struggle to classify the market as anything other than Top Heavy, and it is my view that it would start to heavily resemble the May and Dec 2021 crash events.

Since the price is currently trading at $115k at the time of writing, we still have a buffer zone between here and $95k (although it is only $20k, and a -18% move below us).

This is where those other price levels of $105k and $100k come into play, as they act as the ‘midpoint’ of the current supply distribution, and assuming we can hold above those levels, bull market sentiment should remain largely intact.

However, if we were to break down to $105k…and then $100k…suddenly $95k isn’t that far away, and more and more people will start seeing a growing red number in their portfolio.

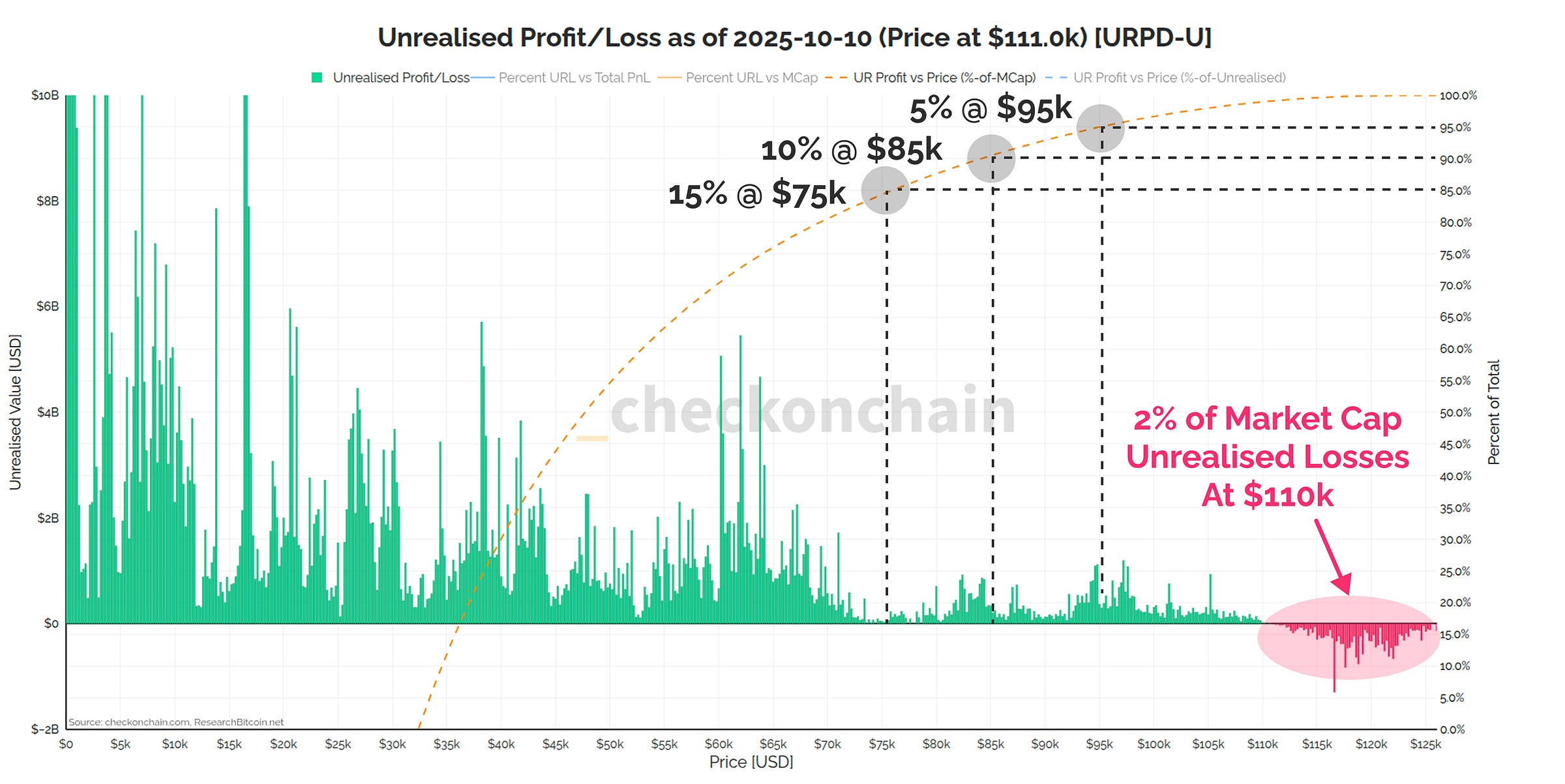

If we did reach $95k, the total volume of unrealised losses held across the market would equal 5% of the Bitcoin market cap, compared to the 2% we are at today.

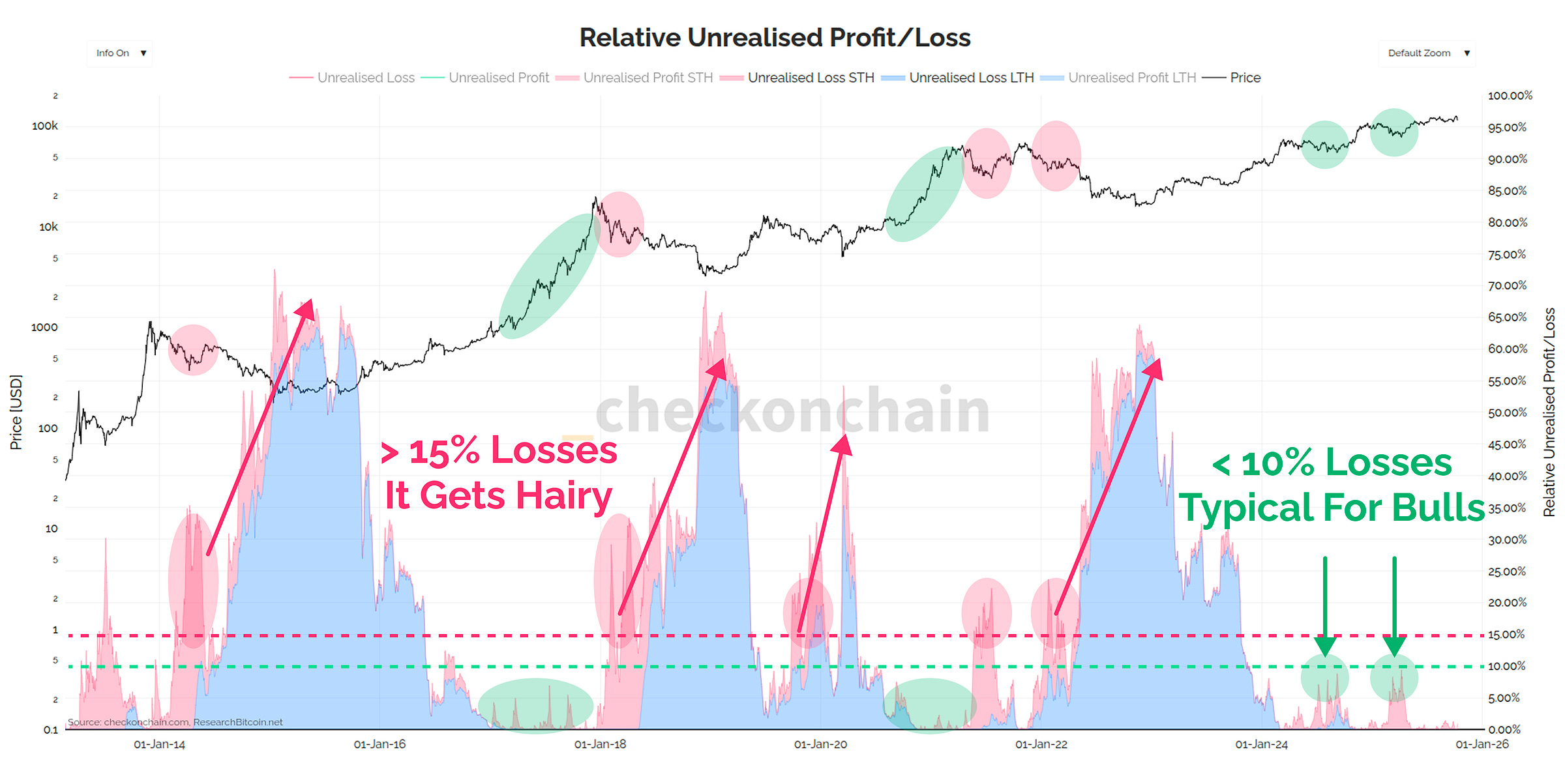

Bull markets of the past have tended to meet their end whenever unrealised losses spike above 10% of the market cap, and we touched that upper bound in both 2024 and 2025. If you can recall, those events also had people calling for the end of the cycle, and the start of a bear market.

