Masterclass #3: Realised Cap and MVRV Foundations

The Realised Cap and MVRV Ratio are arguably the most important and foundational metrics in onchain analysis. They are simple but essential tools for HODLers looking to navigate Bitcoin market cycles.

"An investment in knowledge pays the best interest." - Benjamin Franklin

If you spend enough time around checkonchain channels, you will eventually hear us banging on about how much we love the Realised Cap. Not only was it the first breakthrough onchain metric back in 2018, it was also the subject of what was probably the world’s first onchain educational video on the internet (by yours truly).

The main reason we love this metric so much is that it forms the backbone which supports so many of the incredible insights we can draw from onchain data.

This article is the first in the checkonchain Masterclass series, where we will break down the most important onchain concepts, metrics and tools for our subscribers.

Disclaimer: This article is general in nature, and is for informational, and entertainment purposes only, and it shall not be relied upon for any investment or financial decisions.

🎥 Watch the video version here:

Introducing the Realised Cap

The Realised Cap comes from the concept of pricestamping, where we value each coin (UTXO) at the time when it last transacted onchain. As coins move around the network, and change hands, they are revalued to a new cost basis, reflecting a net capital inflow or outflow.

If you buy 1 BTC at $10k, its realised value remains saved at that price (the acquisition cost). If that coin is spent and sold at a later date at a price of $60k, the buyer must necessarily inject $60k worth of capital, adding an additional $50k of value to the Realised Cap.

Should that new buyer then panic sell at $30k in the bear market, they will have destroyed $30k worth of capital, subtracting if from the Realised Cap.The Realised Cap is therefore a measure of the total value saved, stored, or invested in Bitcoin, and it is currently over $560B.

When people ask me how I know the Bitcoin network is growing and increasing in network effects, I point them to the swelling size of the realised cap.

You can see that the Realised Cap moves in two modes:

Plateaus and downtrends in bears, as top buyers crystallise losses and are washed out by the infamous 75%+ drawdowns.

Rip-roaring uptrends in bulls, where long-term holders take the coins they acquired at cheap prices, and sell to the aforementioned top buyers for a profit.

The steeper the trend (in either direction), the more profit or loss is being locked in. Hold onto that thought, we will revisit it in an upcoming section.

We can also spot market regime shifts when the Realised Cap hits an inflection point. When the bull is over, the dominant investor behaviour shifts from euphoric profit taking, into panic selling, and eventually back into recovery profit taking.

There are three types of inflection point shown below:

🔴 Bull Market Peaks - The Realised Cap stops climbing, and starts to plateau as the trend in capital switches from profit to loss dominance.

🔵 Bear Market Recovery - After the final capitulation, a market floor is established by the HODLers, and capital starts to flow into Bitcoin once again.

🟢 Bull Market Acceleration - Usually as the market approaches new ATHs, those bold bottom buying HODLers start taking chips off the table at higher prices.

Profit Taking During Bull Markets

As we noted earlier, the steepness of the Realised Cap gradient is also an important indicator, and we can measure it to obtain the Net Realised Profit/Loss metric. Now we can see the coins acquired at cheap prices 🟧 being sold at higher prices for a handsome profit during the bull cycle 🟩.

Local and global market tops tend to be set after periods when profit taking sell-side pressure becomes too great, and it overwhelms the inflowing demand. The market often consolidates or corrects after this, but investors still like to add to their stack, and will start to buy on dips.

During resilient uptrends, this metric approaches often approaches and hits the break-even level of 1.0. The market will often find support at this level, suggesting as investors are buying at or near their cost basis.

Note: Net Realised Profit/Loss isn’t the ideal metric to track this behaviour, but a very similar tool like SOPR and STH-SOPR are perfectly suited for this application.

Crystallising Losses During Bear Markets

As you can imagine, many of these principles work in reverse during bear markets. Everyone has to pay their market tuition, and we all go through the experience of buying the absolute top of a market at some stage in our career.

Many coins which are bought high 🟧 are inevitably sold low 🟥, and the Realised Cap will decline as a result. This reflects a net capital outflow from the Bitcoin network, otherwise known as capital destruction.

As the panic of a bear market sets in, dip buying gives way to rip selling, and investors begin to prefer to sell as close to their break even prices as they possibly can (give me my money back Mr Market!).

