That's Not a Dip...

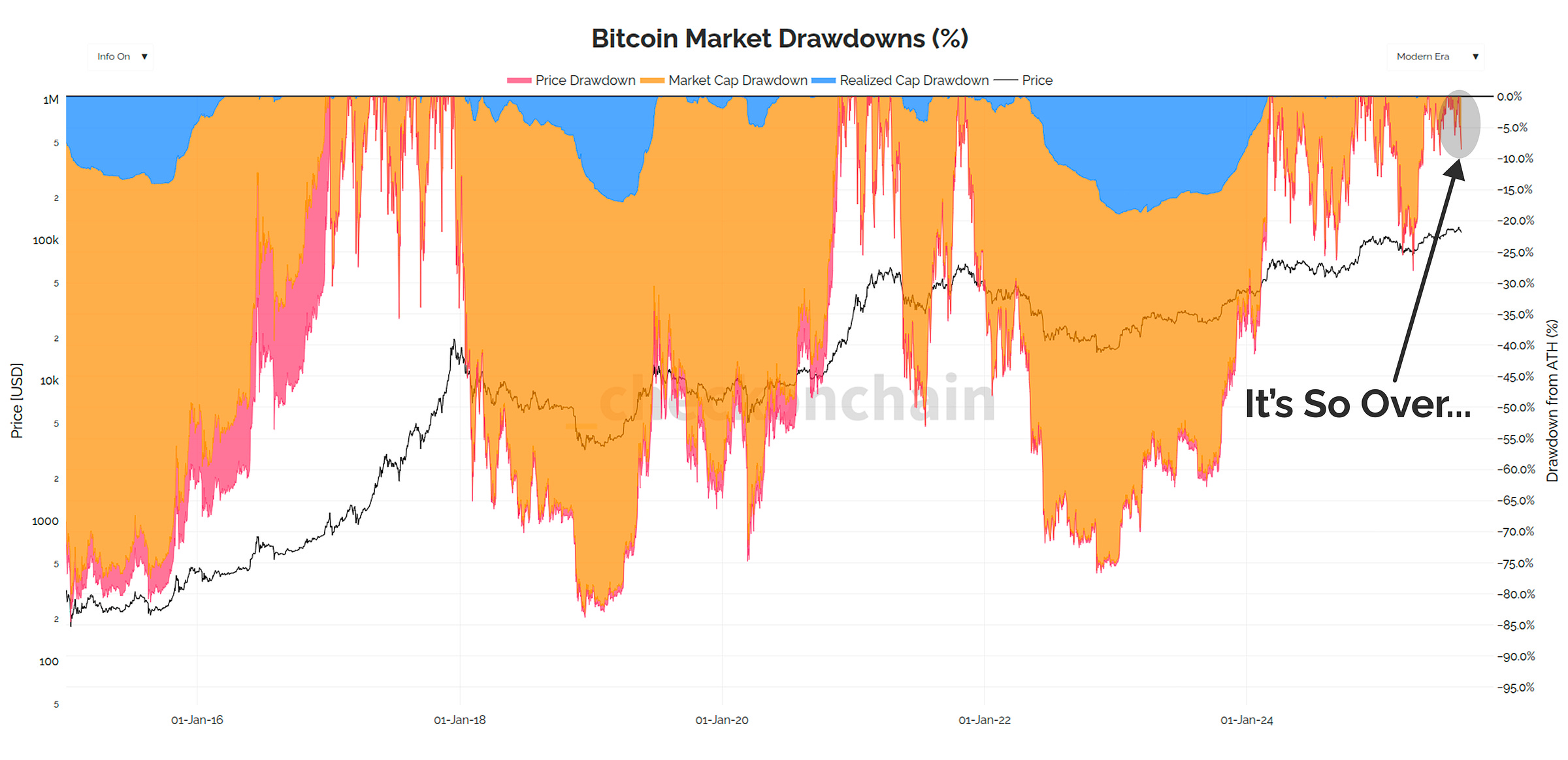

Is the fear we're seeing about this sell-off warranted, and is the damage large enough to justify this fear? How does this compare to the start of prior bear markets? Let's find out.

G’day Folks,

The bears are out in force.

Bitcoin has pulled back a whole…nine percentage points…from a fresh all-time-high, and you’d think the end is nigh.

It’s, once again, so over.

The most fascinating thing about this cycle, with no equal, is how remarkably scared so many investors get during what are historically irrelevant price dips.

Back in my day, I wouldn’t get up for anything less than a -20% correction.

In all seriousness though, as we covered in Soft Around The Edges, it is the right time to be somewhat cautious in the immediate term, simply because the key demand drivers of the ETFs and the Treasury Companies have meaningfully slowed down.

However, we’re a LONG way from needing to panic, and put full bear market goggles on. In fact, I’m not even sure we need to put on a bear market monocle just yet.

Today’s post is going to be an investigation into the damage of this dip so far, and an analysis on how low the Bitcoin price needs to go before we start to break the conviction and sentiment of the bulls.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!