Whilst they were ultimately proven wrong about that, it does go to show how in the gutter sentiment can be at an unrealised loss level of 10%.

The risk is, should the price fall below $95k, losses accelerate quickly, and since we don’t have a huge amount of historical support until $75k…well…you can probably see where I am going with this.

I expect sentiment to get increasingly nasty below $95k, and as a result, I would really rather the bulls stepped in before that, so I don’t have to put this thesis to the test.

So that brings us to the final chart, where we can summarise my current thinking about the key lines in the sand. These levels align both from an onchain perspective, but also from a technical analysis perspective using the volume profile:

So far, we’re still above the STH cost basis at $114k, and this is the bulls first line of defence. To our credit, the bears **still** have not taken this level out, which is a good thing, and arguably shows meaningful strength for now.

If the price gets down as far as $105k or even $100k, we really do need the bulls to step in. This is the mid-point of the range, and the last major volume node before $95k. The 200DMA is there, and we have bottomed out at this equivalent level in both 2024 and 2025.

The bulls last stand is at $95k in my opinion, and I think we should all be very cognisant that things probably deteriorate rapidly as we approach it. It is the bulls last stand, so it can hold…but one has to ask how the bulls allowed the price to get this far down in the first place.

However…it’s not all bad news.

These levels obviously map out a bear case scenario, and we must be very conscious that this is only one potential outcome.

By the same note, a break above $118k would put us above the top-most volume point of control, and if cleared, would be the second time we have survived a failed ATH break below it.

If we break above $118k, I believe we’re off to the races, and I stand by my previous post noting that we have earned a serious shot at $150k.

What I will leave you with, is one final idea.

I don’t think we chop sideways in the weeks and months ahead.

I think the market is primed and ready to trend in a big way.

If we go lower, I think we go a lot lower.

If on the other hand we go higher…I think we go a lot higher.

It’s time to rock and roll, and the next set of these major price levels we bust through, I believe defines the next major trend.

I’m impressed we only traded down -12% on this move, but the time is certainly now for the bulls to step in.

Seat-belts on.

🚨 Reminder: 7 Day Free Trial (48 Hrs Left)

As part of this collaboration, both Checkonchain and The Bitcoin Layer are offering 7 Day Free Trials for our Paid Subscriptions. These offers are ending in 48 hours, so be quick.

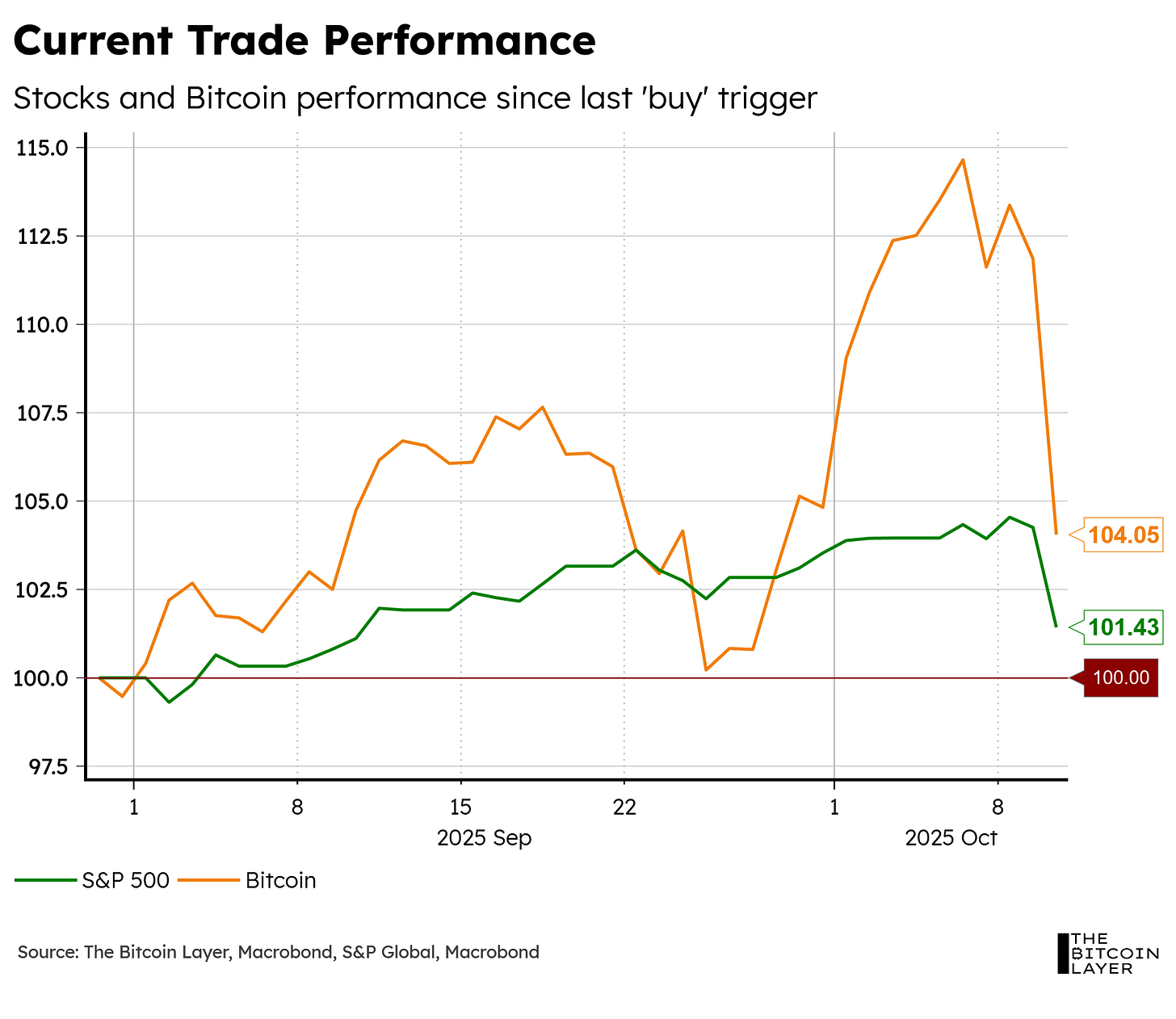

We are finally right in the middle of the long-awaited Uptober, and although bitcoin started the month on an extremely high note, President Trump had different plans (as the Checkonchain team highlighted in their analysis above):

We are starting to seriously consider creating a Trump indicator alongside all of our TBL Liquidity metrics, but that’s a topic for another day.

