Cash And Carry Confusion

25k BTC ($1.8B) flowed into the spot ETFs last week, and yet Bitcoin still hasn't cracked to new ATHs. I suspect much of this inflow volume is associated with the cash and carry trade via CME futures.

If you find all of the financial jargon and lingo around derivatives markets confusing, you’re not alone. Like anything, it takes time, exposure, and practice to wrap your head around these market dynamics.

The confusion I noted in last week’s post around how spot, ETF, and futures markets are interlinked continues this week, and it for sure isn’t helped by tweets like this.

Whilst leveraged funds may very well be short Bitcoin futures via the CME…this chart is most likely only showing one side of the trade.

In this post (and video), I will quickly explain what the cash and carry (or basis trade) is, and why it is very likely a driving factor for recent inflows into the ETFs.

Disclaimer: This article is general in nature, and is for informational, and entertainment purposes only, and it shall not be relied upon for any investment or financial decisions.

🎥Watch Video Update

The Cash and Carry Trade

Futures were invented to improve the trade efficiency for physical commodities:

An oil producer knows they will have production in three months time, but would rather lock in a sale price today to hedge risk.

A farmer knows his crop will yield a certain tonnage of wheat by December, but needs income today for fuel, equipment, and labour.

An industrial bakery needs monthly shipments of wheat, and prefers to lock in at least six months of supply ahead of time to minimise potential disruption.

Notice how these primary producers and suppliers are using futures markets to remove risk from their business, whether from upstream suppliers, or hedging their incomes. Speculators also come into play here, as they like to take that risk from the farmer and make a directional bet on the commodity price.

Quite often, futures will trade at a premium to the spot market (called contango) to account for risks, capital costs, and storage of the physical commodity. Futures prices can also trade below spot markets (called) backwardation, but let’s leave that for now to keep things simple.

Now Bitcoin is a digital commodity, and therefore doesn’t have a large storage cost (certainly not on the same scale as oil drums, or bails of wheat). However futures generally trade higher than the spot price…why?

In Bitcoin, directional trades and speculators are currently willing to pay an interest rate of 10% for the privilege of being long with leverage. Think of funding rates in perpetual swap markets as the cost of doing business (where that business is buying Bitcoin with leverage).

There are two types of futures markets for Bitcoin:

Perpetual swaps - which use a dynamic funding rate that charges interest to long positions, and pays it to short positions every 8-hours. If the futures is pushed too high, the premium gets large, and it opens up an arbitrage opportunity.

Calendar expiring futures - which are the traditional instrument that have a defined expiration date when the commodity changes hands with the futures contract owner. These also tend to trade at a premium to spot (due to speculators), however the yield is fixed at the time the position is opened. On the date of delivery, the futures and spot price will have converged.

This arbitrage opportunity is what we call the cash and carry trade (or basis trade). A trader buys spot Bitcoin (or an ETF), and simultaneously shorts the futures instrument to collect the premium (or dynamic funding rate).

Importantly, these traders are holding a delta-neutral position, where they are not exposed to the price risk of Bitcoin, as they equal parts long and short.

This makes cash-and-carry trades an ‘almost’ risk free rate of return, and unless the trader makes a serious mistake with their collateral management, it is highly unlikely these positions are at risk of a margin call or liquidation.

Cash and carry trades add liquidity and depth to markets, and arguably have relatively little impact on prices. However they do link the futures and spot markets together, creating a natural force that keeps them trading in relative tandem.

