Securing the Bag: My Take On Bitcoins Long-Term Security

The long-term sustainability of Bitcoin's security and mining market remains one of the biggest open questions for the asset. In this piece, I lay out several ideas I use to think through the problem.

G’day Folks,

Once in every Bitcoin market cycle, concerns around the long-term sustainability of Bitcoin mining rises up as a key point of discussion. If you ask an altcoin advocate, they will proclaim that the death of Bitcoin is assured, and is just a few halvings away. If you ask a devout Bitcoin maximalist, they will claim there never was a problem, Bitcoin has already won, and the market will sort it out.

Naturally, the truth is probably somewhere in the middle.

For most people, the influence of mining on day to day trade is pretty insignificant. Miners don’t really affect the BTC price very much, and their influence is very small compared to derivatives, and existing holders taking profit.

However…none of that matters if the security system fails, and the Bitcoin network becomes unreliable and worthless.

From a theoretical standpoint, Bitcoin HODLers should develop some level of understanding about how mining game theory works. Not only is it fascinating, but it is also one of the biggest unanswered questions about Bitcoin’s viability long term.

I have been thinking about this problem in some detail over the last few years, and I became particularly interested in it since the 2024 halving. My mate UkuriaOC pointed out the fact that the Bitcoin Hashrate (the computational power used by miners to process transactions and secure the network) was at an ATH on every halving date, and after a brief pullback, proceeds to moon to set significant new ATHs soon after.

My initial reaction was to ask; why would miners be adding additional hashrate if they know their revenue is about to be cut in half?

In this post, I want to share several ideas and concepts I have found useful whilst thinking through this problem.

I don’t have all the answers, but I believe every HODLer should spend some time contemplating what is arguably one of the bigger risks that exists for Bitcoin: Is the security system of Bitcoin sustainable and resilient long-term?

The purpose of this post is to explore four key questions pertaining to how secure Bitcoin really is.

Does price need to double every 4yrs for Bitcoin to remain secure?

If miners go bankrupt, will that make the Bitcoin network insecure?

Is the ‘security budget’ big enough to prevent a nation state 51% attack?

Is Bitcoin censorship resistant?

Let’s dive into one of the most important, and least understood components of the Bitcoin network.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!

Disclaimer: This article is general in nature, and is for informational, and entertainment purposes only, and it shall not be relied upon for any investment or financial decisions.

TL;DR

Whilst miners generally have a small impact on the day-to-day market, the security they provide is ultimately what stops Bitcoin from going to zero.

The mining industry is ruthless, and is structured in a way that only the strong will survive. A byproduct of this is that miners MUST continuously innovate, finding new business models and optimisations to remain in the game.

Arguments that the BTC price must double every 4yrs to offset the halving are one dimensional, and miss a plethora of fascinating second and third order effects.

I believe a brute force nation state 51% attack is the least likely, most expensive, and least feasible attack vector. Instead, censorship risks exist at the mining pool level, however there are also self correcting mechanisms for this.

The transaction fees are what really secure Bitcoin, since attackers also earn the subsidy. Ironically, fees go up during a censorship attack, which makes it more profitable to mine honestly over the long arc of time.

Full Premium Video

Audio-Only Version

Opening Remarks

There are a few opening ideas which I wanted to kick things off. I believe these ideas can help us simplify what is otherwise a very complex and speculative problem.

Demand for BTC and Bitcoin blockspace in the future is unknown by definition, and thus we must extrapolate based on the information we have today.

It is my opinion, that Bitcoin is a 0 or a 1 phenomena. The system either works long-term and achieves its goals, or it does not.

There is no world where Bitcoin has tail emissions, or has a 42M supply cap, and is still considered Bitcoin. That system is something else, and Bitcoin will have failed if that comes to pass (and so be it).

The UTXO set sits at the heart of the ledger. In the case where PoW mining is found to fail as a security mechanism, attempts to port the UTXO set to another security system will likely be attempted. Whether that system has any value, is another question.

