A Green Open To 2026

Bitcoin has kicked off the new year with a rally back to $93k, squeezing shorts, & supported by a move closer to a healthy spot driven market. Will it be faded by bears? Or do the bulls have legs?

G’day Folks,

Happy new year to everyone, and welcome back to what will no doubt be an exciting fresh year for the orange coin. The Checkonchain team is back in action, with recharged batteries, and fresh legs, ready to analyse the Bitcoin market in an environment we expect will surprise people just as much as 2025 did.

The real question is, in which direction will the surprise be?

Isn’t it nice to see Bitcoin opening the year with a string of solid green candles.

To no surprise, Bitcoin traded within a narrow $2.5k range (~3%) for the two week holiday period. This is oddly reminiscent of the end of 2022, where the trading range was a mere $250 following the infamous collapse of FTX.

The price is currently trading at around $93k, and heading towards the top of the range we have been in since the November sell-off.

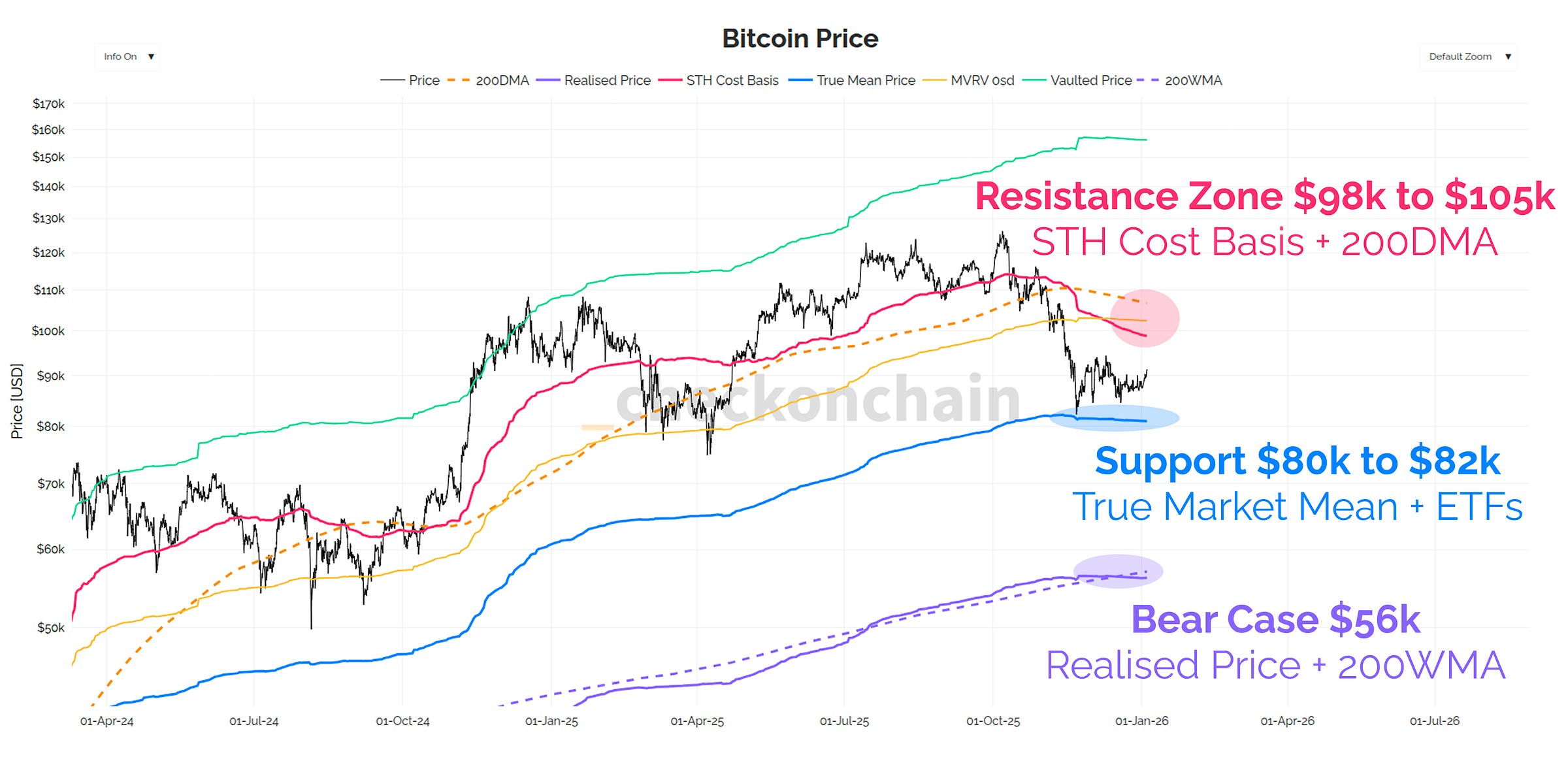

We have support below us at the True Market Mean (~$80k), and a large set of key resistance levels above us between $95k and $105k. The bears are calling for a descent down to the Realised Price and 200-week MA near $56k, and the bulls are concocting a thousand reasons why the 4yr cycle is dead and buried.

In case it isn’t already obvious, nobody actually knows how this year will play out, and price predictions are just like opinions…everybody has one.

Rather than pretending we can predict the future, we’re going to open the year with a detailed assessment of market conditions across the onchain, ETF, and futures sectors. The goal is to assess whether we have hit a degree of seller exhaustion, and whether the bears are getting a bit too cocky, and starting to hit the red button with excessive leverage.

We’re going to focus on reading what the market is actually doing, rather than imagining what it might be doing a year from now.

Premium Members will find the TL:DR summary, video update and the rest of the written post below. Consider upgrading to premium today to unlock the rest of the content!