Institutional Demand, Without the Froth

The spot ETFs have seen $1.3B in new capital inflows, suggesting a new wave of institutional capital may be in bound. However many are puzzled by why such large inflow didn't set a new price ATH?

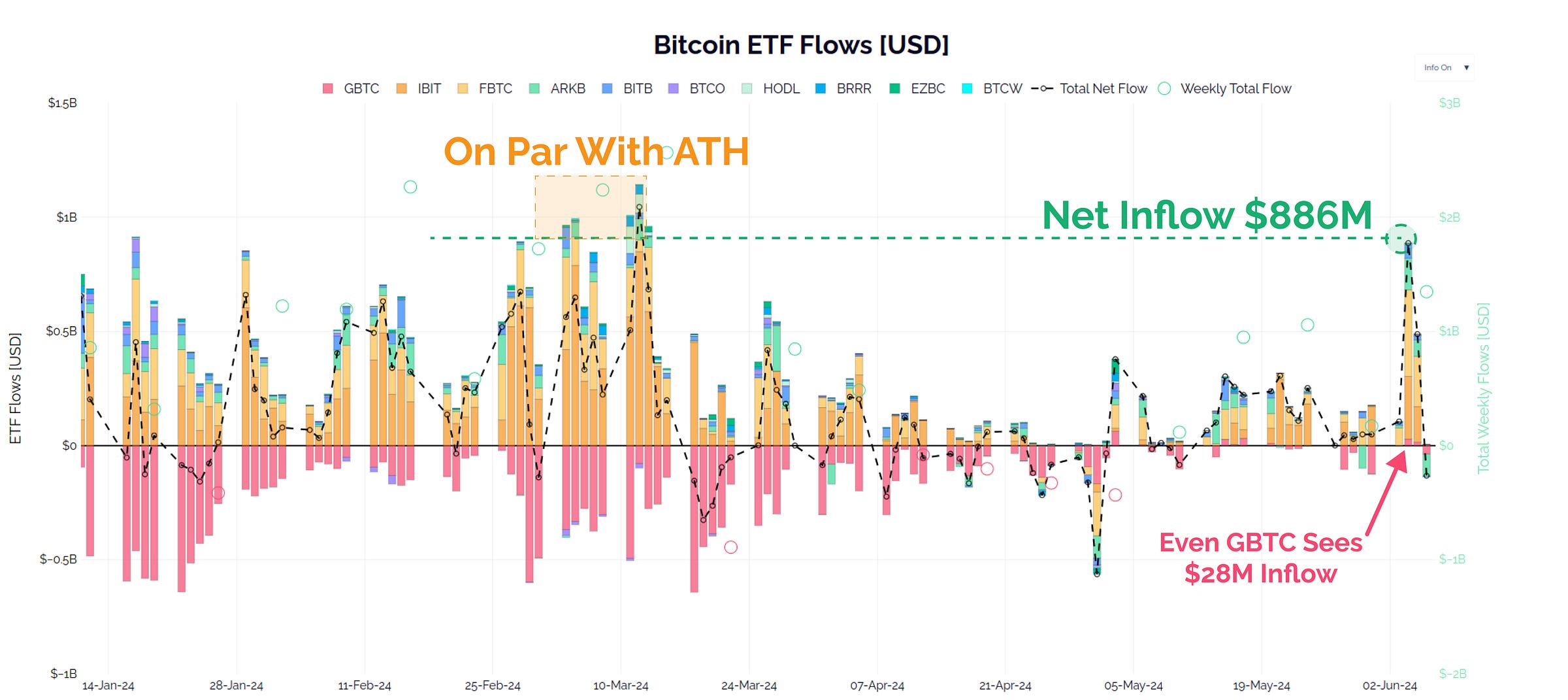

The spot Bitcoin ETFs are back on the map, after seeing an enormous $886m net inflow day on Tuesday, and have thus far absorbed over $1.3B throughout the week. Tuesday’s inflow was one of the largest inflows days to date, and even GBTC saw two successive days of inflows.

This appears to be a resurgence in demand interest for Bitcoin, and continues to paint a picture of strong support for the asset.

One interesting observation is that I’ve lost count of the number of folks who appear to be surprised that such a massive inflow didn’t send Bitcoin prices into the stratosphere. How can it be possible that we’re not trading around $80k? It must be market manipulation right?

Markets are a teacher of many lessons. One lesson I have learned over the years which I think applies here is that the market rarely does what you think it should do, nor at the time you expect it to do it.

Whilst it would seem logical for a single day inflow of $886m to full-send BTC prices to new ATHs, it is important to keep things in perspective, and separate our expectations of what should happen, from what is really happening.

Disclaimer: This article is general in nature, and is for informational, and entertainment purposes only, and it shall not be relied upon for any investment or financial decisions.