The trajectory for Bitcoin is that it is becoming a pristine collateral, and a store of value reserve asset.

Should Bitcoin become a globally accepted pristine collateral asset, for individuals and sovereigns alike, I simply must assume there will be non-zero demand for blockspace.

I believe there is considerable evidence today that Bitcoin is trending closer towards 1, and not towards 0.

Thus, if my logic above holds, I believe it is reasonable to assume there will be a non-zero demand for Bitcoin blockspace well into the future. If there isn’t, then there is no Bitcoin, in which case none of this matters anyway.

The Declining Subsidy

At the core of most arguments claiming Bitcoin is destined to fail, sits the declining block subsidy with each halving. Claims usually indicate that the price must continuously double every four years to offset this.

I do not believe this is the case.

The reason is that miners are forced to constantly innovate and optimise their input costs, else they will invariably go bankrupt. The ‘price must double’ argument only considers the income side of the equation, but it misses several second and third order effects on both the income and expense side which make all the difference.

Miner revenue is comprised of two components:

Subsidy: The new coins which are issued against according to the Bitcoin supply schedule. Whilst the number of BTC issued will halve every 210,000 blocks (~4yrs), the quantity of issued coins is deterministic, and known well in advance.

Fees: The volatile component of transaction fees, which is entirely based on usage demand of the Bitcoin blockchain. It is difficult to estimate what fees will be in the future, however they will eventually become the principle source of miner revenue as more halvings take place.