The breakeven level of 1.0 has now become resistance, which only exacerbates the duration and pain of the bear. Finally, after every hopeful HODLer is worn down…the market reaches a point of ultimate capitulation, usually punctuated by one (sometimes two) massive sell-off that convinces everyone that Bitcoin is finally dead.

This creates massive negative spikes in Net Realised Profit/Loss, signalling that is it not actually Bitcoin which has died, it is actually the bear cycle which is over!

However, I can assure you, it sure doesn’t feel that way when it happens…

The Marvellous MVRV Ratio

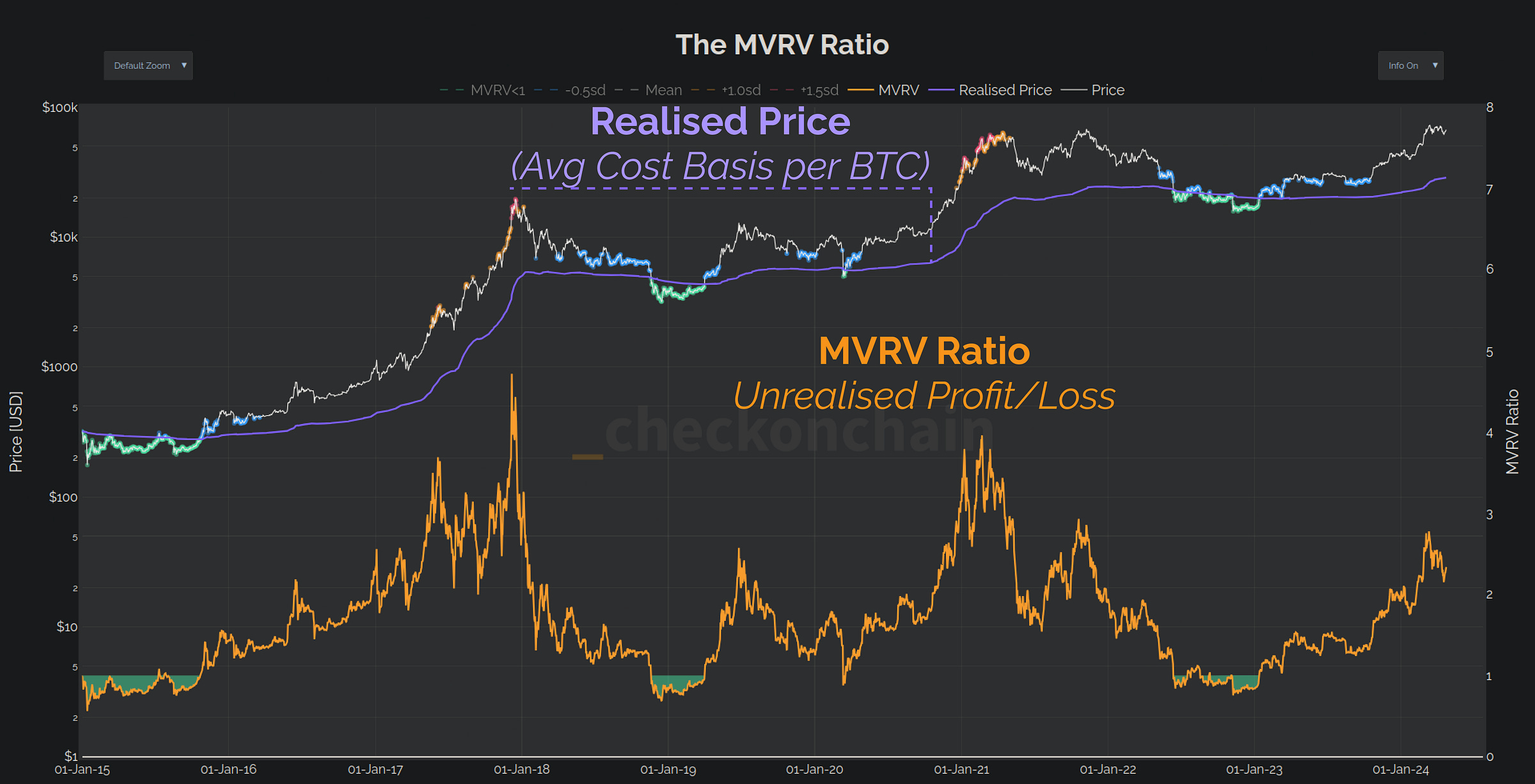

Pretty soon after the Realised Cap metric was released, the brilliant onchain OG duo of David Puell and Murad Mahmudov invented the MVRV Ratio; standing for Market Value to Realised Value. It is an oscillator which measures the divergence between price and the realised price (which is the average cost basis per coin).