For now, suffice it to say that the roaring start to the month of October has been set back by, as Joe Consorti puts it, one of the largest nominal flash crashes in the orange coin’s history, with $278B wiped out in less time than it takes to watch an episode of your favorite Netflix drama.

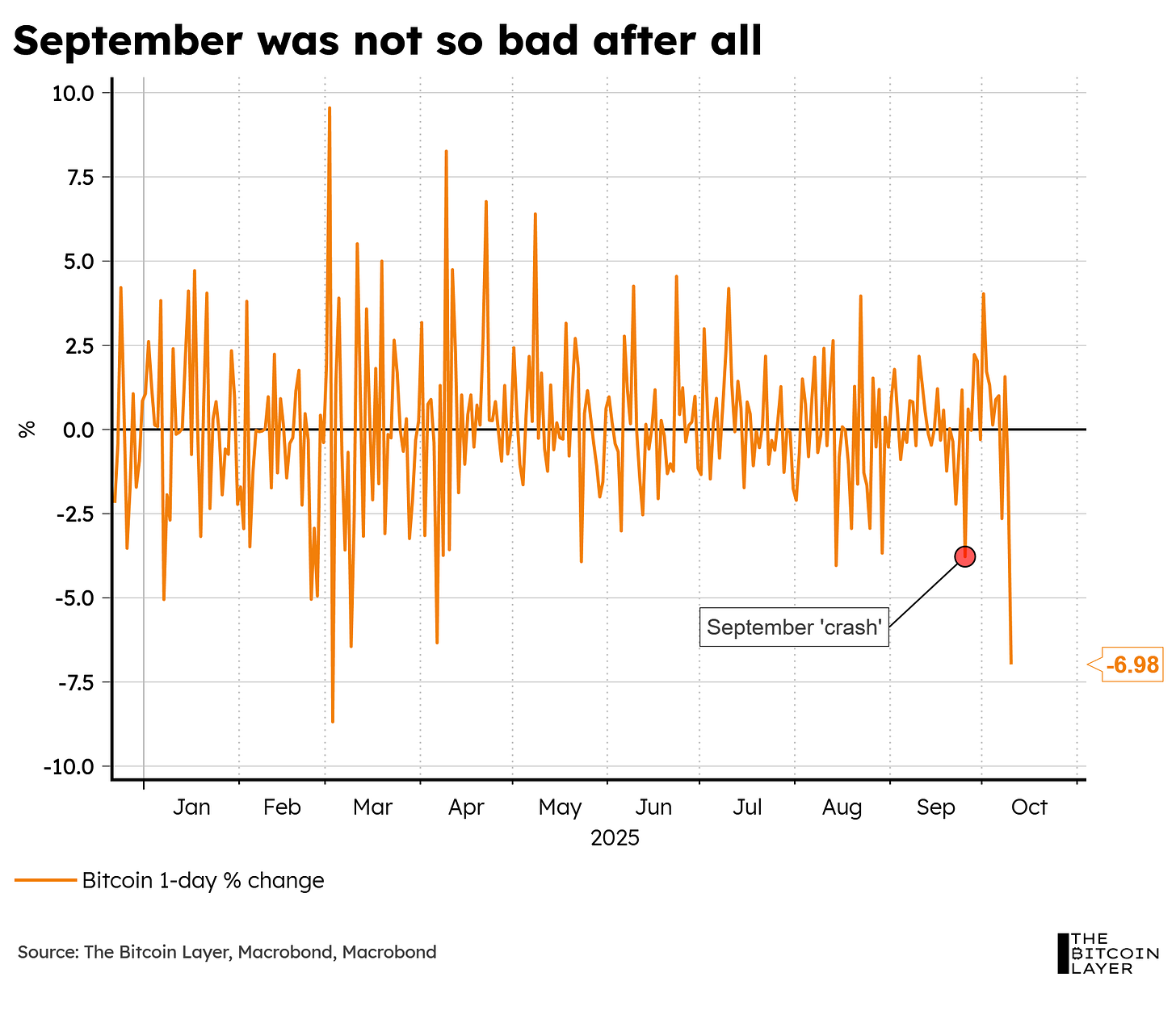

Just a few weeks ago, we were all talking about a 4% crash, which is looking puny right about now:

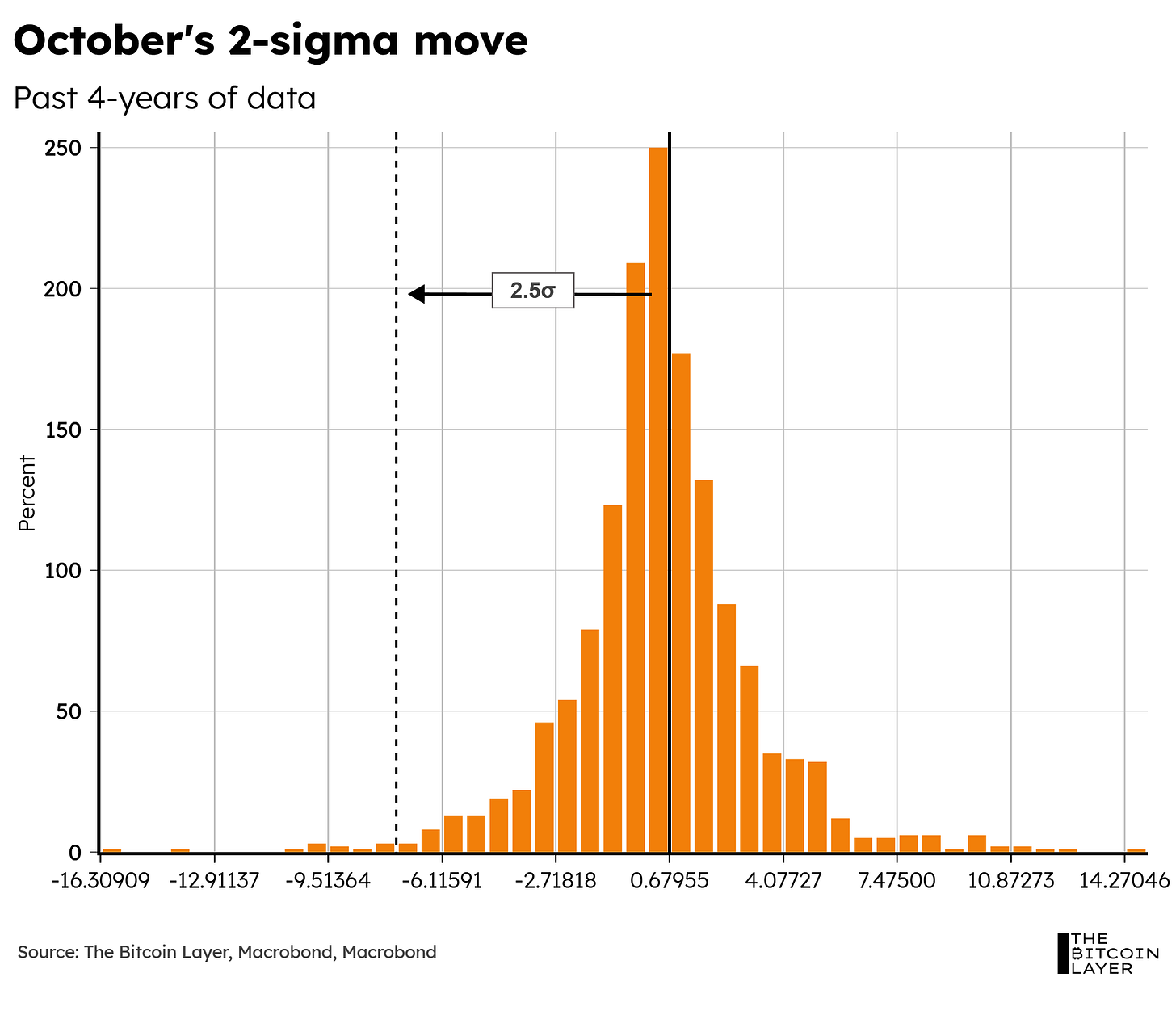

Looking back at the last 4 years’ worth of daily observations, Trump’s tweet ended up being a 2.5-sigma move for bitcoin:

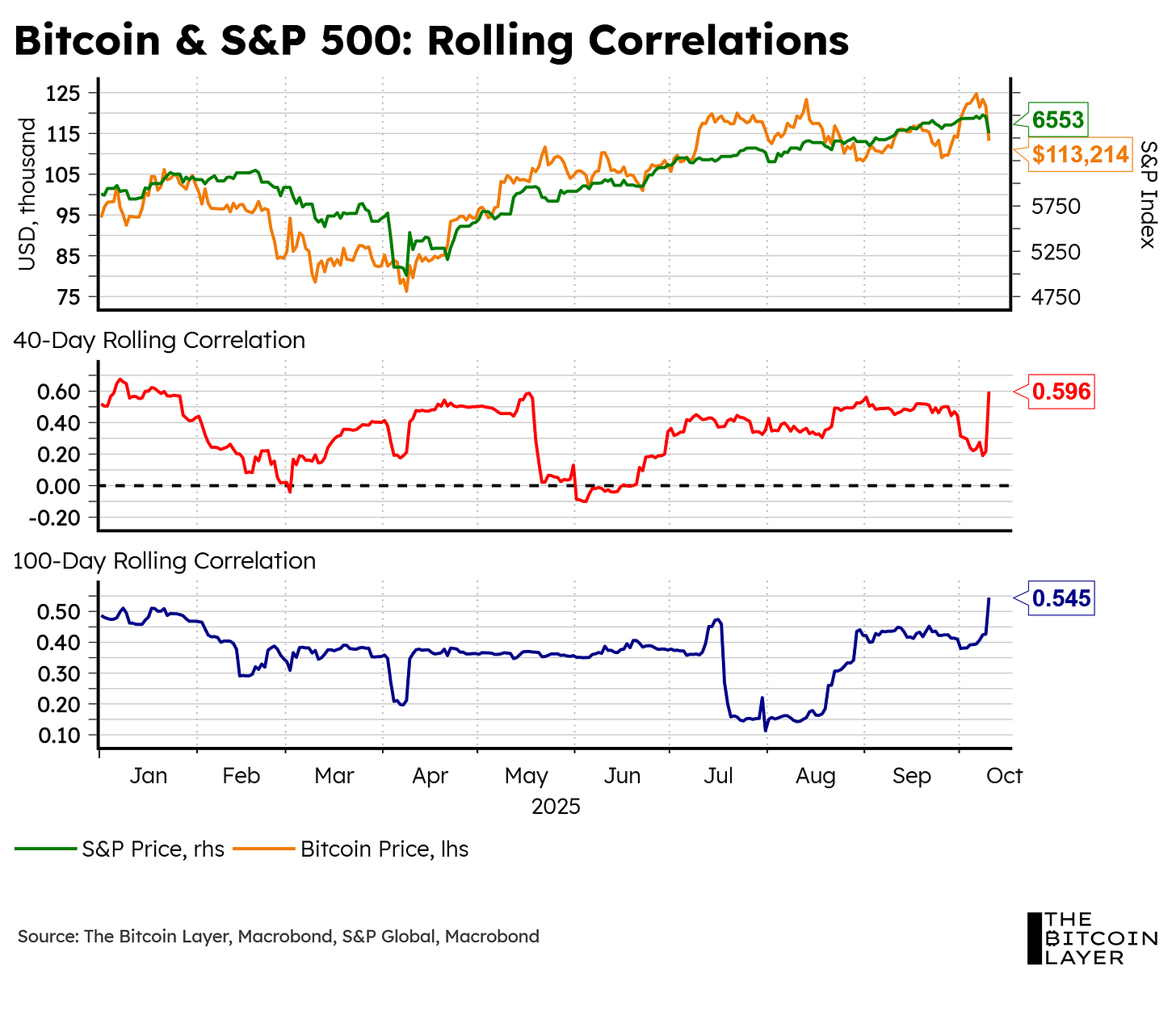

Perhaps this flash crash is a perfect example of just how exposed bitcoin is to more widespread market risks. That is, when correlations with the stock market are high (which they have been on a historical account)…

…that means more exposure to knee-jerk market reactions, such as those we’ve seen this year following Trump’s tweets.

But enough of the doom and gloom. Let’s step away from daily moves and look now at the bigger macro picture.