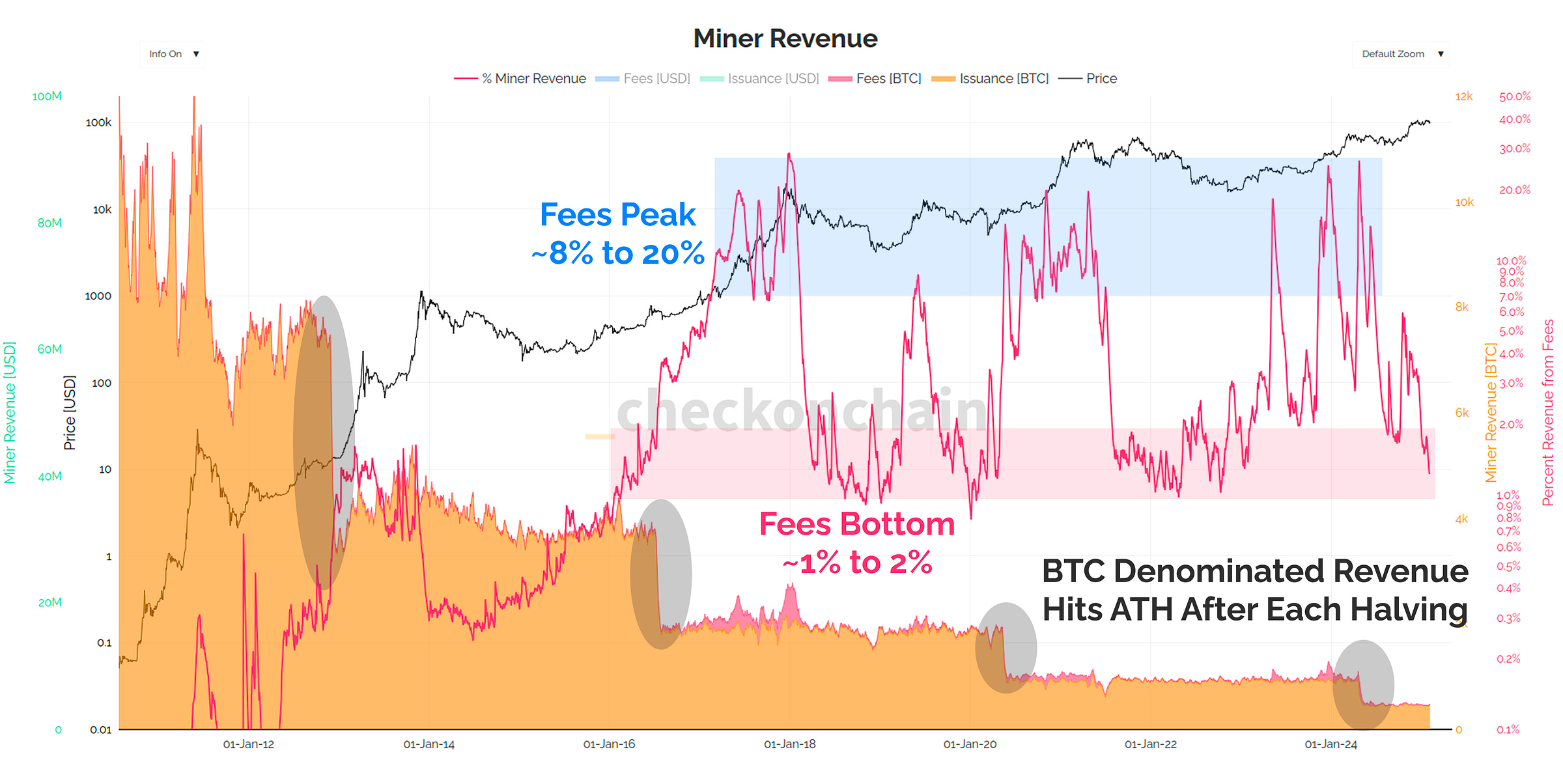

Periods of heavy blockspace demand tend to coincide with bull markets, and often see fee revenues account for around 20% of miner onchain revenues.

Right now, the total BTC denominated block reward (subsidy + fees) is at an all-time-low, with fees only representing 1% of the total payout. The volatile nature of fees rightly makes the long-term viability of the security system an open question.

However, if the BTC block reward is at an all-time-low, why is the current hashrate near ATH? Shouldn’t we be seeing more mining stress, and declining hashrate?

The costs incurred by miners, such as mining rigs, power, logistics, and staffing, are all primarily denominated in fiat currency. Whilst the BTC denominated rewards may be low, the aggregate USD value of this income is around $50M/day, which is not far off the $70M peak hit in April last year.

Empirically, the BTC price has more than doubled every 4yrs to date. However, as Bitcoin grows larger, we cannot assume this will be the case forever.

For the time being, the USD denominated reward has supported the industrialisation of the mining space.

