Like A Moth to a Flame

The market loves to gamble, and speculators are being sucked into leveraged Bitcoin markets like a moth to a flame. I suspect more than a few of them will lose their shirt this week.

G’day Folks,

As it turns out, chopsolidation is a hard habit to kick. Over the last week alone Bitcoin has almost hit an ATH, seen over $2.2B in ETF inflows, and responded by selling off back down to the $69k region.

What mate?

As noted in Impending Volatility…I expect some pretty insane volatility over the next few weeks. Whether we like it or not, Bitcoin is going to be somewhat tethered to the Trump Trade, and as election odds and results shift around, all markets are going to swing like crazy for the next few days.

Down under, we call these nifty little devices Mozzie Zappas, as they attract mosquitos, and zap ‘em with a few too many volts when they fly into it.

In our case, the light source is the volatility surrounding the US election, and the mozzies are the gambling speculators who are currently piling on huge leverage into Bitcoin markets betting on the outcome.

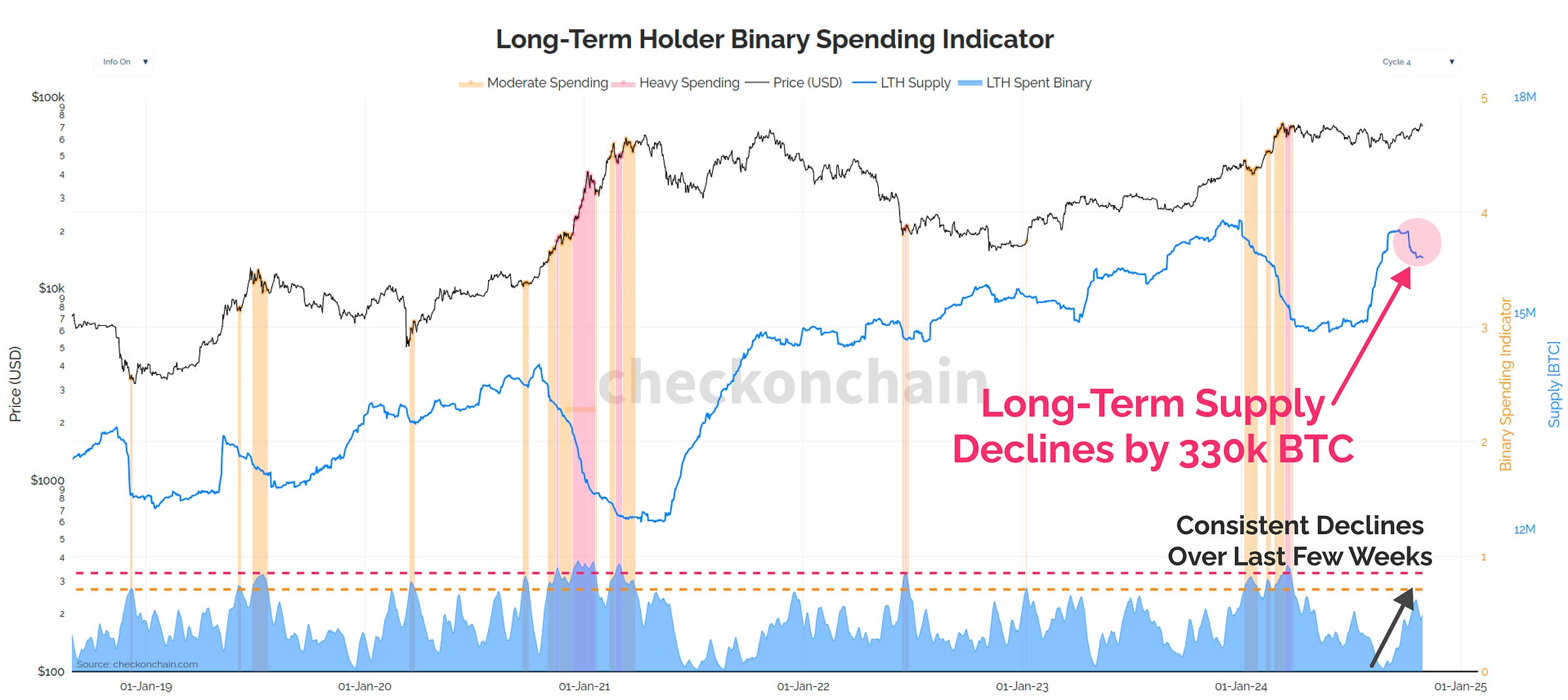

What is even more interesting to me is we’re seeing a marked decline in Long-Term Holder supply, which has decreased by 330k BTC during the ATH attempt. What on earth are OGs selling coins for right now?

Isn’t the bull of all bulls just around the corner?

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!