But...Bitcoin's Too Volatile!?

Bitcoin is too volatile to be useful, and that's why I don't buy it! This is one of the biggest hangups people have with Bitcoin, but when we run the numbers, the orange pill makes a lot more sense.

G’day Folks,

How many times in your Bitcoiner journey have you encountered this argument?

“The only thing that backs Bitcoin is the belief that it has gone up a lot in the past, and will do so in the future. It also might go down a lot in the future, so I won’t buy it!”

How about this one?

“Bitcoin is way too volatile to be useful as a currency. If it was more stable, I would be more interested in buying some”

Countless times, and it drives us mad.

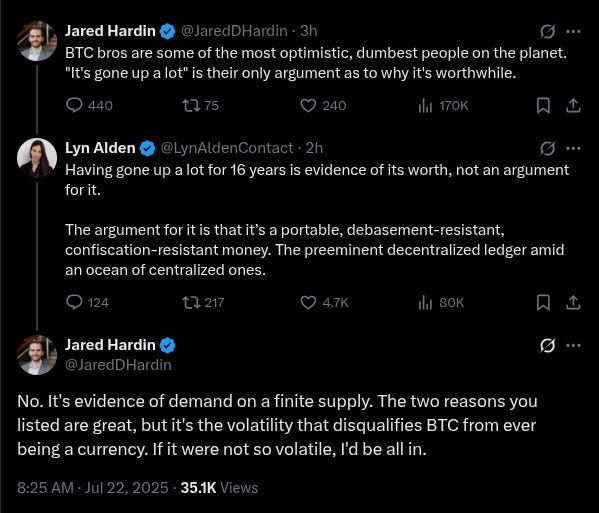

We encounter these arguments all the time in the wild, with one of the latest instalments on X shown below.

For most of us, these arguments make no sense at all, because we know from experience that despite Bitcoin’s volatility, the return profile has been more than enough to compensate us for taking on that ‘risk’.

Yet this set of concerns about Bitcoin ‘maybe going down’, and being ‘too volatile’ are all too pervasive, and often are the reason family and friends just cannot get on board.

In today’s post, I want to put some charts and numbers to this problem, and help us visualise Bitcoin’s performance and volatility relative to other asset classes.

My goal is to equip us with a set of ideas, so we can navigate the next family dinner conversation with some fun facts and figures to illustrate our point.

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!