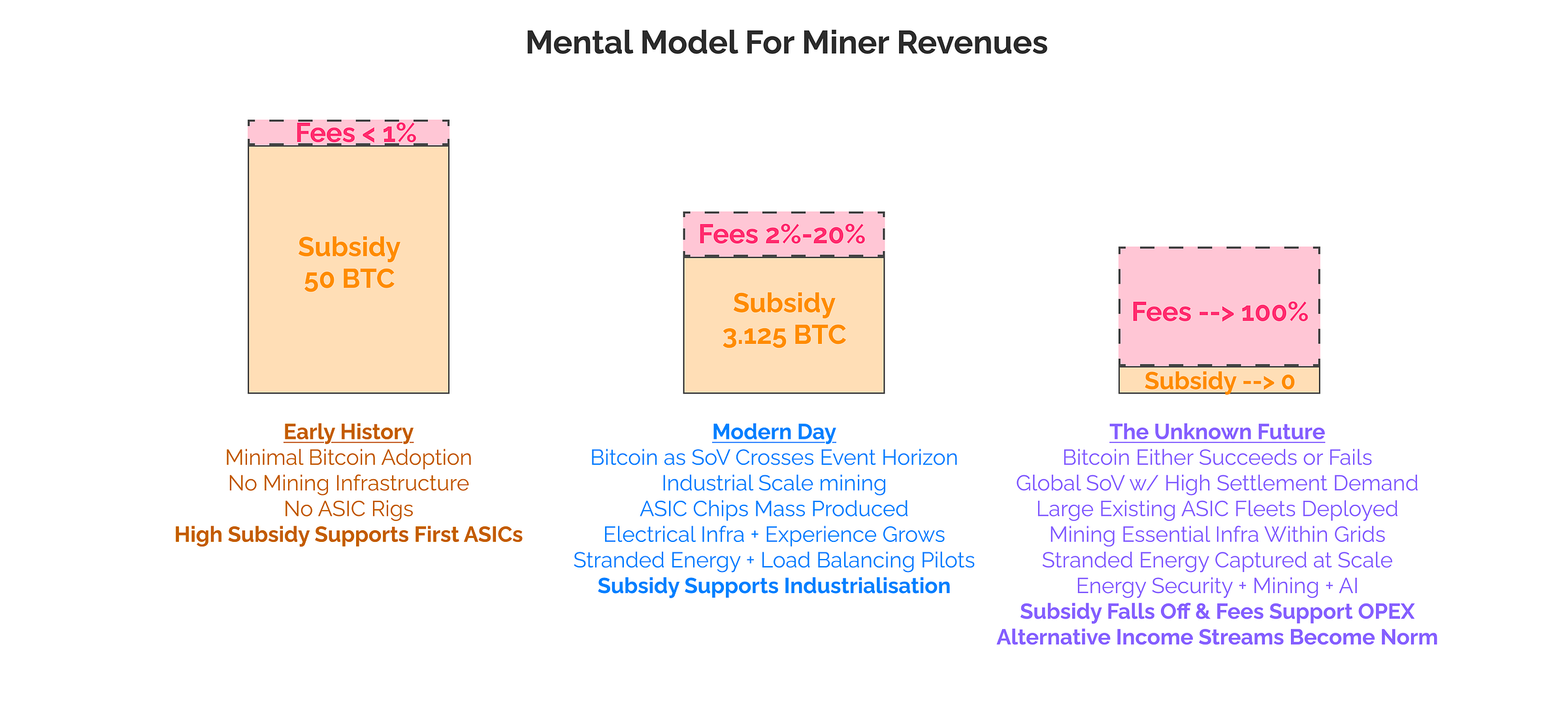

The subsidy component does remain the dominant factor in miner revenues, but this indicates to me that the term ‘subsidy’ is the correct framing. Its role is to enable the initial bootstrapping and build out of the mining industry, and many of these major costs (like inventing the first SHA256 ASIC chip designs) only need to be incurred once.

Mining is a brutal industry, and arguably one of the most competitive, and free markets in the world. Every single card is stacked against the success of an individual miner:

The halving cuts the subsidy in half every 4yrs, and fees are both unpredictable, and cyclical in nature.

Miners do not fully control the price of their input costs (electricity, rigs, staff etc), nor the price of commodity they produce (BTC).

Booms in the BTC price create an incentive for more miners to invest and come online, creating more hashrate fighting over the same number of coins.

Busts are common, deep, prolonged, and result in significant miner turnover.

The difficulty adjustment continues to ratchet up/down in response to hashrate. This forces the production cost of Bitcoin to always be profitable for someone, but not for everyone, and only the strongest miners will survive over time.

Since electrical power is globally distributed, miners can access wasted or stranded energy, driving the profitability threshold for the next marginal unit of hashrate towards zero at all times.

There is no chart more brutal than the revenue miners earn per hash (called the hashprice), which perpetually declines in log-space for both USD and BTC denominations.

However, the silver lining of this process is that individual miners are FORCED by the brutality of their industry to innovate, and find new creative ways to ensure they remain profitable.

If they don’t adapt, they will not be a miner for very long.

Looking at the proportion of miner revenue attributed to fees, we can see two macro phases in their evolution:

The Early Years (Genesis to 2016) where fees were less than 1% of income, and Bitcoin was in the bootstrapping phase.

The Modern Era (2016+) where fees oscillate with market cycles, ranging from bull market booms with fees contributing 20%+, to bear market busts where fees represent less than 2% of revenues.

