Is This Bounce THE Bounce?...

...Or just another head-fake?

G’day Folks,

How many times has the market bounced like this week…only to take it all back just a few trading sessions later.

One of the many experiences in the HODLer’s journey is living through powerful relief bounces during a downtrend. In fact, the strongest rallies often happen during bearish trends. The market goes just high enough that it gives us that little bit of hope we so desire…

Sometimes we stick the landing, but most of the time, our hopes are dashed.

At the end of the day, the reason we are HODLers is because we’re very confident that given enough time, all of this daily chop will ultimately be noise. However, our emotions still live on the daily timeframe, and the immediate feelings of FOMO and hope often cloud our better judgement. It requires active work to combat them.

We will see many relief bounces in our career, so it always helps to have a toolkit for trying to distinguish whether this one is THE one…or if this bounce is just another head-fake.

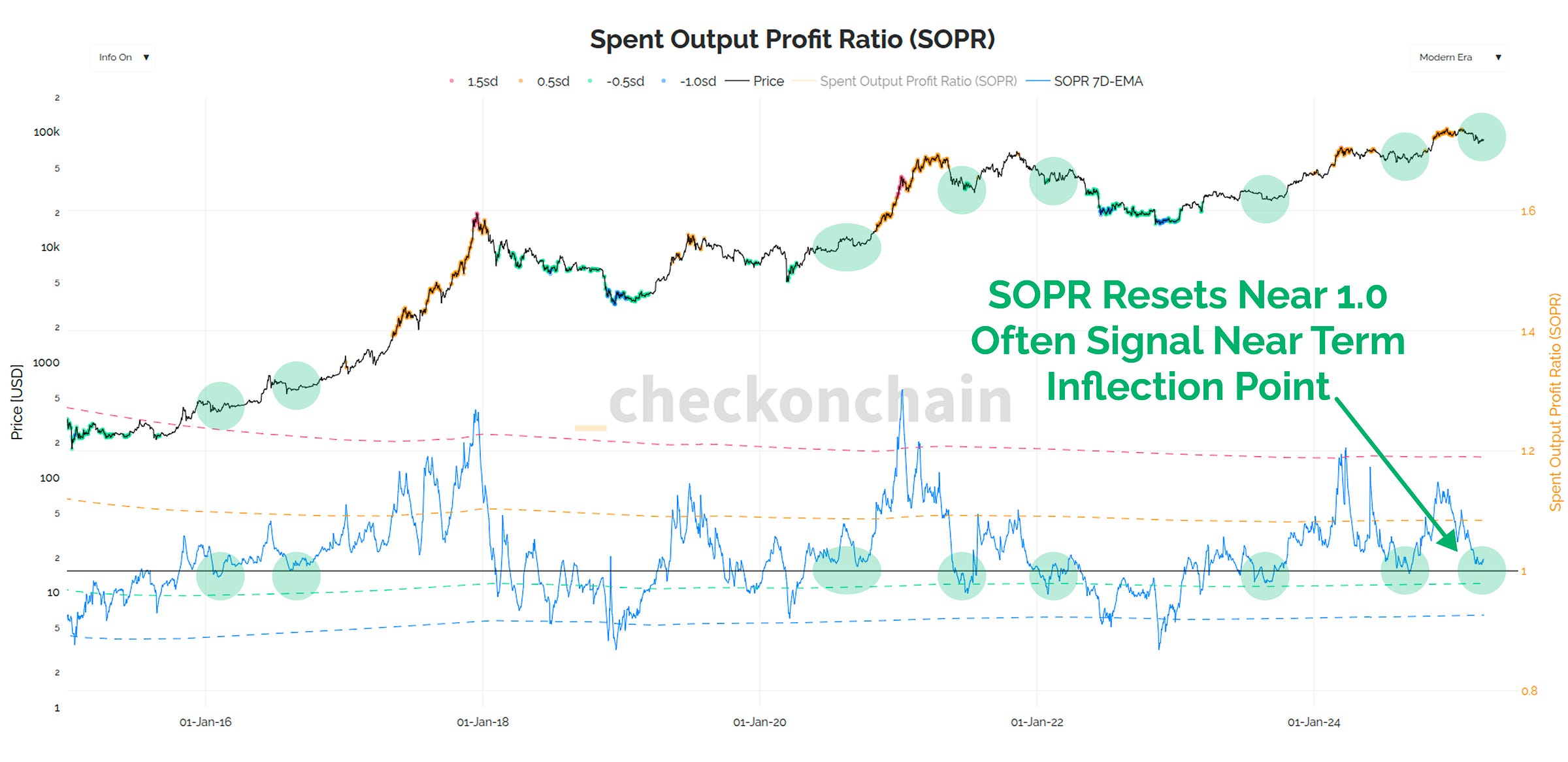

Continuing with the theme of the last few posts, I want to explore the concept of seller exhaustion using onchain tools, and then layer in a side of futures leverage analysis.

With SOPR just about reset to its baseline of 1.0, the odds of the market setting a meaningful low are pretty decent. However, when we look at what futures traders are doing we may determine that we’re not quite out of the woods just yet.

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!