Bitcoin Damage Report

Bitcoin has crashed once again to *checks notes* $113k, being the first pull-back since breaking to new ATHs. In today's report, we inspect the damage to see if there's anything to be concerned about.

🚨 Free Trial Offer – Ends Soon: We’ve enabled a 7 Day Free Trial for those who want to get a taste of our Premium content. This offer will expire in 7 days, and we don’t do this often. Hope to see you on the other side!

G’day Folks,

My favourite thing about onchain data, is how effective it is at visualising market movements ahead of time.

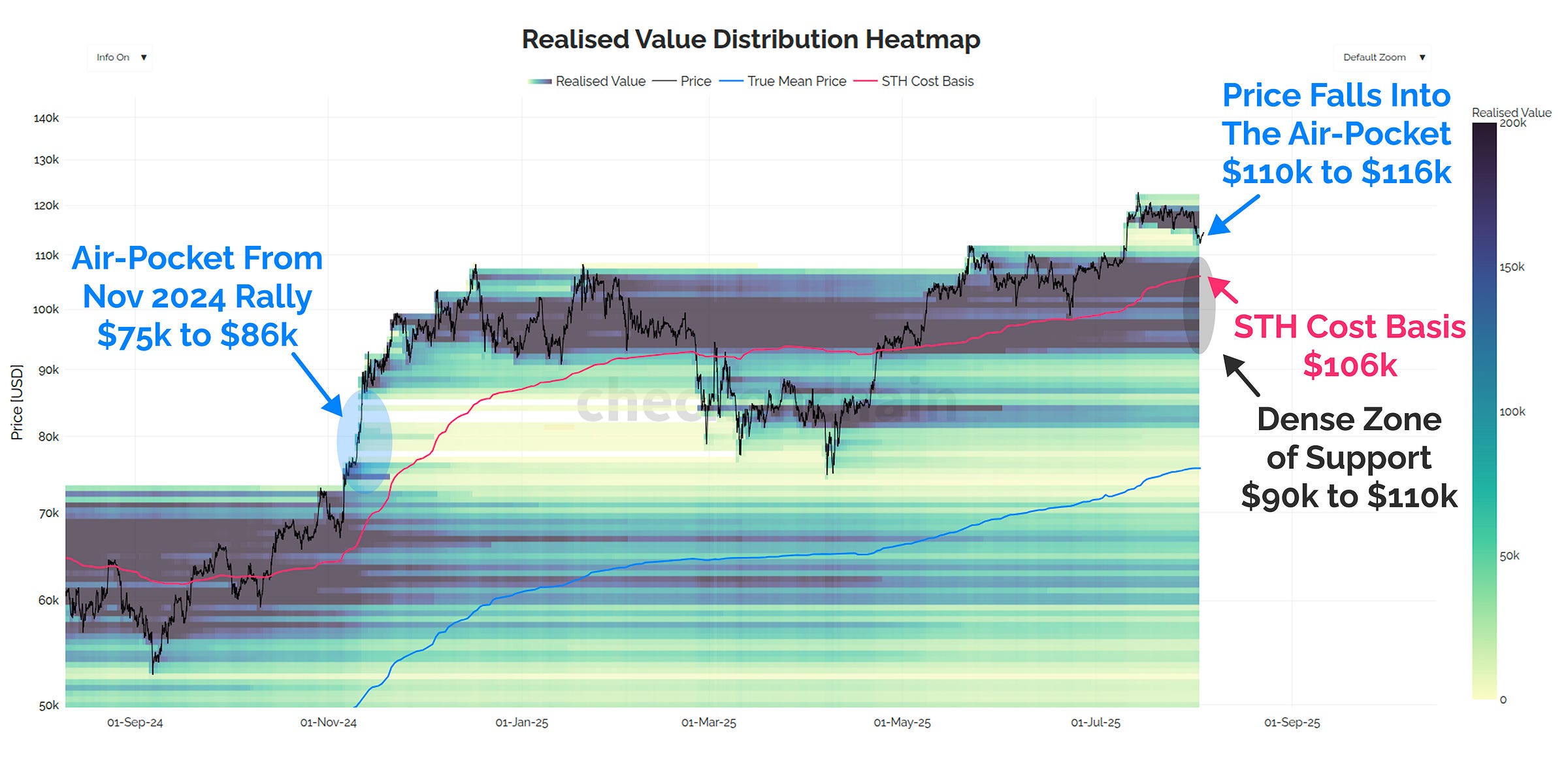

Nobody can predict the future, but we have been talking about the supply ‘air-pocket’ between $110k and $116k for a few weeks now (see latest report).

I don’t know exactly why markets hunt out these zones, but I have seen enough of them back-filled in my time studying Bitcoin that I always treat them with a reasonable probability of occurring. Many keep an eye on CME gaps which form due to the disconnect between spot, and CME futures over weekend trading.

They effectively function in the same way, as a ‘zone of unknown demand’ when the market moves through it too quickly.

On a positive note, we have a very dense zone of previous demand between $90k and $110k, which every analyst and trader worth their salt will expect to function as support. This is my base case too, and until the market breaks below the STH cost basis at $106k, I will be holding my bullish bias firm.

We can however use onchain tools to assess the damage during sell-offs like this one, and use it to identify whether we have a risky situation, with lots of trapped top buyers.

The more people who find themselves with a high cost basis, and heavy portfolio losses, the more likely it is that market conditions deteriorate further. I will analyse from both the perspective of both onchain and derivative data to get a complete picture of how investors are reacting.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Start your 7 Day Premium Trial to unlock the rest of the content!