By definition, the cyclical pattern we are currently in must end, as the subsidy will trend towards zero, and fees will inevitable become 100% of miner revenues.

In other words, the market has not reached it’s long-term equilibrium yet, and as we know, a hell of a lot can change in Bitcoin over a single four year halving cycle.

I believe there is a relationship between the proportion of block subsidy and fees, and the maturity of the mining industry. Many of the major expenses for creating an industrial scale mining industry do not need to be spent twice, and the path from subsidy dominance to fee dominance will be gradual over many years.

Back in 2010, there were no ASIC chip designs for Bitcoin. We now have new and increasingly efficient chip designs being produced at a regular cadence.

Nobody knew anything about how to survive as a profitable miner in 2012. We now see numerous publicly traded mining companies, each sporting teams of skilled engineers with experience in design, install, and operation of industrial mining facilities.

Five years ago, Bitcoin mining was primarily out of China, and mainly used hydro and fossil fuel energy. Today, over 50% of Bitcoin mining uses sustainable energy, 40%+ is now located in North America, and entrepreneurs are using everything from geothermal, to vented methane from oil fields to power it.

Recent history has shown that Bitcoin mining also offers incredible opportunities for building out energy grids in Africa, load balancing and curtailment in Texas, consuming methane gas from landfills, and even miners getting involved in the AI revolution.

The future is unknown.

However, when I think about how different the mining landscape looks today, even compared to just one halving cycle ago, I believe it is very wrong to assume that it will look the same tomorrow.

As the halving reduces the block subsidy towards zero, miners will necessarily find new and innovative ways to cut costs and improve profitability. Arguments claiming that price must double every 4yrs are one dimensional, and have missed the incredible progress miners are making in improving the efficiency of their operations.

In my opinion, the block subsidy is subsidising this initial build out.

A fleet of ASICs now exist, significant engineering experience has been acquired, and energy grids with mining installed are more often stable than those without.

Over time, a third component of miner revenue has emerged, and that is innovation, driven by the ruthless realities of how difficult it is to stay solvent in the mining game.

Bankrupt Miners

I want to highlight what I believe is a very important distinction, and one I see misunderstandings about quite often; Miners are different to the Mining industry.

Individual miners can and will go bankrupt all the time. That does not mean that the mining industry as a whole is unsound, nor that Bitcoin is insecure.

The role of the difficulty adjustment is to ensure that at all times, BTC is profitable to mine for SOMEONE, even if that someone isn’t you!

When a miner goes bust, their rigs and operations will go on fire-sale, and be transferred to an entrepreneur with a better strategy and balance sheet.

There are only two mechanisms by which Bitcoin hashrate can increase:

More mining rigs are deployed: Bringing newly purchased mining rigs online, which necessarily requires an investment of CAPEX to buy and install the rigs.

Newer generation rigs are invented and deployed: Requiring R&D investment to design and fabricate new model chips, which again requires CAPEX spend.

As I thought about why hashrate keeps hitting fresh ATHs, it struck me that a mining industry which was under severe income stress would simply NOT spend additional CAPEX on the design, build-out and installation of new ASIC rigs.

If the mining industry was really in trouble, they would cease investing new CAPEX, and instead just use whatever dwindling budget they have to keep their existing ASIC fleet operational (i.e. switch to OPEX only expenses).

The simple fact that hashrate keeps going higher, tells me that there is sufficient cream on-top of miner revenues for the industry to invest into operational expansion.

There is no perfect way to estimate the cost of production for BTC, but the models that I use provide a decent enough yardstick. I won’t go into the details for brevity, but these models currently estimate an average all-in-sustaining cost of between $68k and $76k.

If we take that estimated production price, we can compare it with the USD revenues earned by miners over time. There are periods where the mining industry is wildly profitable in bulls, and others where it is not.

Since 2012, which is the era since ASICs took over as the primary mining hardware, around 41% of days have been profitable, and 59% of days unprofitable.

This profitability measure oscillates around a 50:50 split, and in my view largely confirms that the difficulty adjustment targets equilibrium. That equilibrium is one where the average individual miner is expected to go bankrupt eventually.

