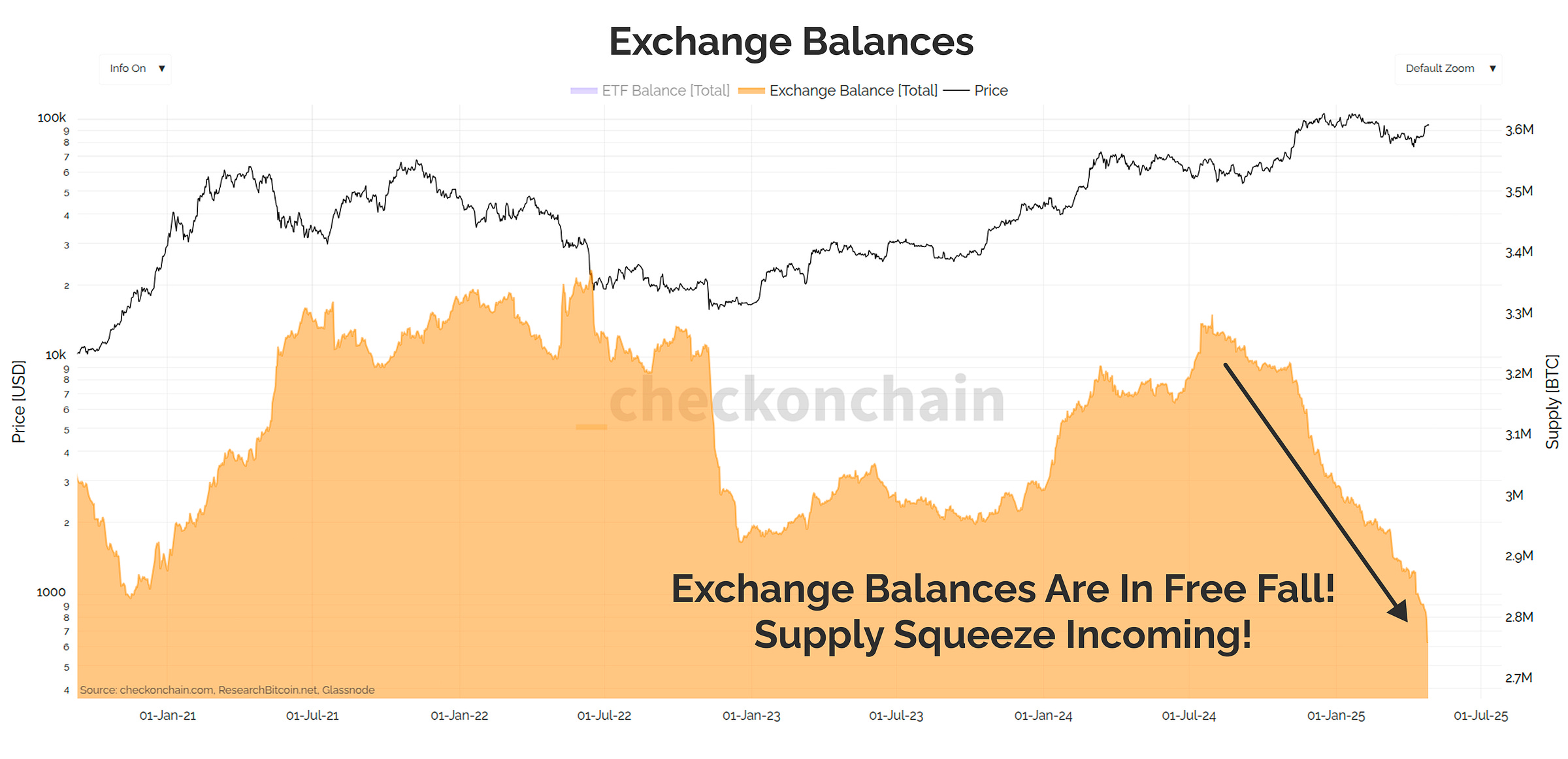

Masterclass #17: Exchanges Are Running Out of Coins!

The exchanges are always just one day away from running out of Bitcoin, and the supply squeeze that follows with be epic...right? Today we tackle the narrative...which just won't go away.

G’day Folks,

Every single cycle, without fail, the narrative of Bitcoin exchanges running out of coins and leading to god-mode supply squeeze comes back from the grave.

Making hyperbolic claims about exchange balances, whales, and large entities is a crowd favourite, because it ‘feels’ extremely bullish, and plays into the hand of Bitcoin’s absolute scarcity. This makes it an extremely attractive story for commentators and influencers to tap into, hunting a dopamine rush from that next thousand likes.

In today’s piece, I am going to address why the narrative about exchanges running out of corn is nonsense, and how I think about these datasets.

As an adjacent topic, I also want to explain why the launch of the ETFs has not created any material shift in the way onchain metrics work. This is one of the most commonly asked questions I have, and I have now built the charts to illustrate why.

This is a piece which has been a very long time in the making, and will no doubt be a reference point for subscribers for many years to come.

Time to clean up our thinking, and up-skill in filtering out signal from the noise.

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!