TBL Liquidity

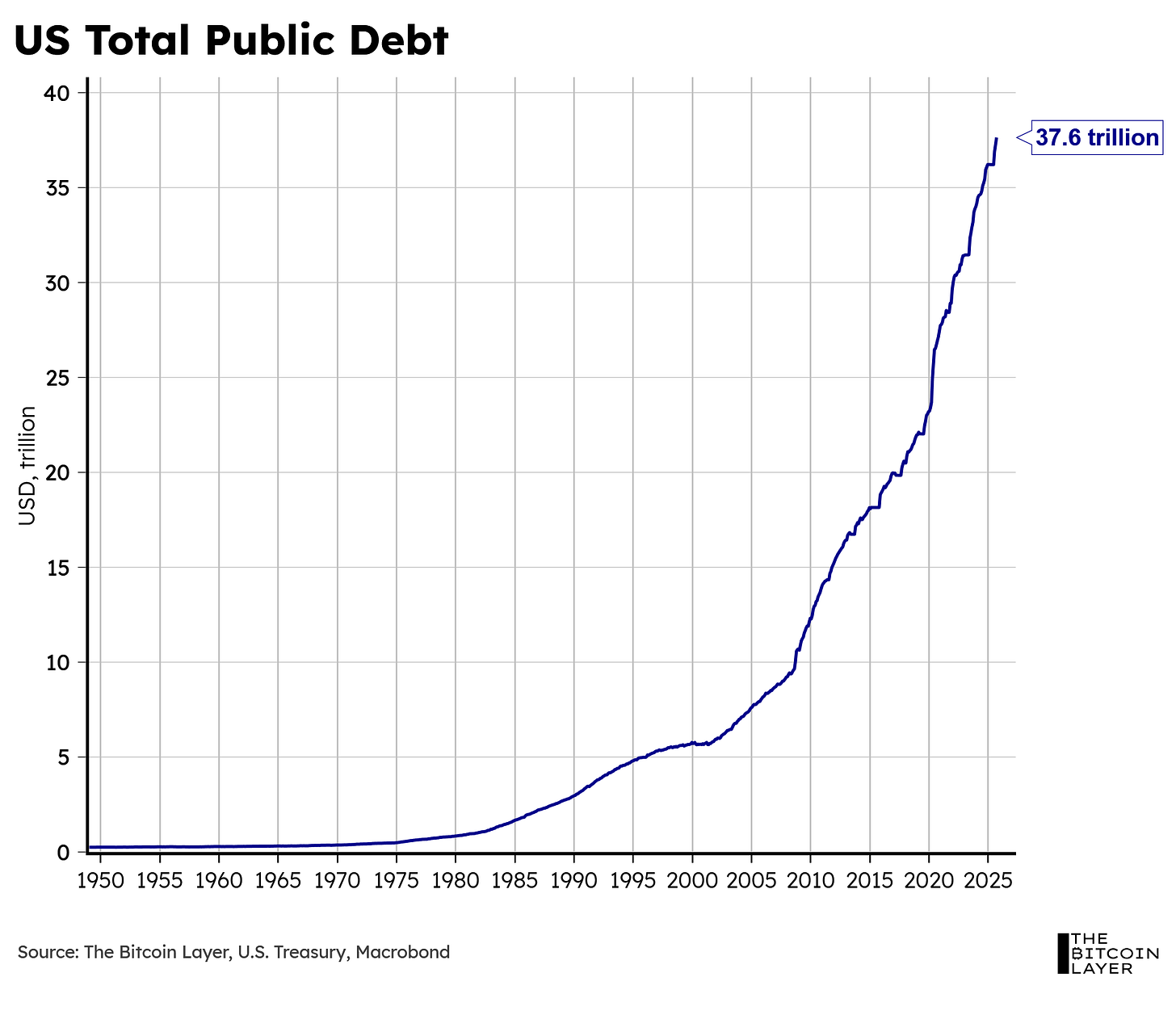

As you’re all aware, US Treasuries play an essential role in today’s financialized economy, and whether we like it or not, they are scarce assets (...yes, we are aware of this chart):

Why are they scarce? Despite an insurmountable level of debt, U.S. Treasuries are still considered by many to be the risk-free asset of the world. Furthermore, each Treasury is its own individual asset with a unique CUSIP and characteristics. Unlike the fungibility of Apple stock—whereby exchanging one Apple stock with another leads to holding the same asset—exchanging one Treasury for another doesn’t exactly work like that.

If the US Government issues a 10-year note, while at the same time, there is an old 30-year bond that was issued 20 years ago and therefore has 10 years left to mature, these two Treasuries may match in maturity, but that doesn’t make them fungible.

Over 70% of the trading volume in the US Treasury market takes place in on-the-run securities, which are the most recently auctioned Treasuries (source). And while the story of how that came to be is beyond the scope of this article, the key takeaway here is that, in a self-fulfilling manner, financial infrastructure and liquidity have concentrated around newly issued Treasuries—put simply, everyone wants the new ones because there’s just a lot more infrastructure, and therefore, more you can do with them. On-the-runs are also easier to post as collateral in repo transactions, even though technically all Treasuries are supposed to warrant the same haircut as each other—bilateral repo participants don’t always agree with the idea that a deep off-the-run Treasury equals an on-the-run one.

Ergo, US Treasury Buybacks. Given the high spreads and illiquidity behind old Treasuries, older issues add frictions to the market (clogging balance sheets and, therefore, liquidity), so removing these older issues from the market leads to reduced frictions and fewer hiccups overall.

Anyway, where were we? Oh, that’s right! The scarcity of US Treasuries—specifically, on-the-run Treasuries.

The reason we mention that is because of something known as the circulation of collateral. As a result of the aforementioned scarcity, as well as high demand, US Treasuries are prime collateral, leading a single US Treasury security to circulate around multiple balance sheets. The Fed puts it best:

“In a world where collateral can be scarce, the ability to freely circulate collateral alleviates some of the costs associated with scarcity” (source).

In a recent piece, we explained what the collateral multiplier is in more detail, but to keep things simple and in line with this section of the article (in case you forgot, we’re talking about TBL Liquidity), when a single Treasury is rehypothecated multiple times in funding transactions (repo markets), that is an indication that US Treasuries are extremely prime collateral, which is why a greater number of funding transactions are taking place on a fixed number of Treasuries (i.e., a high collateral multiplier).