Only the strongest will survive, and it is a constant struggle to remain solvent.

So if the average miner is expected to go bankrupt, doesn’t this make Bitcoin insecure?

Not at all.

If I was to sell you a latest generation ASIC rig for $100, even if it was worth $10k USD, you’d be able to profitably mine even with very expensive power since your initial investment was so cheap.

ASIC rigs are best thought of as a physical call option; they have an initial upfront cost, are expected to produce a certain amount of BTC income, and have an expiration date since new rigs will eventually make it obsolete.

The wrong time to buy a call option is when everyone else wants to buy a call option (aka buying the top)…and the best time is when nobody wants to (at the bottom of a bear).

Now think about this at scale. At the height of the 2021 bull market, a combination of a soaring BTC price, and supply chain disruptions caused ASIC rig prices to skyrocket. Miners who bought their rigs at this time paid a hefty premium, and many did indeed go bankrupt in the 2022 bear as a result.

On the flip-side, during bear markets, ASIC prices become much cheaper, and smart entrepreneurs can acquire them in the bad times, and then ride both the BTC bull, but also the bull market in ASIC rig prices.

The point here is that mining is always profitable…at the right price.

Whenever one guy goes bankrupt, it creates a fire-sale opportunity for another guy with a better balance sheet, strategy, and cost of capital to get those rigs spinning once again.

The thing folks often miss is that ASIC rigs have a cost basis as well, and even an outdated obsolete model can be profitable if purchased and plugged in at the right CAPEX and OPEX price.

Miners can and will go bankrupt all the time. The mining industry however, will continue to tick along, the rigs simply change hands.

Fun Fact: The All time Production Cost of Bitcoin

Throughout Bitcoin’s life, a total of $74.6B has been paid out to miners, calculated by pricing each block reward (subsidy+fees) on the day it was mined. This sum is called the Thermocap, and can be thought of as the all-time cost of production for the circulating supply.

Interestingly, as Bitcoin matures, the BTC price has bottomed out at increasingly high ‘premiums’ to this aggregate production cost. Right now, Bitcoins market cap is $1.865T, which is 25x larger than the all-time income miners have earned.

In my view, this is a clear sign that a monetary premium is developing over time.

Nation State Attackers

The final major misconception I want to address, and one recently raised by the Ethereum Foundation’s lead researcher, which claims that the ‘cost to 51% attack’ Bitcoin is insignificant relative to the size of a nation state.

The element which Bitcoin critics seem to gloss over is the insane hurdle rate imposed by both capital, and the laws of physics in order to do this.

In Justin’s commentary, he makes it seem like spinning up a fleet of ASIC rigs to attack Bitcoin is a trivial and easy task, where a nation will stumble across a small country worth of power, and use it to **check’s notes** nuke the savings of a bunch of their voters.

This is an embarrassingly unserious position to take, especially by folks who redesigned Ethereum’s consensus mechanism, arguably because of false assumptions such as these.

According to a terrific study by CoinMetrics, approximately 67% of the existing mining fleet is made up of three rig models, which I will use to illustrate the sheer size and scale of Bitcoin’s security system.

I want to demonstrate why the nation state 51% attack…is not the attack we should be worried about.

If we take these three ASIC rigs, value them at today’s prices, and then scale them up to conduct a 51% attack, it would require approximately $11.4B in rig costs alone.

The attack would require the fabrication of approximately 6.9 million ASIC rigs, with each rig housing 76 or more individual chips. Those chips require usage of advanced and extremely scarce semiconductor fabrication capacity, which have long lead times, and will be competing with every other application that also requires chip production.

It would also be very difficult to hide such an operation, giving Bitcoiners advanced warning.

Those 6.9 million ASIC rigs will then need to be shipped, racked up in warehouses, installed by electrical engineers, have cooling systems built out, plugged in, and powered up, with this entire operation drawing around 25GW of power.

