Base Camp 1

The Bitcoin market cap has just flipped silver, and it isn't hard to make a case that this is just the appetiser. Some Long-Term Holders are taking profits, but is it really enough to stop this train?

G’day Folks,

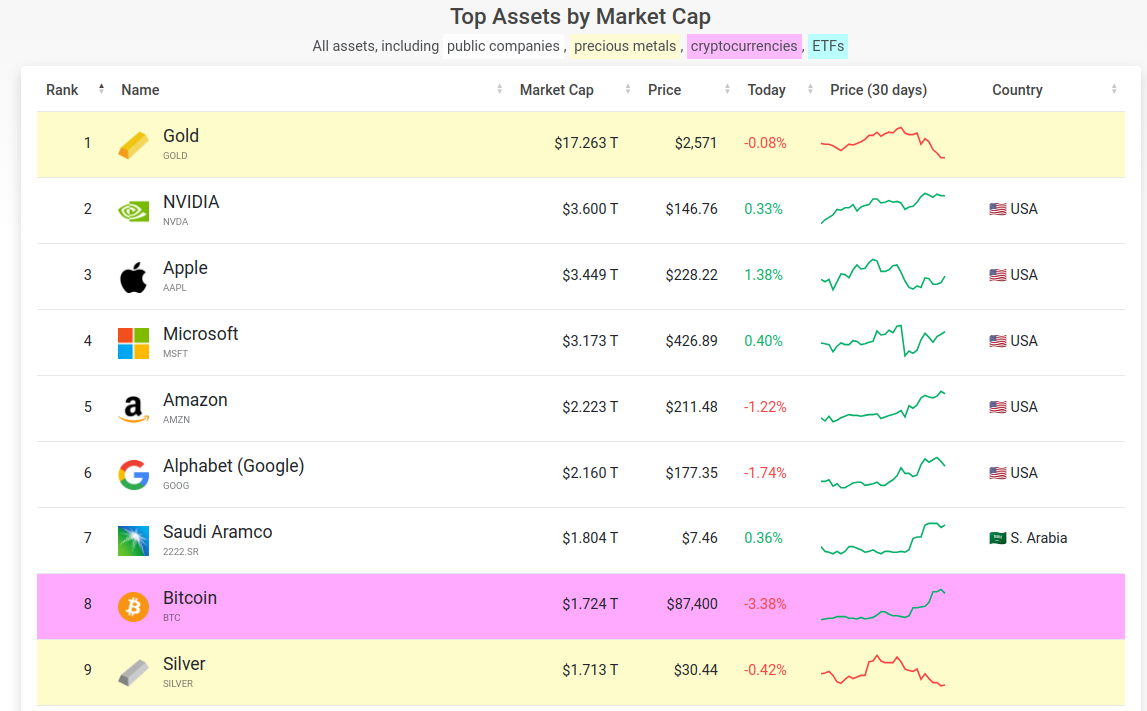

It’s hard to believe, but in less than 16yrs, Bitcoin has flipped Silver in market cap, surpassing one of the oldest monetary assets in history. Is it really that insane to think that a 10x to compete with Gold is an unrealistic target in the long term?

It won’t happen tomorrow of course, but I am very confident it will happen. One unit of BTC is now worth more than 1kg of gold, and it isn’t far off setting a new ATH against the yellow metal either.

The last several months of chopsolidation have also proven that Bitcoin deserves its place as a $1 Trillion asset. We tried to hold this level twice in 2021, and were savagely rejected in both instances.

The post-ETF chopsolidation saw Bitcoin trade above $1 Trillion for seven consecutive months, with every dip being bought heavily, leading to a market cap increase of more than $400B in just a matter of days.

In my opinion, Bitcoin has earned its place as a Trillion dollar asset, and we’re very unlikely to see most of those chopsolidation prices again (barring some asteroid level event).

With prices now hovering between $86k and $91k, Bitcoin appears to have reached base camp 1, and is taking a brief pause to consolidate its gains. At the same time, a pool of Long-Term Holders have restarted their profit taking, with around 230k BTC on the move since we busted through $73k.

In this post, I will characterise who these Long-Term Holders are, and assess whether the inflow of demand is likely to overpower this sell-side.

The idea is to see how likely we are to achieve the next leg up, reaching base camp 2, on our way to the summit of this Bitcoin bull.

📈 Reminder: you can find the charts from our articles on the Checkonchain Charting Website, and a guide in our Charts Tutorial Video.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!