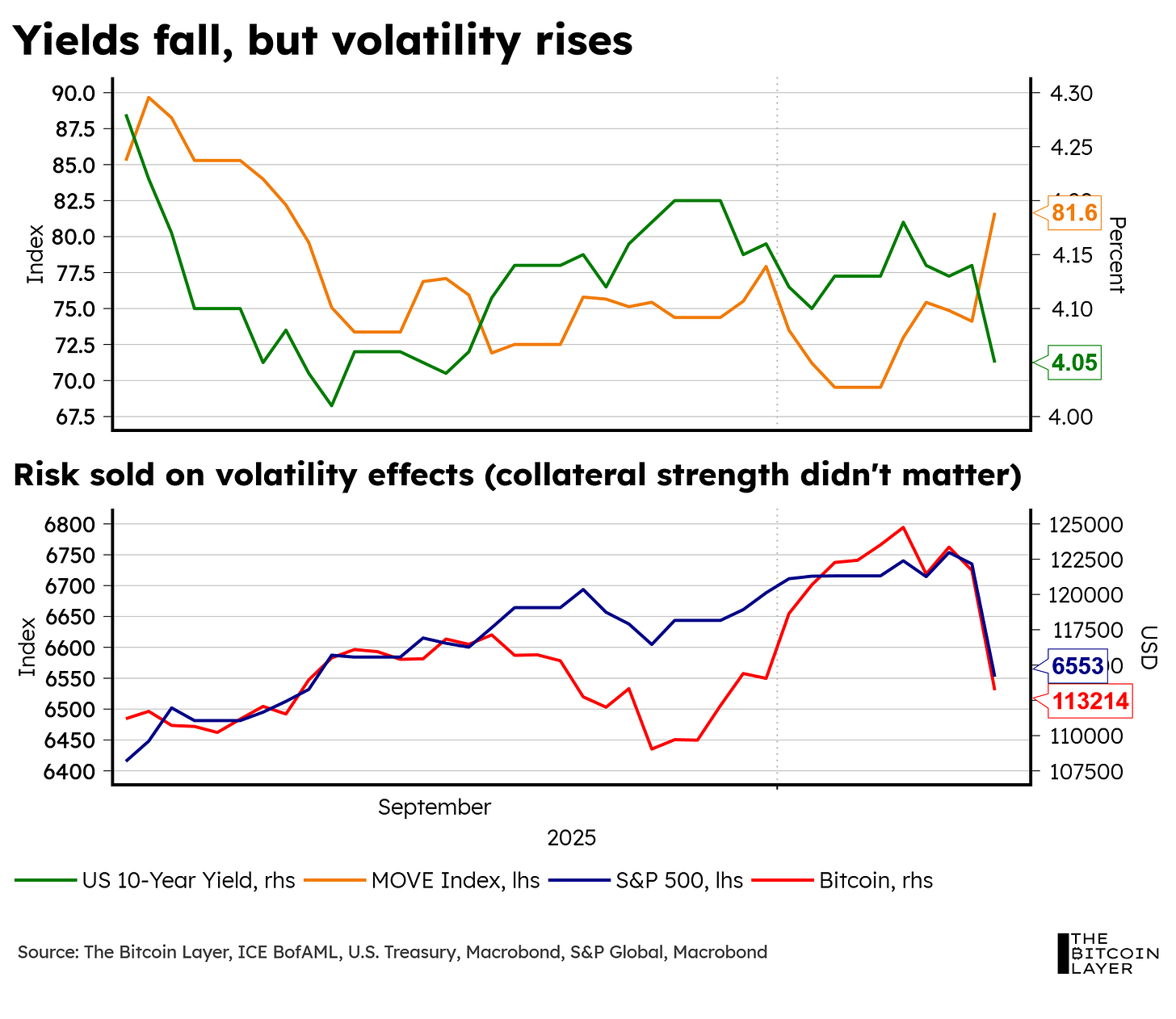

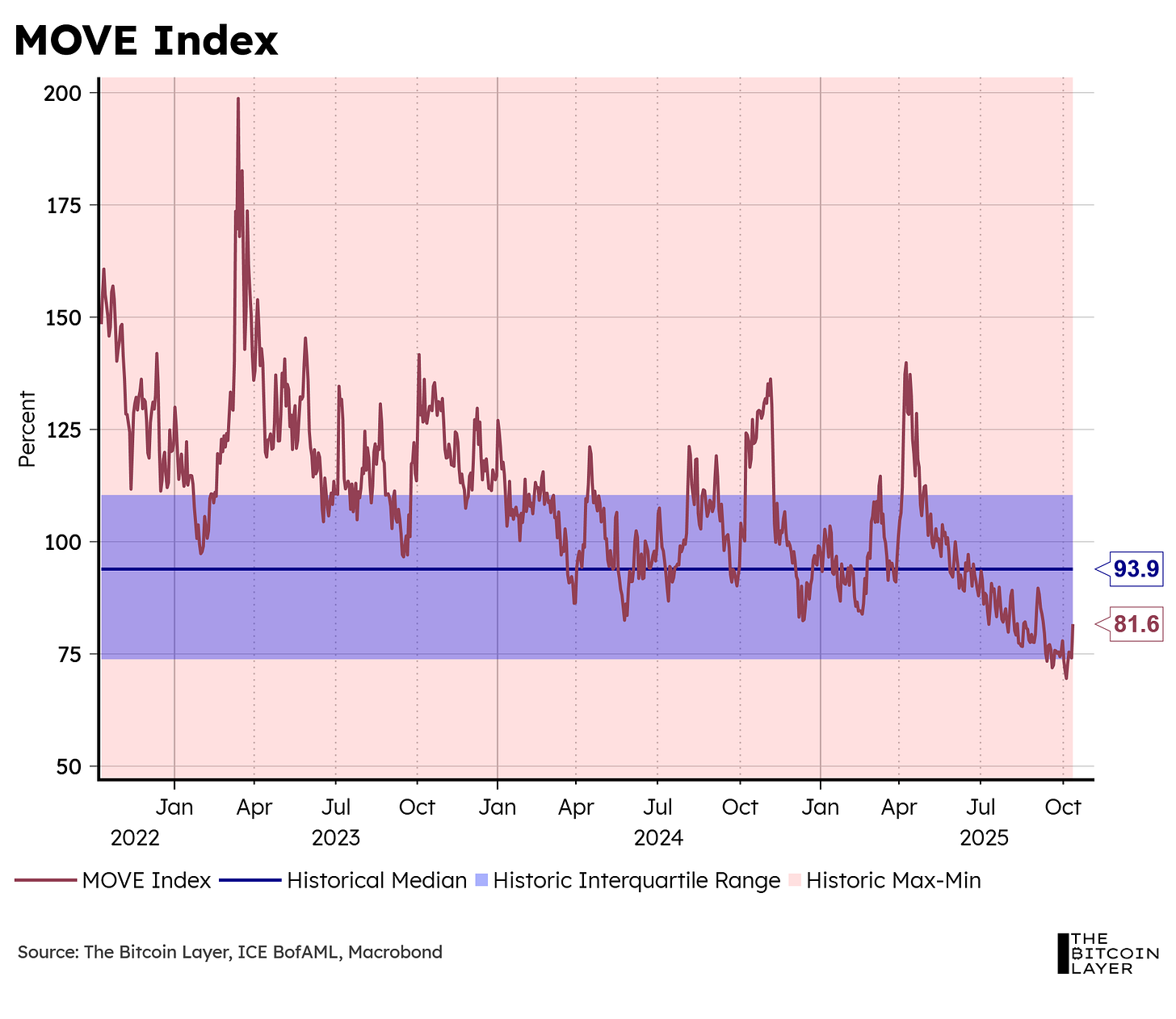

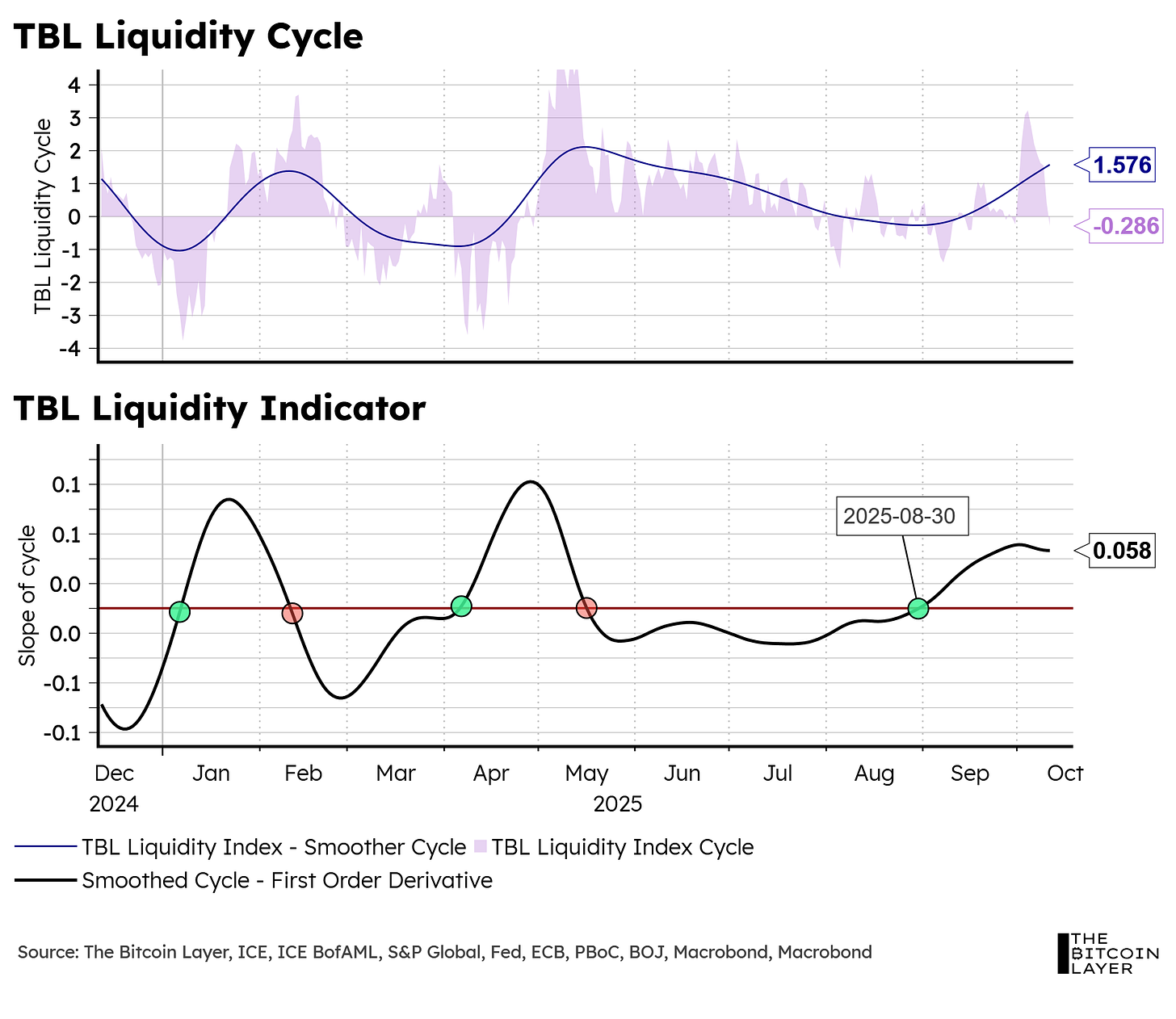

The only reason participants would be willing to borrow against borrowed collateral (rehypothecation) is that the collateral is extremely stable. In comes the MOVE Index. Bond market volatility affects the collateral multiplier directly, and therefore risk assets like bitcoin, because when it rises (MOVE Index up), you get two things:

Existing funding transactions on the current stock of Treasuries become fragile, as people may want or need their collateral back.