The MVRV Ratio describes the average unrealised profit or loss held by the market.

The MVRV Ratio has a relatively simple interpretation framework:

Higher values mean everyone is happy, and holding big green paper gains. Careful though, as extremely high MVRV values mean sellers are increasingly likely to take ever larger profits (sell-side).

Low values mean most folks are sad, and nursing very red portfolios. However, extremely low values also mean that the weak hands are almost completely shaken out, and only the strong handed HODLers remain.

A value of 1.0 is the breakeven level, and has historically only been intersected during the very late stages of bear markets.

If you have made it this far, well done, you’ve made it through the most important part of this article. We have covered the core fundamentals of the Realised Cap and MVRV, but there is so much more to this iceberg. The section below will very briefly touch on some more advanced concepts which we will explore more in later posts.

Advanced MVRV Divergences and Momentum

We can also find bearish divergences in the MVRV, being points in time where price is trading to higher levels, but MVRV is struggling to, or not at all. The chart below shows the fabled 2017 parabolic peak. Notice how price was mooning on each leg higher, but MVRV was not?

How can price be higher, but the average paper gains held be lower?

This divergence is describing top buyers starting to saturate the market, as well as a market with a relatively expensive average cost basis.

All the new folks who only bought Bitcoin because it was shown on the TV are now buying in, and their cost basis is much higher than the average bear. Simultaneously, the smart money who acquired cheap coins in the previous bear market are on the sell-side, and divesting with each leg higher.

We can see a similar divergence in 2021 except on two different scales:

🔴Local Divergence in March to May 2021 as the first peak was established.

🔵Global Divergence between the April and November 2021 peaks. This shows that an absolutely enormous volume of coins took profits on the second leg up.

Hint: you will now be able to recognise where the weird looking ‘hump’ which peaked in the Realised Cap in Dec-2021 comes from!

This final chart shows one of my preferred tools for tracking big picture market momentum. It uses a very simple cross-over between the MVRV Ratio, and its 1y moving average.

When a bull market finally reaches its crescendo, it usually comes with a huge influx of top buyers; who buy too many coins, at too high of a price. This makes the market ‘Top Heavy’, and when prices eventually sell-off, all those paper gains evaporate very quickly.

This causes the MVRV Ratio to fall rapidly, and slice decisively below its 1y average. This indicates that sentiment is most likely broken to the downside, and the bear is probably here when this happens.

On the flip side, after a major capitulation event, a huge number of coins are transferred to the hardcore HODLers and sat stackers who set the floor. When there are no sellers left, the market becomes ‘Bottom Heavy’, and only the strong remain.

A decisive break of MVRV back above the 1yr average often signifies that the bear has been slain, and we can start becoming more constructive on the trend ahead. Also note that bullish divergences occur in the MVRV during ‘Bottom Heavy’ markets, as price trades sideways or down, but MVRV starts moving higher.

Summary

I do hope you enjoyed reading (and watching) this masterclass on the Realised Cap and MVRV Ratio. Understanding these metrics was my personal ‘ah-ha’ moment with Bitcoin onchain analysis, and I have been hooked ever since.

If you can wrap your head around the mechanics of what these tools are describing, you will set yourself up to find opportunities and avoid risks throughout Bitcoin market cycles. Let me leave you with some final thoughts to ponder as I find them extremely useful when thinking about markets in general.

Every buyer is matched with a seller (and vice-versa).

Profit taking (supply) is therefore also a measure of capital inflows (demand).

Realised losses are a capital outflow, but also still represent demand.

A little profit is good, but too much of it creates sellers.

When the market feels the worst…the downtrend is probably almost over.

When the market feels unstoppable…check the MVRV Ratio!.

Thanks for reading!

James