Playing with Fire

The Bitcoin market is on the cusp of a big move, and it increasingly feels like the folks who are playing with fire (leverage and alts), could be in for a wild ride.

G’day Folks,

The Bitcoin market is in somewhat of a precarious position, having found resistance at the Short-Term Holder cost basis for the third time since June.

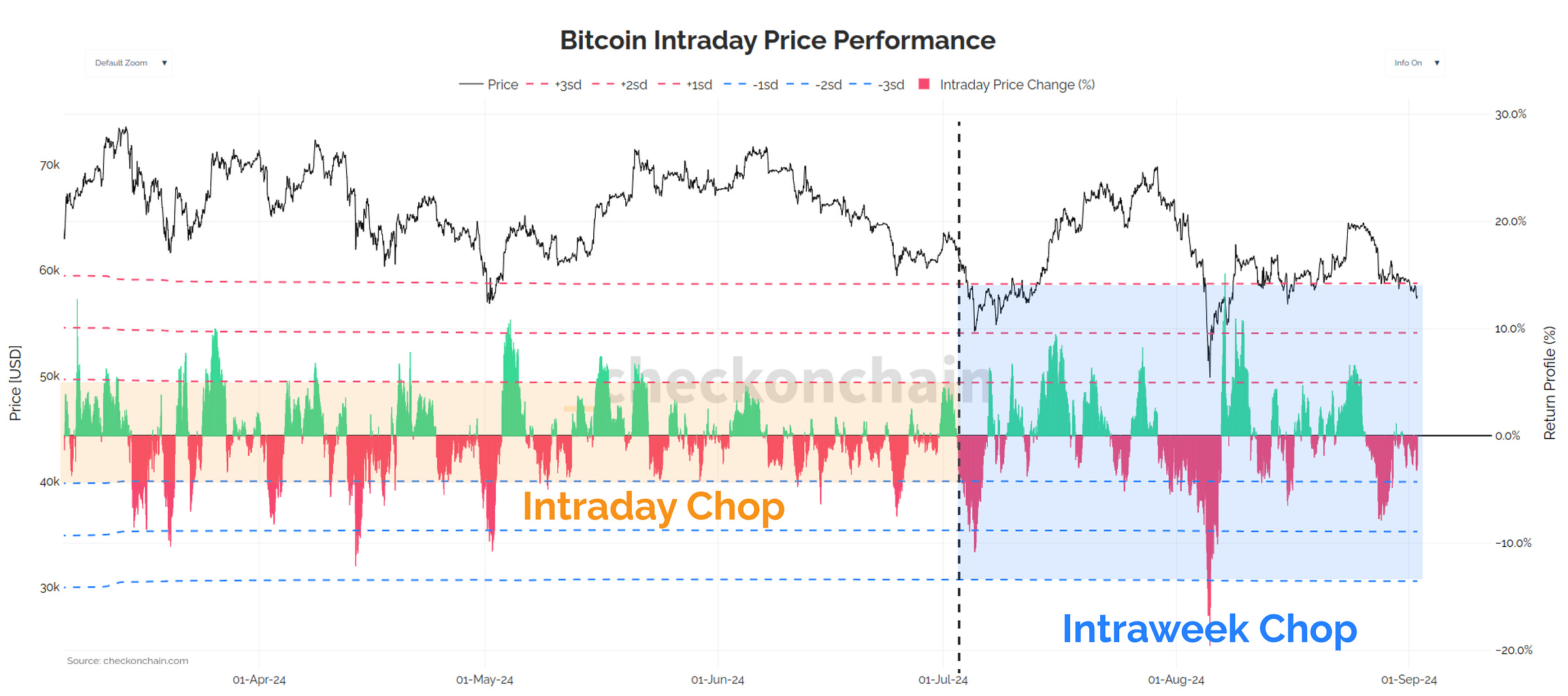

If we look at the intraday price performance, there has also been a ‘regime shift’ since the German Government finished selling their coins in July. Our beloved chopsolidation is evolving, and seems to have shifted into higher amplitude swings.

The swings up and down are becoming larger, and more sustained, which screams that a regime shift is underway. I see a higher likelihood that the market is preparing to move away from this price range…but where to?

With an increasingly volatile and chaotic backdrop, I instinctively want to check what is happening within the Short-Term Holder cohort, and in derivatives. These sectors are the ones that drive near-term price action, and their behaviour is therefore of the most interest.

In this edition, I want to answer the question ‘how bad is it?’, to try and get a better read on whether this instability is constructive…or something of concern.

🔔Check out our Glossary to get up to speed with terminology and acronyms we often use in our posts.

📈 Charts Reminder: you can find the charts from our articles on our Charting Website, and a navigation guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update (25 min) and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!