New funding transactions decrease, given the unpredictable state of the collateral.

The net effect is that risk asset positions financed via repo (with Treasuries as collateral) fade, and risk plummets.

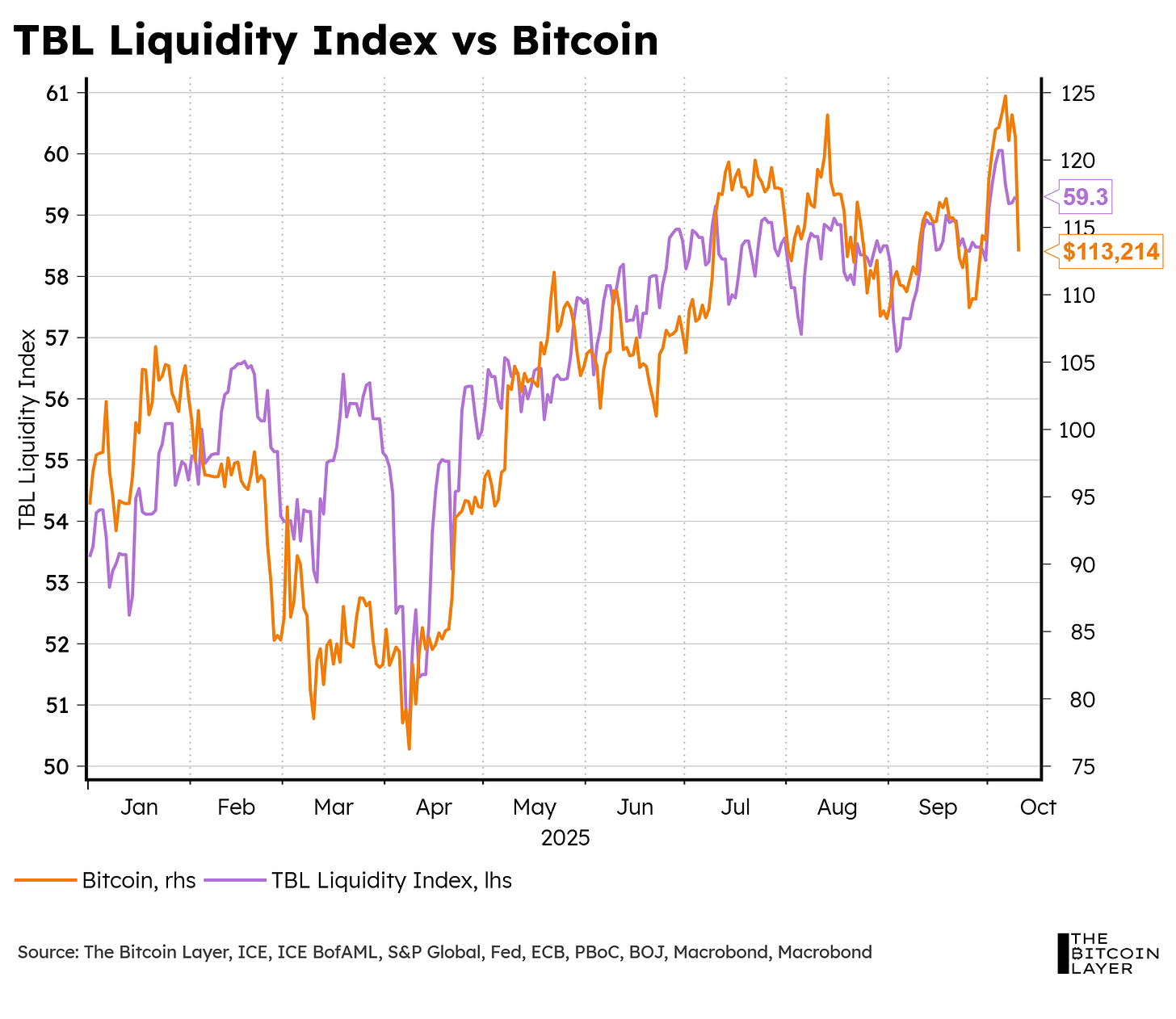

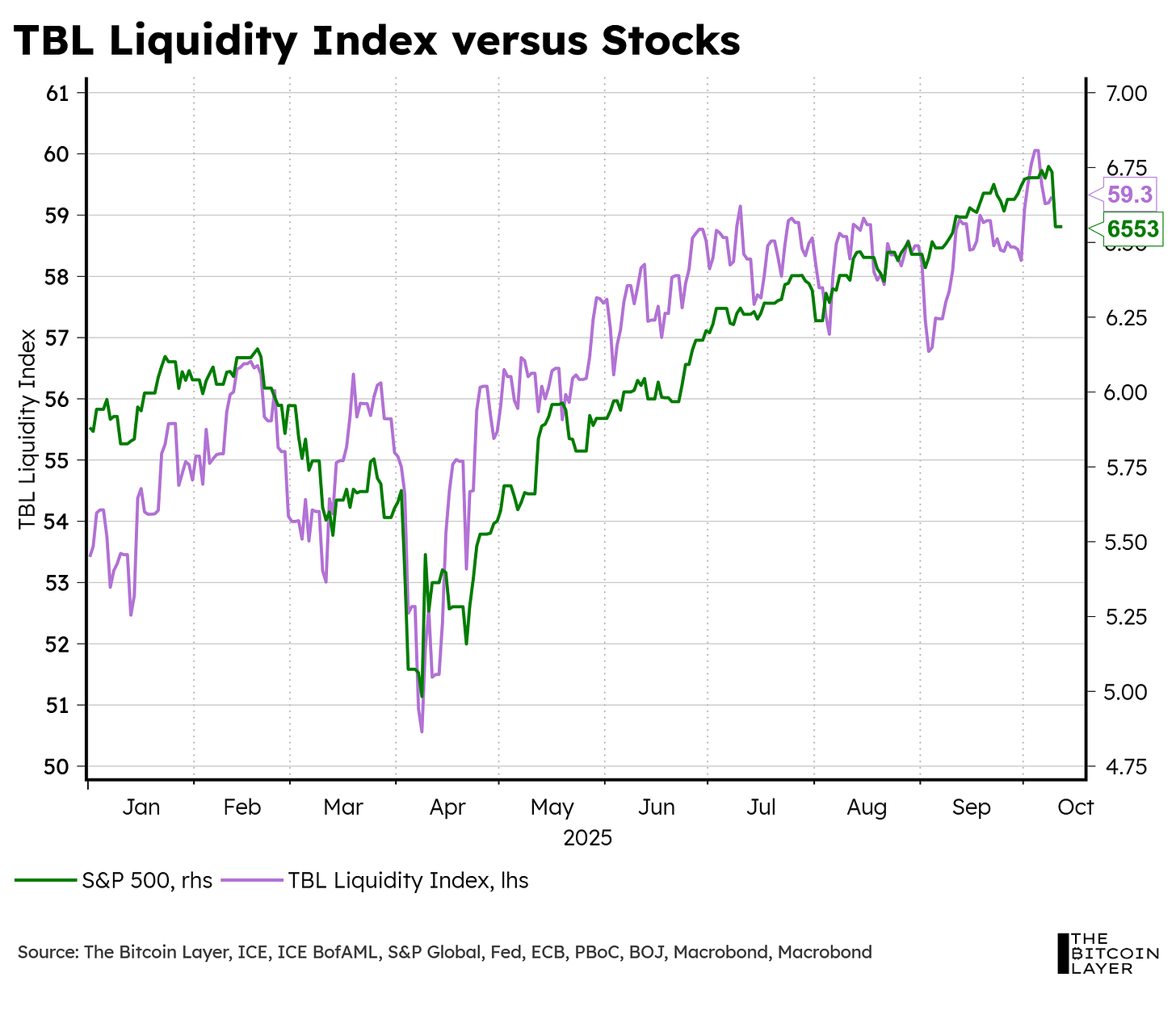

Herein lies the importance of bond volatility to our TBL Liquidity Index—specifically, its opposing effects on our index. Just look at TBL Liquidity next to both bitcoin and the S&P 500 over the past year as bond volatility has decreased (which, in our framework, is positive for liquidity):