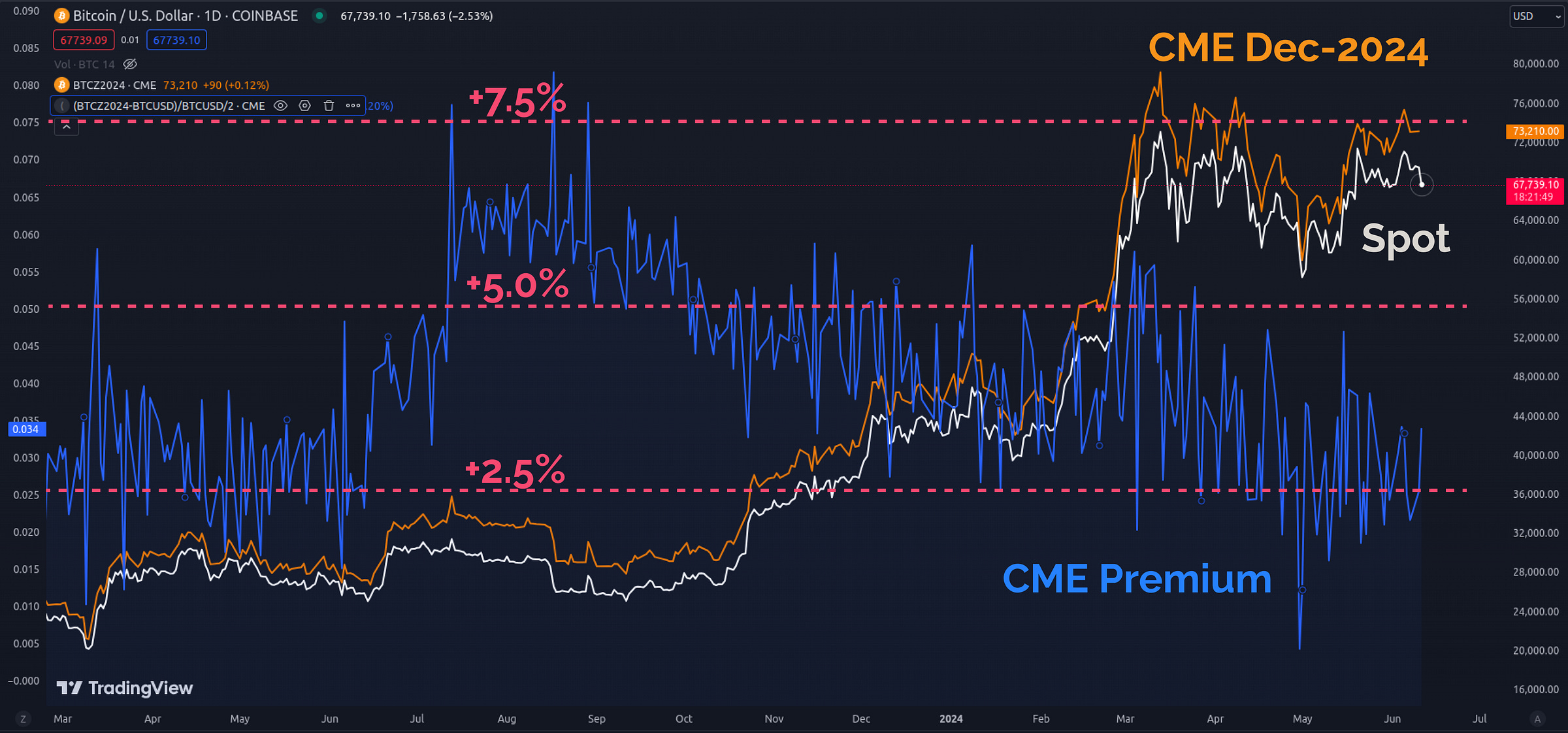

The chart below shows the spot BTC price (white), and the CME December 2024 contract price (orange). Notice how the CME contract is trading at $73.2k whilst spot is at $68.4k. This represents a delta of $4.8k with around 200-days until expiry.

If a trader buys 1BTC ($68.4k) via a spot ETF, sells a 1BTC position via the December future (total capital of $136.8%), and holds both for 200-days until expiration, they will earn $4.8k (3.5%). If we annualised this, it comes out at 6.4% which is above the ‘risk-free rate’ of 5.5% in US T-bills.

