Add Another Trillion

Back in January, I argued the idea that Bitcoin may not have not seen sufficient capital inflows to justify a move to $150k. A lot has changed since then, and it's time to revisit that analysis.

G’day Folks,

For the last few weeks, all eyes have been on the gold price, and there is no denying that it has been on a spectacular run.

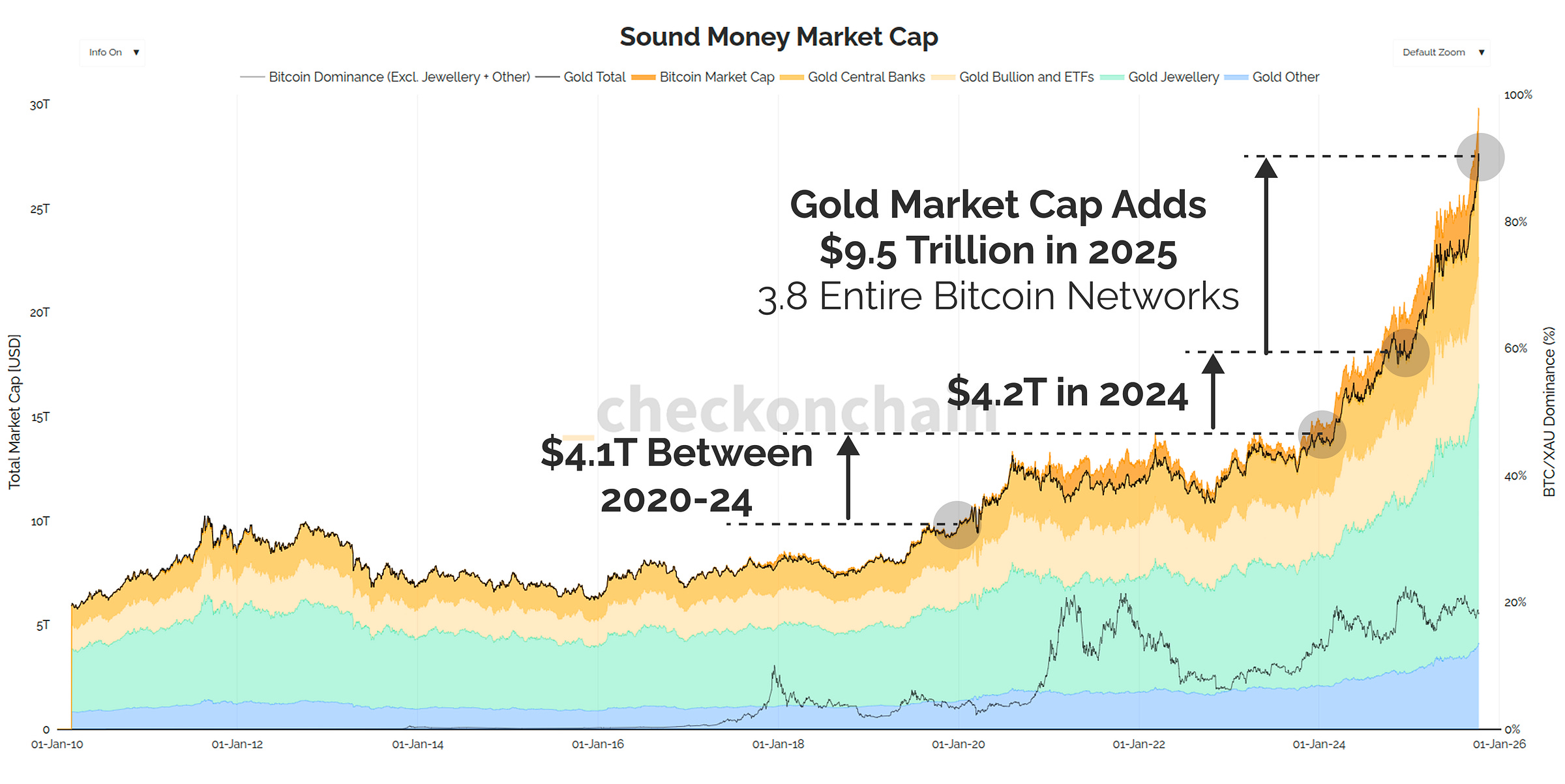

Serious gold bull markets tend to be breathtaking, namely because it is the single largest asset by market cap, and when it moves like this, it appreciates by several trillion dollars in short order.

Gold tends to be one of those assets that does nothing for a very, very long time, and most investors are under-allocated when it starts to move. They simply cannot justify holding a barbarous relic to their investors, especially when there are high flying tech stocks everywhere you look.

In 2025 alone, the gold market cap has increased by $9.5 Trillion, equivalent to 3.8 Bitcoin networks at the prevailing ATH price.

If an inert yellow metal like gold can add this much to its market cap in a year, it doesn’t take much imagination to envision adding another trillion or so to our magic orange internet money.

Now today’s post is most certainly not going to be about gold, but such powerful moves in the OG barbarous relic makes me wonder what it will take for Bitcoin to take off from here, and how high we could go?

Back in January this year, I published The Law of Large Numbers, where I proposed that we likely didn’t yet have the capital inflows required to make the move from a $2 Trillion (~$100k), to a $3 Trillion (~150k) market cap.

In today’s piece, I want to revisit that framework, and see if we now have the measurable capital inflows required to justify the move up to $150k.

Back in January, I wasn’t sure we had earned our place in the Three-Trilly club.

As we know, a lot has changed since then.

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!