Now, one thing that’s important to note here is that volatility is what matters in these financing transactions. In other words, if the collateral increases in value (Treasuries rise in price—yields fall), but does so in a violent way, a lender in repo markets will still demand a higher haircut. These are short-term loans with terms set ex ante, so if a lender doesn’t know where the Treasury will be tomorrow, that uncertainty affects the loan terms more than whether the collateral’s value ultimately rises or falls. This is why volatility measures like the MOVE index are more relevant for understanding repo market conditions (and liquidity) than the direction of Treasury price movements.

A prime example of this hierarchy of importance took place yesterday: despite the underlying collateral becoming more valuable (yields down), bond volatility rose, which negatively affected the collateral multiplier, which hurt liquidity, and risk sold (chart below):

Outlook for Uptober

That said, our outlook for October is still bullish. Zooming out, we have 4 things going our way:

First, volatility remains at historically low levels, which is what has been leading our overall bullish liquidity narrative in the first place:

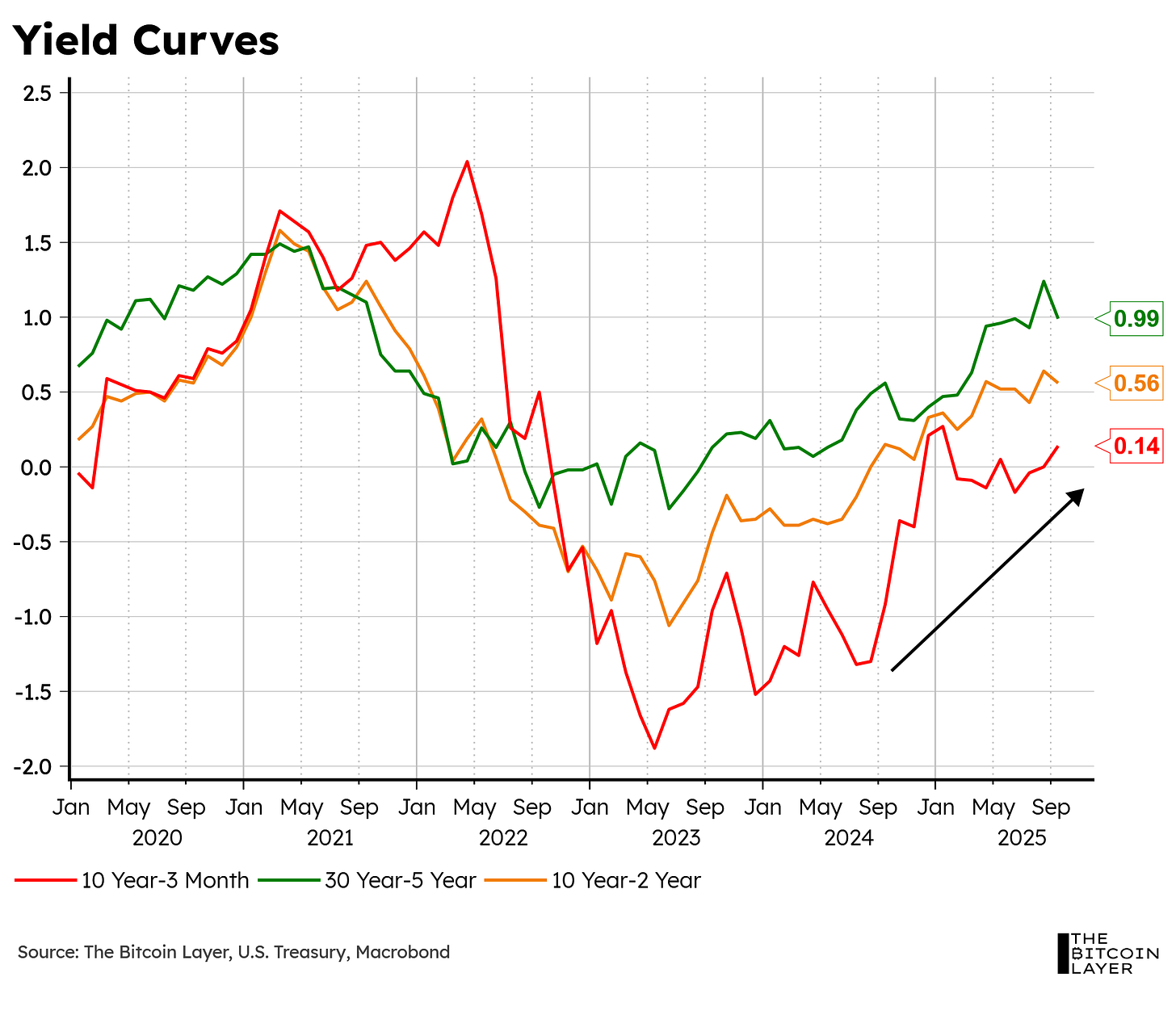

Second, as the current administration fixes its mind’s eye on what people care about the most (inflation), low rates may continue to be the target of some more Trump-Tweet scrutiny, with a special focus on the back-end of the curve due to mortgage rates. This creates US Treasury tailwinds, which, over time, bleed into the system in the form of lower haircut benchmarks (positive for liquidity).

Third, steeper curves may lead to better numbers in banks’ earnings reports over the next few weeks, which may help a V-shape recovery in the overall market:

This, as seen from the correlation chart above, could bleed into a V-shape for bitcoin as well.

Lastly, despite the government shutdown, the market remains fairly certain on 2 cuts this year, which again provides tailwinds in the overall market for risk.

We continue to rely on our proprietary TBL Liquidity Indicator for our buy-and-sell signals, whose latest buy signal remains green in both stocks (+1.43%) and bitcoin (+4%):

Overall, our narrative for October remains bullish—only if Trump has mercy with his tweets.

James’ Concluding Thoughts

It is always a pleasure to collaborate with The Bitcoin Layer team, and they always bring a unique perspective to the macro and liquidity landscape that we really need as Bitcoiners.

Bitcoin is a macro asset, and every man and his dog has been watching the price chart like a hawk over the weekend so see what might come next for their portfolio. Bitcoin is increasingly linked to the wider markets, and signs of weakness in equities would no doubt ripple into Bitcoin markets as well.

I already think gold has shown us where this road leads (much higher). But I am conscious that further weakness in Bitcoin may be telling us the road to get there could be a bumpy one.

We have a positive liquidity tailwind, and the bears haven’t proven their case just yet.

Strap in.

Thanks for reading,

James

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Looking for an Onchain Data API?

My friend The Bitcoin Researcher has just rolled out a new API for Bitcoin onchain data which has just about every metric you’d want. I’ve had a few folks reach out looking for API access, and I highly recommend checking this service out if you’re interested in playing with the underlying data feeds.

Really appreciate the collaboration with The Bitcoin Layer. keep up the good work, I love it.

"XPR" haha. How have I not heard this before?