You can plot this CME (non-annualised) premium for December 2024 in TradingView using this ticker:

(CME_DL:BTCZ2024-COINBASE:BTCUSD)/COINBASE:BTCUSD/2

Long ETF and Short Futures

Now that we have the groundwork for what the cash and carry trade is, let’s see if we can gauge how much of the recent ETF inflows are likely to be associated with the cash and carry trade.

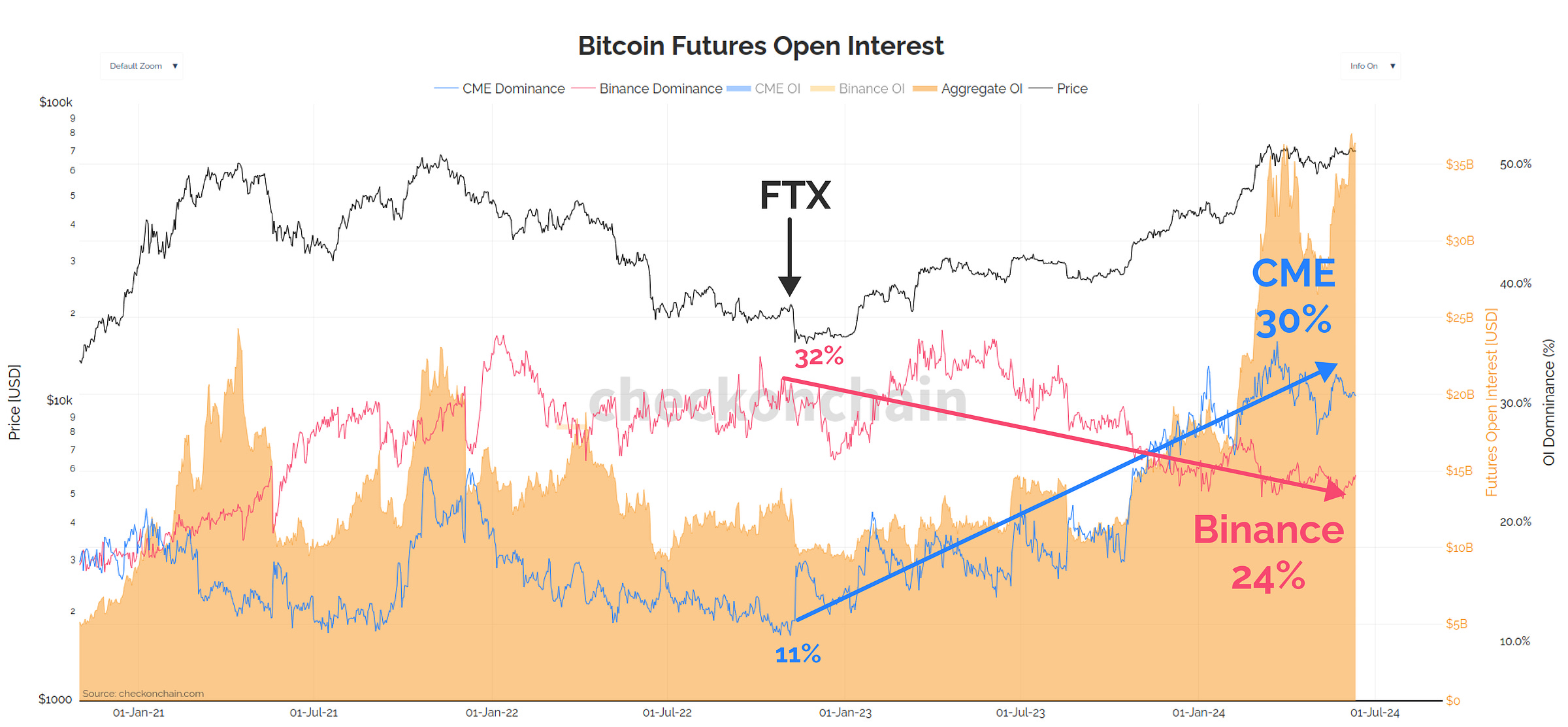

Futures markets are certainly in a bull market, and global open interest has added 92k BTC (+21%) worth of contract value since the start of the year. Binance, Bybit, and CME are the three dominant trading venues, but CME has been a primary source of market share growth.