It would require 50x Hoover dams, or one Three Gorges Dam to power this.

It’s worth noting that this power probably cannot be pulled from the existing civilian grid, unless widespread black-outs for voters is an intended result of the attack.

Thus we should perhaps factor in the construction time and costs for a few new coal or nuclear power plants while we’re at it.

Bitcoin’s heavy energy consumption is an integral part of its security system, because even nation states cannot print energy from thin air. The simple fact that Bitcoin consumes as much energy as Egypt and Poland is a key reason why it is so resilient.

The 25GW of power required to pull off this attack is equivalent to 2x New York Cities, or the entire energy demand of countries like the Netherlands and Argentina.

The obvious answer, is that nation states undertaking via a 51% attack, is highly unlikely via the introduction of new hashpower. They would either have to coordinate with multiple super-power governments (good luck with that), or commandeer existing mining facilities within their borders (which runs into legal challenges in most of the developed world).

The reality of a ‘nation state attack’ is that it will almost certainly NOT be a brute force take-down via hashrate.

This is the hardest, most expensive, and least effective possible attack route.

Side note: The main reason I decided to sell my Ethereum back in 2022 wasn’t so much due to the Merge. It was the fact that none of the giga-brain designers of the PoS system recognised that they were designing it based on perfectly incorrect assumptions, and were chasing the wrong boogie man.

The Real Risk Is Censorship

The real risk for all blockchains is censorship, defined as the refusal of miners/validators to include some set of transactions.

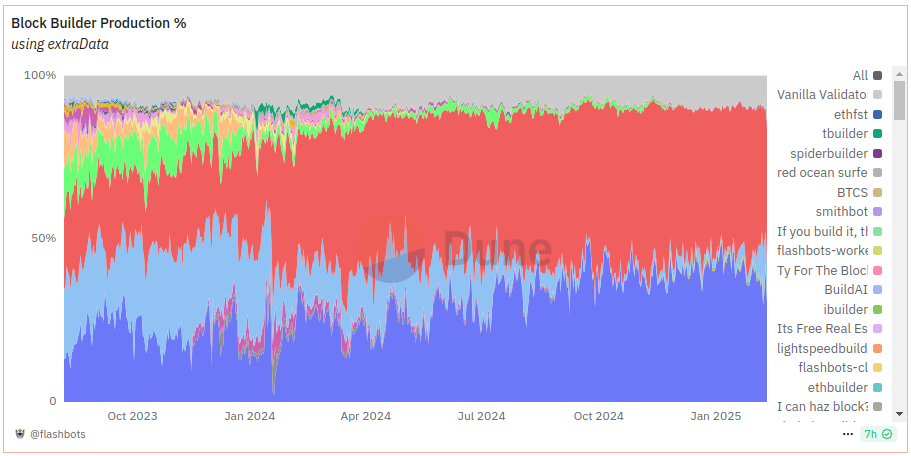

This is a problem and a risk for both PoW and PoS blockchains, and the central issue stems not from the miners/validators, but from the mining and staking pools.

Miners/Validators are the individual operators who provide the work/stake required to build the next block.

Pools are the ones who aggregate the hash/stake, and are usually responsible for providing the block template of what transactions to include (or ignore).

In Bitcoin, according to mempool.space, the top three pools account for over 65% of the hashpower, and it is argued many of the smaller ones are associated with the larger ones. This means that if a government wanted the transactions of a specific person/group to be censored, it could lean on just two or three pools, which would prevent a majority of the hashrate from including their transactions.

The remaining pools would eventually pick that transaction up, but a further risk exists that the dominant pools would refuse to build on top of a block containing a censored transaction, which morphs into a form of 51% attack.

For Ethereum, this problem is even worse, with upwards of 80%-90% of all blocks being built by just two entities.

Thankfully, Proof-of-Work has a degree of natural resistance to this problem which is not present in Proof-of-Stake systems. In PoW, individual miners can, and often do redirect their hashrate to another pool. This requires a simple change of a text file, so anytime a miner suspects their pool is not operating in the best interest of Bitcoin, they have the option to take action.

