Masterclass #21: Wen Top?

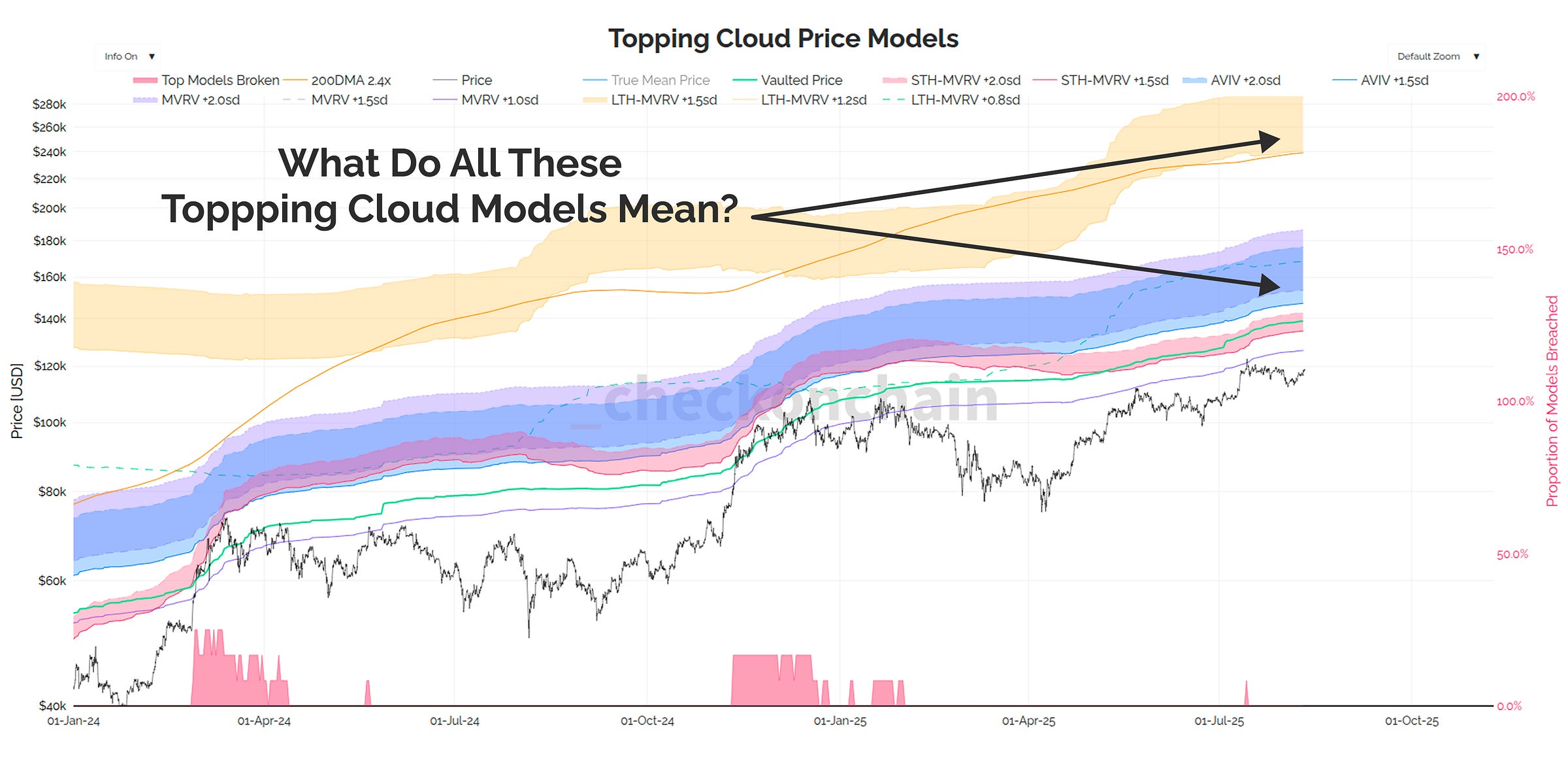

"How to spot Bitcoin cycle tops?" is by far the most popular question I receive as an analyst. Whilst we cannot predict the future, we can model where things are getting a bit silly.

G’day Folks,

The two most popular questions in Bitcoin; Wen Top, and Where Top?

The reason this question is so popular seems obvious, but it very much depends on who you are, and what stage of life you are in;

For hardcore HODLers, you may not plan to sell any Bitcoin, but if you’re like me, you probably don’t want to pour a large lump sum of capital in at the top…again. You might also be in a stage of life where you want to buy a house, pay off a mortgage, or pay for your kids to attend a great school or college.

For money managers and retirees, you either don’t have the latitude with your clients to weather a bear, or you don’t have the time to sit through years of choppy downside, no matter how strong your conviction is.

For speculators and cycle traders, you’re very aware that every swing trade and cycle has an expiration date, and spotting overheated conditions is useful in that it preserves your portfolio value to take opportunities in the downturn.

For many of us, Bitcoin is a dominant part of our net worth, and having an awareness of when our life savings are in a near-term bubble is obviously very useful.

The reason people want to identify cycle tops often has nothing to do with their conviction on Bitcoin as an asset.

Instead, it is a reflection of how bear markets affect our quality of life, and the truth is, they can limit our options more than many Bitcoiners like to admit.

I’m not planning on selling any Bitcoin this cycle, but I also don’t plan to buy heavily when every metric I have is flashing more warning signs than a Christmas tree. I love Bitcoin, but I love living a stress free life with plenty of optionality even more.

No matter what your reason is, being able to think through scenarios in advance helps to develop not only your Bitcoin strategy, but your life plans as well.

Today’s post is going to be a deep dive on how I think about Bitcoin cycle tops, and the tools I use to write my plan down on paper, months before I need it.

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!