Looking Down

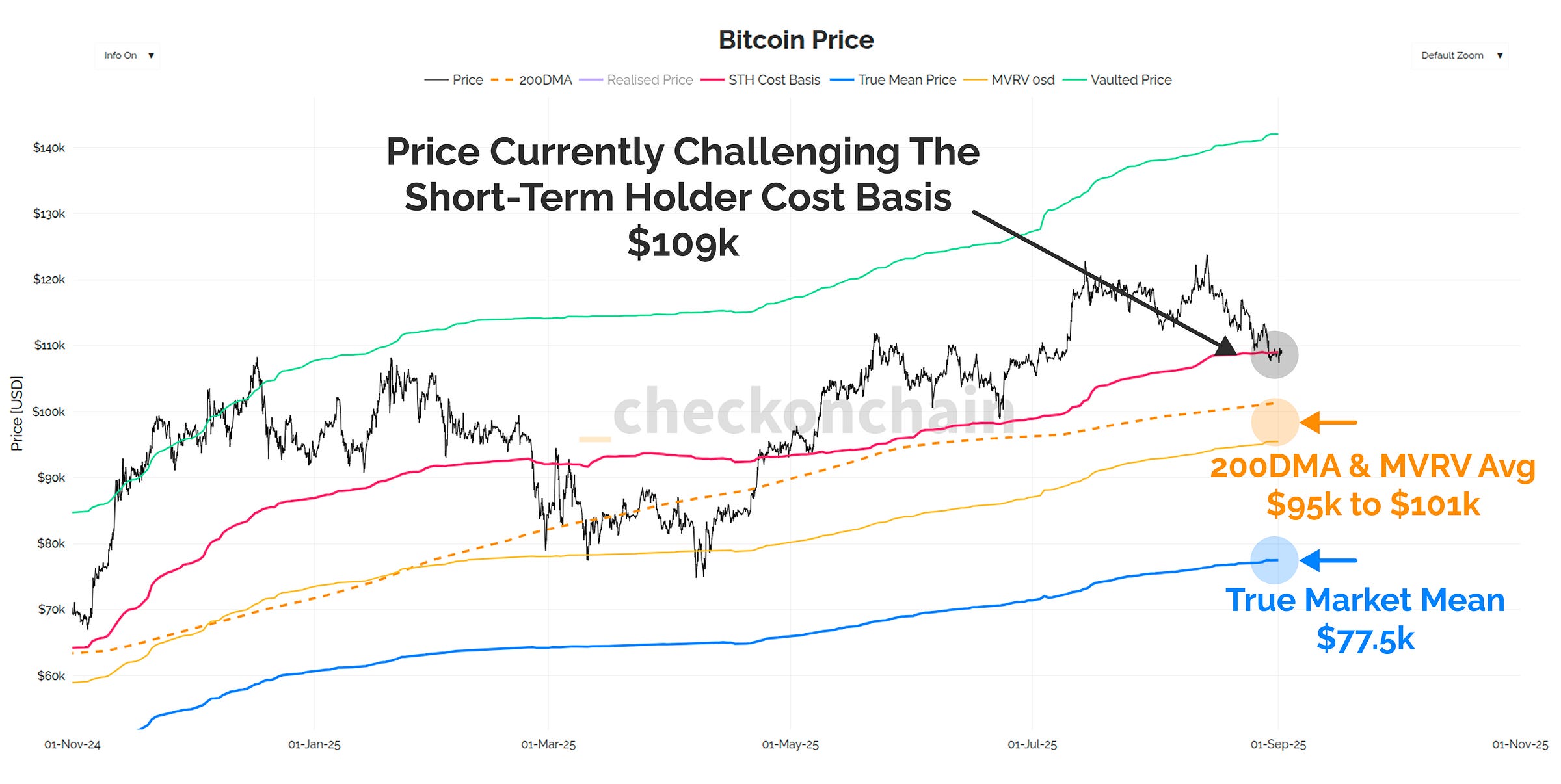

The market is working pretty hard to hold onto the Short-Term Holder cost basis at $109k, but as yet, the bulls are yet to put in a meaningful bottom, so its time to take a hard look at downside risks

G’day Folks,

Markets absolutely love to seek out maximum pain, and the more time you spend as an investor, the more this teaches you about your own pain thresholds.

The reasons for why markets seek out maximum pain are complex, but the empirical evidence shows that trends rarely reverse until it finds it.

From a technical analysis perspective, I’d characterise Bitcoin as being in a downtrend on the daily timeframe, within the context of a much larger, multi-year uptrend. Now, whenever the bear market does decide to arrive, it will have started on the 1min chart first, and nobody will have noticed it. Then it progresses up to the hourly, and then the daily charts.

By the time the downtrend has reached the more significant weekly and monthly charts, we’re well into it, so the challenge is in identifying deterioration as it develops.

This is one of many reasons I love analysing Bitcoin through the lens of onchain data, in that we can see cost basis levels, identify supply clusters, and then compare that with ETF flows, futures leverage, and any other market data.

With the market challenging the Short-Term Holder cost basis as we speak, the question is, how close are we to the market’s max pain threshold (noting that pain to the upside is still a very real thing)?

Today’s post will be a broad assessment of market conditions, across multiple market sectors. Continuing the quest from the last few weeks, I’m working to establish whether we have the conditions necessary for a deterioration into a full fledged bear, or whether it is just another run-of-the-mill correction in the prevailing bull market.

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!