I should note, that this may be complicated in the case where the Government is the one doing the leaning, which may limit the options of individual large miners within their jurisdiction.

In Ethereum’s PoS systems however, the nature of staking pools is much stickier, but that is a separate discussion.

What really protects Bitcoin from censorship is the transaction fees.

Let’s assume that a nation state attacker wants to censor Bitcoin by leaning on the biggest pools and miners, and requires them to mine empty blocks, rendering the Bitcoin network useless.

As transactions start to back up in the mempools, so will the fee pressure from folks who urgently want to transact.

If the attack is large enough, the pool of transactions paying a high fee will keep growing, creating a large backlog.

The subsidy does NOT protect Bitcoin from this attack, because the attacking miners earn it just the same as the honest miners do.

This growing fee pressure ultimately creates a bigger and bigger incentive for new miners to bring hashrate to market.

Miners outside the attacking jurisdiction now have an opportunity to be increasingly profitable. If the US is the attacker, then miners in China, Iran, Venezuela, and Kazakhstan can ramp up hashrate to collect those fees.

The attacking miners may also have the option to spin down their operations, yielding power to external miners. It would quickly become unprofitable for them since they are no longer collecting fees, and would likely require a government subsidy to continue (and voters would start asking whether this is a good use of their tax dollars).

At the extreme, the opportunity of a large fee backlog becomes a magnet for miners to switch pools, create new pools, and even bring the dusty S9 out of the garage, and start mining to collect the fees.

This is one of my all time favourite nuances of Bitcoin, and is a topic that is widely misunderstood in the crypto world.

Tail emissions would not protect Bitcoin from censorship, as the attacker gets them too.

Only transaction fees provide censorship resistance, and at the extreme, even a nation state is unlikely to prevent external or clandestine hashrate from emerging to collect them.

Concluding Thoughts

I feel like I have run a mental marathon after writing this piece, and if you made it this far, you probably do too.

Bitcoin mining is one of the least understood, and most nuanced components of the system. For most of us as investors, it can be safely ignored, as the impacts on the market day to day trade are negligible.

However, given the biggest risk to my Bitcoin holdings is that the system fails, and my holdings become worthless, I believe it is worth thinking about.

Bitcoin’s proof-of-work security system is incredible in its simplicity, yet infinitely complex in its game theoretical implications. The same vectors a nation state may use to attack it, are exactly the reasons a nation state may want to mine honestly.

If the threat of censorship exists, but Bitcoin is your pristine collateral, surely you want to ensure your nation has secured its share of the hashrate.

The great irony of altcoiners making arguments about Bitcoins inevitable collapse due to the halving, is that the halving was never the big issue. The subsidy will go to zero by definition, and by that time, it will have subsidised the build out of a globally competitive, and hyper optimised mining landscape.

The enemy will not attack the front gate with hashrate cannons. They will enact a sly roundabout way to try and censor those they disagree with.

This is why I have three Bitaxe miners on my desk in front of me. Not because they will ever be profitable, or will ever find a block. Instead, I bought them to learn about mining, and to support the developers who are building out open source mining infrastructure, which we may need if things ever went pear shaped.

The Bitcoin mining network is the most secure digital system ever created.

I’m not personally too worried about the block subsidy declining, as I believe Bitcoin miners will adapt to the change gradually as it happens. Under the assumption that our current trajectory towards a global reserve asset continues, I believe transaction fees will continue to rise. In fact, fees may boom under attacking conditions!

The biggest risk to Bitcoin in my opinion, is actually apathy. If people stopped caring, and stopped using it, that would be the real cause of death.

Thanks for reading,

James

Looking for an Onchain Data API?

My friend The Bitcoin Researcher has just rolled out a new API for Bitcoin onchain data which has just about every metric you’d want. I’ve had a few folks reach out looking for API access, and I highly recommend checking this service out if you’re interested in playing with the underlying data feeds.