If we look at futures open interest denominated in USD, we can see it has effectively doubled YTD, and is currently at an all-time-high of $36.3B.

Binance was the market leader for many years, sporting over one third of the market in early 2023. However, despite Binance open interest currently at a record high of $8.7B, it has been surpassed by the highly regulated CME exchange, which now commands top spot, with over $11.1B in contract value.

Note that the cash and carry trade via spot BTC and perpetual swaps has been available for crypto-native firms and traders for many years. This recent explosion in CME market share appears to be closely linked to the roll-out of the spot ETFs, suggesting a new cohort of cash and carry traders are playing the game.

This flippening of Binance and CME for futures dominance is important as it signals that a new cohort of highly regulated traders and investors are participating, in both directional, and delta-neutral cash and carry trades for Bitcoin.

Now this final chart is not intended to give a perfect answer, but it seeks to provide a gauge for how much of the recent ETF inflow is likely to be a cash and carry trade via the CME. It presents a few traces:

Bar charts showing BTC volumes flowing into the ETFs (IBIT, FBTC and Others, Excludes GBTC which is mainly outflows).

Blue Line chart showing the 1-day change in CME open interest. This isn’t a perfect metric to assess this, but TradFi data can be notoriously hard (and expensive) to get our hands on.

What I notice is there are two distinct regimes between these traces:

Jan to April where spot ETF inflows massively exceeded CME open interest growth. This reflects a strong spot demand, where futures markets were taking a back seat.

May to today where CME futures are growing approximately equal to ETF inflows. Overall, this suggests that there is at the very least a higher likelihood that a meaningful portion of ETF inflows of late are one side of a delta neutral cash and carry trade.

This does not mean that every ETF buy is being matched by a futures short. It also doesn’t mean every futures position is arbitraging this premium. What it does mean, is that it is much more likely that a decent chunk of them are, which would explain why $1.8B in ETF inflows are not pushing prices higher (as a large volume of them are balanced by an equal and opposite short futures position).

Closing Thoughts

It is easy to get swept up in hysteria and concern that Wall Street is manipulating and suppressing the price. They for sure have a track record for doing such things, and it is widely speculated (known) that gold has been on the receiving end of this.

However not every short position is a conspiracy trying to suppress the price. Sometimes it just describes traders making the rational decision to capture and almost risk free premium imparted by directional speculators, many of which are betting just a little too much on a ‘sure thing’.

The cash and carry trade exists on every asset with a futures market, and futures markets will appear for every asset that grows to a meaningful size. These dynamics are part of the process, and are an important component of how futures and spot markets remain in sync.

What we really need for the market to get moving again is a serious impulse of non-arbitrage demand, which overwhelms spot sell-side from HODLers and existing holders.

Thanks for reading,

James

PS: I have also rolled out a set of new derivatives metrics checkonchain, and have a few more in the pipeline.

Well, there go the days of getting excited over ETF inflows. 😢

Hi James, very illuminating, again…..! You are living up to your tagline: ‘your BTC personal trainer’…….! I have a few follow-up questions.

- is it correct that CME futures are USD cash-backed only and that margin requirement is 50%? Is that the reason you said that these traders will not get liquidated? In other words, no short squeeze to expect here?

- what overall percentage of BTC futures is backed by BTC collateral and what is generally the kind of margin requirement and leverage that is used for these futures. I hear about insane leverages of 100 x 1, is that true? Is it correct that the very steep rises (and falls) of BTC are often driven by BTC-backed futures liquidations? Short squeezes more likely here?

Thanks in advance.